Nevada Child Care Assistance Program is a state-funded initiative designed to support eligible families by providing financial aid for child care costs. Administered by the Nevada Division of Welfare and Supportive Services, this program aims to reduce the financial burden of child care for low-income families, enabling parents to work or participate in approved training or education programs. By offering subsidies, it ensures that children have access to quality care in nurturing and safe environments while their parents pursue opportunities for self-sufficiency. The program's support extends to families with children from infancy to 12 years old, with some exceptions for children with special needs who may be eligible until age 13.

Nevada Child Care Assistance Program Eligibility Requirements

The Nevada Child Care Assistance Program (CCAP) offers financial aid to eligible families to help cover the cost of child care. This allows parents to work or attend school while ensuring their children receive quality care. To access this valuable resource, families must meet specific eligibility requirements set by the Nevada Division of Welfare and Supportive Services (DWSS).

Here's a breakdown of the key eligibility criteria:

- Residency:

- You must be a resident of Nevada.

- Income:

- Your family's gross monthly income must fall below a certain threshold.

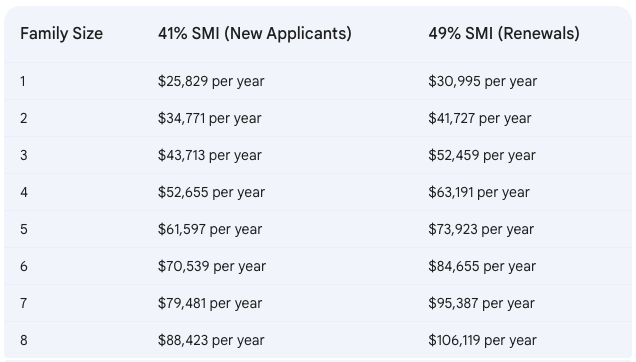

- Effective October 1, 2024, new applicants must have a household income at or below 41% of the State Median Income (SMI).

- Families renewing their applications remain eligible if their income is at or below 49% SMI.

- Income limits vary based on family size. You can find the most up-to-date income limits on the DWSS website (dwss.nv.gov).

- Work/School Status:

- To qualify, parents must be engaged in one of the following approved activities:

- Employed: Working at least 20 hours per week.

- Actively Seeking Employment: Engaged in documented job search activities.

- Enrolled in Education/Training: Participating in an approved education or training program.

- Participating in DWSS-approved Activities: Engaged in activities that prepare individuals for employment.

- Child's Age:

- The program generally supports children from infancy to 12 years old.

- Children with special needs may be eligible for assistance up to age 13.

- Additional Requirements:

- Social Security Numbers: All household members must have Social Security numbers.

- Citizenship/Immigration Status: Proof of citizenship or eligible immigration status is required for all household members.

- Immunization Records: Children under 6 years old who are not in licensed care must have up-to-date immunization records.

Important Notes:

- Meeting these basic requirements does not guarantee approval. DWSS will review each application individually.

- Eligibility criteria and income limits are subject to change. Always refer to the official DWSS website for the most current information.

By understanding these eligibility requirements, families can determine if they qualify for the Nevada Child Care Assistance Program and take the first step towards receiving valuable support for their child care needs.

Income Limits for Subsidy

The Nevada Child Care Assistance Program (CCAP) provides crucial financial support to families who need help affording quality child care. A key factor in determining eligibility for this subsidy is your family's income.

Understanding Income Limits

To qualify for the Nevada Child Care Subsidy, your household income must fall below a certain percentage of the State Median Income (SMI). This percentage recently changed, so it's important to be aware of the following:

- New Applicants (as of October 1, 2024): Must have a household income at or below 41% of the State Median Income (SMI).

- Renewal Applicants: Continue to be eligible if their household income is at or below 49% of the State Median Income (SMI).

Income Limits Based on Family Size

Because family size impacts financial need, income limits are adjusted accordingly. Here's a general idea of the income limits, but it's crucial to check the official Nevada Division of Welfare and Supportive Services (DWSS) website for the most up-to-date figures:

Important Considerations:

- Gross Income: The income limit refers to your family's gross monthly income before taxes or deductions.

