Imagine up to $50,000 for your goals or unexpected needs, directly in your account, without the wait.

Apply Now & Get Fast Funding!For many students and their families, the high cost of college can feel like an insurmountable barrier, placing the dream of a higher education just out of reach. The prospect of graduating with a debt-free degree can seem like a myth, but for low-income families, it is an achievable reality.

Obtaining a college education without the burden of student loans is not the result of a single, nationwide free college program, but rather a mosaic of opportunities that must be strategically assembled. The path to a debt-free degree involves a combination of federal grants, state-level initiatives, and generous institutional aid from colleges and universities. This roadmap will illuminate every available option and detail the precise steps required to access them, transforming the possibility of a tuition-free education into a concrete plan.

The foundation of any financial aid package for a low-income student is federal grant money. Unlike loans, grants are a form of gift aid that does not need to be repaid, making them the most valuable type of financial assistance.

The Pell Grant: Your Financial Foundation

What is the Pell Grant?

The Federal Pell Grant is the cornerstone of need-based financial aid provided by the U.S. Department of Education. It is awarded almost exclusively to undergraduate students who have not yet earned a bachelor's or professional degree and who display exceptional financial need. The maximum Pell Grant award for the 2025–26 award year is $7,395, though this amount can change annually.

How is the Pell Grant Calculated?

The actual amount a student receives is not a flat figure but depends on several key factors:

The Pell Grant is more than just a source of funds; it is a critical key that unlocks a wide array of other financial aid opportunities. Eligibility for the Pell Grant serves as a universal signal of high financial need that many other aid programs use as a primary qualification criterion. This means that successfully establishing Pell eligibility through the FAFSA is the single most powerful action a student can take, as its value extends far beyond the dollar amount of the grant itself.

Pell Grant Eligibility Essentials

To be considered for a Pell Grant, students must meet several criteria. The primary requirement is demonstrating significant financial need as an undergraduate. While there is no absolute income cutoff to qualify for federal student aid, most Pell Grants are awarded to students from families with an annual income below $30,000, with some partial awards available to families earning up to $60,000.

Specific eligibility extends to certain situations, including students enrolled in post-baccalaureate teacher certification programs or those in approved Prison Education Programs. Students can receive the Pell Grant for a maximum of 12 full-time terms, which is roughly equivalent to six years of study.

Beyond Pell: Other Key Federal Grants

While the Pell Grant is the largest federal grant program, other sources of federal gift aid are available for students with the highest levels of need.

Accessing the vast majority of financial aid requires completing one or both of two key applications: the FAFSA and the CSS Profile. Understanding their distinct purposes and processes is essential.

Mastering the FAFSA (Free Application for Federal Student Aid)

The FAFSA is the single most important application for financial aid. It is the gateway to all federal aid, including the Pell Grant and federal work-study, and is also used by states and most colleges to award their own grants and scholarships. The application is free and should only be completed on the official government website, fafsa.gov.

The process can be broken down into several clear steps:

The CSS Profile: The Key to Private College Aid

What is the CSS Profile?

For students applying to certain private colleges and universities, a second financial aid application is often required: the CSS Profile. Administered by the College Board, this application is used by nearly 250 institutions and scholarship programs to award their own non-federal, institutional aid.

Key Differences from the FAFSA

The CSS Profile differs from the FAFSA in several important ways:

While the FAFSA relies on a rigid formula, the CSS Profile's comprehensive approach can be a significant advantage for families with complex financial situations. The application includes a "Special Circumstances" section, which provides a crucial opportunity for families to explain issues not reflected in the numbers, such as a recent job loss, high unreimbursed medical expenses, or the cost of caring for an elderly relative.

This narrative component allows financial aid officers at private institutions to gain a more holistic understanding of a family's true ability to pay, which can result in a more generous and accurate institutional aid package. Rather than being a burden, this detailed application is a family's best tool for advocating for their financial needs.

In recent years, the most significant movement toward tuition-free college has come from the states. Dozens of states have launched "Promise Programs," which are place-based scholarships designed to make college affordable for residents. These programs have demonstrated overwhelming bipartisan support across the country, from Tennessee and West Virginia to Oregon and Connecticut.

How Promise Programs Work

Promise programs generally fall into one of two categories, and understanding the distinction is critical for managing a student's overall finances.

Last-Dollar Programs

This is the most common model. A last-dollar program covers the remaining balance of tuition and mandatory fees after all other federal and state grant aid (like the Pell Grant) has been applied. For example, if tuition is $4,000 and a student receives a $3,000 Pell Grant, a last-dollar program would cover the remaining $1,000. While this makes tuition free, it also means the Pell Grant funds cannot be used for other expenses.

First-Dollar Programs

This model is less common but more beneficial for low-income students. A first-dollar scholarship covers tuition and fees before any other aid is applied. In the same scenario, a first-dollar program would pay the full $4,000 in tuition, allowing the student to use their $3,000 Pell Grant to pay for books, transportation, housing, and food.

Key Eligibility Requirements

While each program has its own specific rules, most share a common set of eligibility criteria. Students are typically required to be a resident of the state, have a high school diploma or equivalent, and enroll at an in-state public college or university.

Almost universally, students must complete the FAFSA to be considered, as the programs are designed to work in tandem with federal aid. Some programs may also require a minimum high school GPA, continuous enrollment, or that students maintain satisfactory academic progress once in college.