- Changes to Income: If your family's income changes after you've been approved for the subsidy, you must report it to DWSS. This ensures you continue to receive the correct amount of assistance.

- Verification: Be prepared to provide documentation to verify your income, such as pay stubs, tax returns, or benefit statements.

Where to Find the Most Current Information:

- DWSS Website: The official DWSS website (dwss.nv.gov) is the best source for the most current income limits and eligibility requirements.

- DWSS Office: You can contact your local DWSS office directly for assistance and clarification.

By understanding the income limits for the Nevada Child Care Subsidy, you can determine if your family qualifies for this valuable program that helps make quality child care more affordable.

Required Documents for Nevada Child Care Assistance Application

Applying for the Nevada Child Care Assistance Program (CCAP) requires gathering specific documents to verify your family's eligibility. Having these ready can streamline the application process and prevent delays.

Here's a checklist of the essential documents you'll likely need:

- Identification for All Household Members

- Adults: Driver's license, state-issued ID card, passport, or other government-issued photo identification.

- Children: Birth certificate, passport, or other official document verifying the child's age and identity.

- Proof of Nevada Residency

- Utility bill (gas, electric, water)

- Lease agreement or mortgage statement

- Bank statement

- Voter registration card

- Official mail with your name and Nevada address

- Social Security Numbers

- Social Security cards or official documentation with the Social Security number for each household member, including adults and children.

- Proof of Citizenship or Eligible Immigration Status

- U.S. birth certificate

- U.S. passport

- Naturalization certificate

- Permanent Resident Card (Green Card)

- Other documentation verifying eligible immigration status

- Proof of Income for All Household Members

- Recent Pay Stubs: At least the last 30 days of pay stubs for all employed household members.

- Tax Returns: Previous year's tax return (Form 1040)

- Benefit Statements: If applicable, provide documentation of benefits received, such as SNAP, TANF, unemployment, Social Security, or child support.

- Self-Employment Documentation: If self-employed, provide profit and loss statements, tax returns, or other documentation verifying income.

- Purpose of Care Verification

- Employment: Employer verification, work schedule, or recent pay stubs.

- Job Search: Documentation of job search activities, such as applications submitted, job search logs, or registration with Nevada JobConnect.

- Education/Training: Enrollment verification from the school or training program.

- Child's Immunization Records (if applicable)

- If your child is under 6 years old and not in licensed care, you'll need to provide their immunization records.

- Custody Documentation (if applicable)

- If applicable, provide legal documentation establishing custody of the child(ren), such as a court order.

Tips for Gathering Documents:

- Make Copies: Keep original documents safe and provide copies with your application.

- Organize: Organize your documents neatly to ensure a smooth application process.

- Check for Updates: Requirements may change, so check the DWSS website (dwss.nv.gov) for the latest information.

By preparing these documents in advance, you'll be well-equipped to complete the Nevada Child Care Assistance Program application and move forward in securing financial assistance for your child care needs.

Finding Licensed Child Care Providers in Nevada

Choosing the right child care provider is a crucial decision for any parent. In Nevada, you can find a variety of licensed child care options, including child care centers, family child care homes, and in-home providers. Here's how to locate licensed providers in your area:

- Nevada Child Care Resource & Referral:

- Website: nevadachildcare.org

- What they offer: This resource, a partnership between The Children's Cabinet and Las Vegas Urban League, provides referrals to licensed child care providers throughout Nevada. They offer online search tools and personalized assistance to help families find care that meets their needs and preferences.

- Contact: You can reach them by email at info@nevadachildcare.org or by phone at their various locations:

- Las Vegas: (702) 825-8978

- Reno: (775) 746-5511

- Carson City: (775) 684-0880

- Elko: (775) 738-3808

- Nevada Division of Welfare and Supportive Services (DWSS) Child Care Licensing:

- Child Care Licensing Contact List (The Nevada Registry):

Tips for Finding the Right Provider:

- Use the Online Search Tools: Utilize the online resources mentioned above to create a list of potential providers.

- Visit Providers in Person: Schedule visits to child care centers or homes to get a feel for the environment and meet the caregivers.

- Ask Questions: Don't hesitate to ask providers about their experience, qualifications, and approach to child care.

- Check References: Ask for references from other parents who have used the provider's services.

- Trust Your Instincts: Choose a provider that feels right for you and your child.

By utilizing these resources and taking the time to research and visit providers, you can find a safe, nurturing, and enriching environment for your child.

Nevada Child Care Assistance for Children with Special Needs

The Nevada Child Care Assistance Program (CCAP) recognizes that children with special needs may require specialized care and support. The program offers assistance to eligible families with children who have disabilities or special needs, helping them access quality care that meets their unique requirements.

Eligibility for Children with Special Needs:

In addition to the standard eligibility criteria for CCAP, families with children with special needs must provide documentation of their child's disability or special need. This may include:

- Medical Diagnosis: A written diagnosis from a qualified medical or mental health professional.

- Individualized Education Program (IEP): If the child has an IEP, a copy of the IEP can serve as documentation.

- Early Intervention Services Plan: If the child receives early intervention services, a copy of their Individualized Family Service Plan (IFSP) can be provided.

- Other Supporting Documentation: Any other documentation that supports the child's need for specialized care.

Benefits for Children with Special Needs:

- Increased Age Limit: While the standard age limit for CCAP is 12 years old, children with special needs may be eligible for assistance up to age 13.

- Specialized Care: CCAP can help cover the cost of care provided by licensed providers with experience and expertise in caring for children with special needs. This may include:

- Specialized Child Care Centers: Centers with staff trained to work with children with disabilities.

- Therapeutic Child Care: Care that integrates therapeutic interventions into the child's daily routine.

- In-Home Care: Specialized care provided in the child's home by a qualified caregiver.

- Increased Support: CCAP may provide higher levels of financial assistance to families with children with special needs to help cover the often higher costs associated with specialized care.

Finding Child Care for Children with Special Needs:

- Nevada Child Care Resource & Referral: This resource can help families identify licensed child care providers with experience in caring for children with special needs. You can find their contact information and website in the previous response.

- Nevada Disability Resources: This organization provides information and resources for individuals with disabilities in Nevada, including child care options.

- Local Support Groups and Organizations: Connecting with local support groups and organizations for families of children with special needs can provide valuable insights and recommendations for finding appropriate care.

Important Considerations:

- Early Application: It's advisable to apply for CCAP as early as possible, as there may be waiting lists or limited availability for specialized care.

- Provider Communication: Open and honest communication with potential child care providers is essential. Discuss your child's specific needs and ensure the provider has the experience and resources to meet those needs.

By understanding the resources available and advocating for their child's needs, families can ensure that their children with special needs receive the quality care and support they deserve through the Nevada Child Care Assistance Program.

Common Reasons for Nevada Child Care Assistance Denial

While the Nevada Child Care Assistance Program (CCAP) aims to support as many eligible families as possible, applications can sometimes be denied. Understanding the common reasons for denial can help you prepare a strong application and increase your chances of approval.

- Income Exceeds Limits:

- Strict Income Guidelines: One of the most frequent reasons for denial is exceeding the income limits set by the program. These limits are based on family size and the State Median Income (SMI). It's essential to ensure your family's gross income falls within the allowed range.

- Accurate Reporting: Accurately report all sources of income for all household members. Failure to do so can lead to denial or even the repayment of benefits if discovered later.

- Failure to Meet Work/School Requirements:

- Required Participation: Parents must be employed, actively seeking employment, or enrolled in an approved education or training program to qualify.

- Providing Verification: You'll need to provide documentation to verify your participation, such as pay stubs, employer verification, job search logs, or school enrollment verification.

- Missing or Incomplete Documentation:

- Essential Documents: Submitting all required documents is crucial. This includes proof of identification, residency, income, citizenship/immigration status, and Social Security numbers for all household members.

- Application Accuracy: Ensure your application is complete and accurate. Errors or omissions can lead to delays or denial.

- Inaccurate or Inconsistent Information:

- Truthful Information: Providing false or misleading information on your application can result in denial and potential legal consequences.

- Consistency: Ensure consistency between the information provided on your application and supporting documents. Discrepancies can raise red flags.

- Child's Age:

- Age Limits: Generally, children must be between infancy and 12 years old to be eligible. While there are exceptions for children with special needs, it's important to confirm your child meets the age requirements.

- Lack of Child Care Need:

- Justifying Need: You must demonstrate a need for child care assistance, typically related to work, job search, or education/training. If the need isn't clearly established, your application may be denied.

- Choosing an Unqualified Provider:

- Licensed Providers: CCAP generally only provides assistance for care provided by licensed child care centers, family child care homes, or approved in-home providers.

- Failure to Cooperate with DWSS:

- Responding to Requests: Respond promptly to requests for information or documentation from DWSS. Failure to cooperate can lead to denial.

Tips to Avoid Denial:

- Review Eligibility Carefully: Thoroughly understand the eligibility requirements before applying.

- Gather All Documents: Prepare all necessary documents in advance.

- Complete the Application Accurately: Double-check your application for accuracy and completeness.

- Be Honest and Transparent: Provide truthful and consistent information.

- Contact DWSS with Questions: Don't hesitate to contact DWSS if you have any questions or need clarification.

By understanding these common reasons for denial and taking steps to avoid them, you can increase your chances of a successful application and access the valuable support provided by the Nevada Child Care Assistance Program.

Frequently Asked Questions

What is the Nevada Child Care Assistance Program?The Nevada Child Care Assistance Program (CCAP) is a state-funded program that helps eligible families pay for child care. This allows parents to work or attend school while ensuring their children receive quality care in a safe environment.

Who is eligible for the Nevada Child Care Assistance Program?To be eligible, you must be a Nevada resident with a family income below a certain threshold. You must also be working, looking for work, or enrolled in an approved education or training program. Your child must be between infancy and 12 years old, or up to 13 years old for children with special needs.

How do I apply for the Nevada Child Care Assistance Program?You can apply online through the Nevada Division of Welfare and Supportive Services (DWSS) website, in person at your local DWSS office, or by mail. You'll need to provide documentation such as proof of identification, residency, income, and citizenship/immigration status.

What types of child care are covered by the program?The program covers care provided by licensed child care centers, family child care homes, and approved in-home providers.

How much does the program pay for child care?The amount of assistance varies based on your family's income, the type of child care, and the age of your child. You may be required to pay a co-payment.

What if my application for child care assistance is denied?If your application is denied, you will receive a notice explaining the reason for the denial. You may be able to appeal the decision.

How do I find licensed child care providers in Nevada?You can find licensed child care providers through the Nevada Child Care Resource & Referral, the DWSS Child Care Licensing website, or by contacting your local Child Care Licensing office.

What if my child has special needs?The program offers assistance for children with special needs, including higher age limits and support for specialized care.

How long does it take to get approved for child care assistance?Processing times vary, but it typically takes several weeks to receive a decision on your application.

Where can I find more information about the Nevada Child Care Assistance Program?The DWSS website (dwss.nv.gov) is the best source for detailed information about the program, including eligibility requirements, application procedures, and contact information. You can also contact your local DWSS office for assistance.

Child Care Assistance Program Mississippi offers invaluable support to working families by providing financial aid for child care expenses. This program ensures that parents, whether employed or pursuing education, can access affordable, high-quality care for their children. Eligibility requirements include Mississippi residency, income limits based on family size, and parental engagement in work or educational activities. By alleviating the financial burden of child care, the program empowers parents to maintain stable employment or further their education while their children thrive in nurturing environments.

Mississippi Child Care Assistance Program Income Limits

Understanding the income limits for the Mississippi Child Care Assistance Program (MCCAP) is crucial for families seeking financial aid for child care. These limits are determined by the State Median Income (SMI) and vary based on family size.

Here's a breakdown of the income limits for MCCAP:

Priority Group 1: Very Low Income

- Income Limit: Up to 50% of the State Median Income (SMI)

- Eligibility: Families in this group receive priority access to MCCAP due to their lower income levels.

Priority Group 2: Special or At-Risk Populations

- Income Limit: Up to 85% of the State Median Income (SMI)

- Eligibility: This group includes:

- Children with special needs

- Single parents with special needs

- Parents deployed in the United States Armed Services, MS National Guard, or Reserve

Priority Group 3: Low Income

- Income Limit: Between 50% and 85% of the State Median Income (SMI)

- Eligibility: Based on funding availability, children of parents who are:

- Enrolled in an approved, full-time educational program

- Working the required 25 hours per week

Important Notes:

- State Median Income (SMI): The SMI is adjusted annually. You can find the current SMI on the Mississippi Department of Human Services (MDHS) website.

- Family Size: The income limits increase with each additional family member.

- Gross Income: Eligibility is based on gross family income, which is your income before taxes and deductions.

- Verification: You will need to provide documentation to verify your income, such as pay stubs or tax returns.

Where to Find More Information:

- MDHS Website: The most up-to-date information on income limits and eligibility criteria can be found on the official MDHS website.

- County DHS Offices: Local county DHS offices can provide personalized guidance and assistance with the application process.

By understanding the income limits and eligibility requirements, families can determine if they qualify for MCCAP and take the first step towards securing affordable child care.

Required Documents for MCCAP

Applying for the Mississippi Child Care Assistance Program (MCCAP) requires gathering specific documents to verify your eligibility. Having these ready can streamline the application process. Here's a breakdown of the essential documents:

- Identification

- For the Applicant: Driver's license, state-issued ID, passport, or other government-issued photo ID.

- For All Household Members: Social Security cards or birth certificates.

- Proof of Residency

- Recent Utility Bill: A utility bill (gas, electric, water) with your name and address.

- Lease Agreement or Mortgage Statement

- Voter Registration Card

- Proof of Income

- Pay Stubs: Recent pay stubs for all working household members, covering at least one month.

- Tax Returns: Previous year's tax return (Form 1040).

- Employer Verification: A letter from your employer stating your gross income and hours worked.

- Other Income Documentation: If applicable, provide documentation for other income sources such as child support, alimony, or unemployment benefits.

- Child(ren)'s Information

- Birth Certificate(s)

- Social Security Card(s)

- Proof of Special Needs (if applicable): Documentation from a medical professional or educational institution.

- Work or School Verification

- Employment Verification: If employed, provide a letter from your employer stating your work schedule and hours.

- School Enrollment Verification: If attending school, provide proof of enrollment from your educational institution.

Important Notes:

- Copies: Make copies of all documents for your records.

- Originals: Be prepared to present original documents if requested.

- Updates: Keep your information updated if any changes occur in your income, address, or household composition.

- Additional Documents: The MDHS may request additional documents depending on your specific circumstances.

Where to Find More Information:

- MDHS Website: Visit the official Mississippi Department of Human Services (MDHS) website for the most current document requirements.

- County DHS Offices: Local county DHS offices can provide personalized guidance and answer your questions about the application process.

By gathering the necessary documents beforehand, you can ensure a smoother application process for MCCAP and increase your chances of receiving timely assistance.

Types of Child Care Covered by MCCAP

The Mississippi Child Care Assistance Program (MCCAP) offers financial assistance to eligible families for a variety of child care settings. Here's a breakdown of the types of child care covered:

- Licensed Child Care Centers

- Definition: Centers that meet Mississippi's licensing requirements for health, safety, and quality standards. They typically provide care for larger groups of children in age-appropriate classrooms.

- Benefits: Structured learning environment, trained staff, opportunities for socialization.

- Finding a Center: Use the MDHS Child Care Finder tool https://www.mdhs.provider.webapps.ms.gov/ccsearch.aspx to locate licensed centers near you.

- Licensed Family Child Care Homes

- Definition: Homes that are licensed to provide care for a smaller number of children in a family setting.

- Benefits: Home-like environment, individualized attention, flexible hours.

- Finding a Home: Contact your local County DHS office for a list of licensed family child care homes in your area.

- After-School Programs

- Definition: Programs that provide care for school-aged children before and after school hours.

- Benefits: Supervised activities, homework help, safe environment.

- Finding a Program: Check with your child's school or contact your local County DHS office for information on after-school programs.

- In-Home Care

- Definition: Care provided in the child's own home by a relative, friend, or nanny.

- Benefits: Familiar environment, individualized attention, convenience.

- Requirements: In-home providers may need to meet certain requirements to be eligible for MCCAP reimbursement. Contact your local County DHS office for specific details.

Important Considerations:

- Licensing: Always ensure the child care provider you choose is licensed by the state of Mississippi.

- Quality: Look for providers who offer developmentally appropriate activities and create a nurturing environment.

- Availability: The availability of different types of care may vary depending on your location and the age of your child.

Where to Find More Information:

By understanding the types of child care covered by MCCAP, families can make informed choices and find the best fit for their child's needs and their family's circumstances.

How Much Child Care Assistance Can I Receive in Mississippi?

Figuring out how much child care assistance you can get through MCCAP in Mississippi can be tricky. It depends on a few things:

- Your Family's Income

- Lower income = more help: The less your family earns, the more MCCAP will usually pay towards your child care costs.

- Income limits: Remember those income limits we talked about before? You have to meet those to qualify at all.

- Changes matter: If your income changes, let MDHS know right away, as it could affect how much assistance you get.

- Your Child's Age

- Babies are expensive: Care for infants and toddlers usually costs more, so MCCAP may pay a larger amount.

- As kids grow: The amount may go down as your child gets older and care becomes less expensive.

- The Type of Child Care

- Centers vs. homes: Licensed centers often have higher rates than family child care homes.

- Full-time vs. part-time: The amount of assistance will differ based on how many hours of care you need each week.

- Your Co-payment

- Sharing the cost: Even with MCCAP, you'll likely have to pay something towards your child care costs. This is called a co-payment.

- Sliding scale: Your co-payment is based on your income. The lower your income, the lower your co-payment.

How to get an estimate:

- No easy calculator: Unfortunately, there's no simple online tool to give you an exact amount.

- Best guess: The MDHS Child Care Finder tool can give you an idea of the maximum rates MCCAP pays for different types of care in your area.

- Talk to your county: Your local County DHS office is the best source for personalized help figuring out your potential costs and co-payment.

Keep in mind:

- It's not always the full cost: MCCAP might not cover the entire cost of your chosen provider.

- Changes happen: The amount you receive can change if your circumstances change, or if MCCAP rules are updated.

By understanding these factors and working closely with your County DHS office, you can get a clearer picture of how much child care assistance you can receive through MCCAP.

Child Care Assistance for Special Needs Children in Mississippi

Finding quality child care for children with special needs can be especially challenging. Thankfully, the Mississippi Child Care Assistance Program (MCCAP) offers support to eligible families with children who have disabilities or special needs.

Here's what you need to know about MCCAP for special needs children:

Eligibility:

- Qualifying Conditions: Children with a wide range of developmental, physical, or mental conditions may qualify. This includes autism, Down syndrome, cerebral palsy, and other disabilities.

- Documentation: You'll need to provide documentation of your child's special needs, such as a diagnosis from a medical professional or an Individualized Education Program (IEP) from their school.

- Priority Status: Children with special needs often receive priority access to MCCAP due to the increased costs and specialized care required.

Benefits:

- Financial Assistance: MCCAP helps cover the cost of care at licensed child care centers, family child care homes, and other settings that can accommodate your child's needs.

- Inclusive Settings: MCCAP encourages the inclusion of children with special needs in mainstream child care settings whenever possible.

- Specialized Care: If your child requires specialized care, MCCAP may help cover the costs of services like therapeutic care or one-on-one assistance.

Finding the Right Care:

- MDHS Child Care Finder: While the online tool may not specifically identify providers specializing in special needs care, it can help you locate licensed centers and homes in your area.

- Contacting Providers: Reach out to child care providers directly to inquire about their experience and ability to meet your child's needs.

- County DHS Offices: Your local County DHS office can provide valuable guidance and connect you with resources and providers specializing in special needs care.

Navigating child care for a child with special needs can be complex. By utilizing MCCAP and other available resources, families can find the support and care their child needs to thrive.

Child Care Assistance and TANF in Mississippi

In Mississippi, the Child Care Assistance Program (MCCAP) and Temporary Assistance for Needy Families (TANF) often work together to support low-income families with children. Understanding how these programs interact can help you access the best possible support.

What is TANF?

TANF is a federal program that provides temporary financial assistance to very low-income families with children. In Mississippi, TANF is administered by the Mississippi Department of Human Services (MDHS). It aims to help families achieve self-sufficiency through:

- Cash assistance: Monthly payments to help with basic needs like rent, utilities, and food.

- Work support: Assistance with job training, job search, and work expenses.

- Other support services: May include child care assistance, transportation assistance, and other services to help families overcome barriers to employment.

How MCCAP and TANF Relate:

- Combined Support: Families receiving TANF are often automatically eligible for MCCAP, making it easier to access affordable child care while they work towards self-sufficiency.

- Work Requirements: TANF generally has work requirements, meaning recipients must participate in work activities to continue receiving benefits. MCCAP helps fulfill this requirement by providing child care so parents can work or participate in training.

- Transitioning from TANF: Even if families no longer receive TANF cash assistance, they may still be eligible for MCCAP to support their continued employment and child care needs.

Important Considerations:

- Eligibility: Eligibility for both TANF and MCCAP is based on income, family size, and other factors.

- Application Process: You may need to apply for both programs separately, though the process may be streamlined if you're already receiving TANF.

- Coordination of Benefits: MDHS works to coordinate benefits between TANF and MCCAP to ensure families receive the appropriate level of support.

Where to Learn More:

- MDHS TANF Information: https://www.mdhs.ms.gov/help/tanf/

- Your Local County DHS Office: They can provide personalized guidance on TANF, MCCAP, and other available resources.

By understanding the relationship between MCCAP and TANF, families in Mississippi can access the combined support they need to overcome financial challenges, secure stable employment, and provide quality care for their children.

Frequently Asked Questions

What is the Mississippi Child Care Assistance Program (MCCAP)?The Mississippi Child Care Assistance Program (MCCAP) is a state-funded program that helps eligible families pay for child care. This allows parents to work or attend school knowing their children are in a safe and nurturing environment.

Who qualifies for child care assistance in Mississippi?To qualify for MCCAP, you must be a Mississippi resident, meet certain income requirements, and be working, looking for work, or enrolled in school or training. Your child must also be under 13 years old (or under 19 with special needs).

How much does child care assistance pay in Mississippi?The amount of assistance you receive varies based on your family income, the age of your child, and the type of child care you need. Generally, families with lower incomes receive more assistance.

What types of child care are covered by MCCAP?MCCAP covers a variety of child care settings, including licensed child care centers, licensed family child care homes, after-school programs, and sometimes in-home care.

How do I apply for child care assistance in Mississippi?You can apply for MCCAP online, by mail, or in person at your local county Department of Human Services (DHS) office. You'll need to provide documentation like proof of income, residency, and your child's age.

What are the income limits for child care assistance in Mississippi?The income limits for MCCAP are based on the State Median Income (SMI) and vary by family size. You can find the current income limits on the Mississippi Department of Human Services (MDHS) website.

What if my child has special needs?MCCAP can help cover the costs of child care for children with special needs. You'll need to provide documentation of your child's disability or special needs.

Can I get child care assistance if I receive TANF?Yes, families receiving TANF are often automatically eligible for MCCAP. This helps parents meet TANF work requirements by providing child care while they work or participate in job training.

Where can I find a list of approved child care providers?You can use the MDHS Child Care Finder tool to search for licensed child care providers in your area. You can also contact your local county DHS office for a list of providers.

What if I have more questions about MCCAP?For more information, visit the Mississippi Department of Human Services (MDHS) website, contact your local county DHS office, or call the MDHS Customer Service Center.