Spotlight on Prominent State Programs

The landscape of promise programs is diverse, with each state tailoring its approach to meet local needs.

| State | Program Name | Income Cap (Family AGI) | Key Eligibility Requirements | Coverage | Model |

|---|---|---|---|---|---|

| Arizona | Arizona Promise Program | Pell Grant Eligible | AZ resident, HS GPA ≥2.5, enroll at ASU, NAU, or U of A | Tuition & Fees | Last-Dollar |

| California | California College Promise Grant | Income/Need-Based | CA resident, demonstrate financial need | Community College Enrollment Fees | Fee Waiver |

| Illinois | Illinois Commitment | ≤$67,100 | IL resident, family assets ≤$50,000, attend U of I Urbana-Champaign | Tuition & Fees | Last-Dollar |

| Michigan | Go Blue Guarantee | ≤$65,000 | MI resident, family assets ≤$50,000, attend University of Michigan | Tuition & Fees | Last-Dollar |

| Minnesota | North Star Promise | <$80,000 | MN resident, attend public or Tribal college | Tuition & Fees | Last-Dollar |

| New York | SUNY Free Community College | No Degree | NY resident, age 25-55, enroll in high-demand field | Tuition, Fees, Books, Supplies | Last-Dollar |

| Tennessee | UT Promise Scholarship | <$60,000 | TN resident, qualify for HOPE Scholarship | Tuition & Fees | Last-Dollar |

| Texas | Paydirt Promise | ≤$75,000 | TX resident, attend UT El Paso | Tuition & Fees | Last-Dollar |

Beyond federal and state aid, the single largest source of funding comes directly from colleges and universities themselves. Certain types of institutions have made it their mission to eliminate financial barriers for low-income students through unique educational models or by leveraging massive endowments to provide generous aid.

Tuition-Free Institutions: Unique Models and Commitments

A small but notable group of colleges has eliminated tuition entirely, often in exchange for work or service.

Service Academies

The five U.S. Service Academies—the U.S. Military Academy (West Point), U.S. Naval Academy, U.S. Air Force Academy, U.S. Coast Guard Academy, and U.S. Merchant Marine Academy—offer a complete educational package. Students receive free tuition, room, board, and medical benefits. In return, graduates must commit to a period of active military service, typically at least five years.

Work Colleges

A handful of federally recognized Work Colleges have integrated student labor into their educational model. At institutions like Berea College in Kentucky and College of the Ozarks in Missouri, all resident students are required to work 10-15 hours per week in on-campus jobs that are essential to the college's operation. The earnings from this work are applied directly to their educational costs, covering 100% of tuition and allowing students to graduate without debt. This is a mandatory component of the curriculum, distinct from optional federal work-study programs.

Specialized Institutions

Some colleges offer free tuition to all admitted students in highly specialized fields.

Elite Universities with Full-Ride Opportunities for Low-Income Students

For high-achieving students from low-income backgrounds, the nation's wealthiest and most selective private universities are often, counterintuitively, the most affordable option. These institutions possess massive financial endowments, sometimes in the tens of billions of dollars, which they use to fund incredibly generous financial aid programs. The sticker price at these schools may be the highest in the country, but for a majority of families, the actual net price is dramatically lower, and for low-income families, it is often zero.

Meeting 100% of Demonstrated Need

The cornerstone of their aid philosophy is the promise to meet 100% of a student's demonstrated financial need. This means the university pledges to cover the full difference between the total cost of attendance and the amount the family is determined to be able to contribute, as calculated through the FAFSA and CSS Profile. Crucially, they meet this need without including loans in their financial aid packages for low-income students.

Generous Income-Based Promises

Many of these universities have established explicit income-based promises that eliminate all costs for qualifying families.

| University | Income Threshold for Free Tuition | Income Threshold for Full Cost of Attendance (Tuition, Room, Board) | Notes |

|---|---|---|---|

| Brown University | ≤$125,000 | <$60,000 | Meets 100% of demonstrated need for all students. |

| Columbia University | <$150,000 | <$66,000 (No Parent Contribution) | Meets 100% of demonstrated need without loans. |

| Cornell University | <$75,000 (No Loans) | <$60,000 (No Parent Contribution) | Meets 100% of demonstrated need. |

| Dartmouth College | ≤$125,000 | <$65,000 (No Parent Contribution) | Meets 100% of demonstrated need without loans. |

| Duke University | ≤$150,000 (NC/SC Residents) | ≤$65,000 (NC/SC Residents) | Meets 100% of demonstrated need. |

| Harvard University | ≤$200,000 | ≤$100,000 | No parent contribution for incomes ≤$85,000. |

| Princeton University | Most families up to $250,000 | ≤$100,000 | Meets 100% of demonstrated need without loans. |

| Rice University | $ $75,000 - $140,000$ | <$75,000 | The Rice Investment program offers tiered support up to $200,000. |

| Stanford University | <$150,000 | <$100,000 | Meets 100% of demonstrated need without loans. |

| Yale University | N/A | <$75,000 (No Parent Contribution) | Meets 100% of demonstrated need without loans. |

The Rise of No-Loan Policies

In addition to the top-tier universities, a growing number of excellent colleges and universities have adopted "no-loan" financial aid policies. This means that for eligible students, the institution replaces any federal loans that would typically be part of a financial aid package with its own institutional grants and scholarships. This commitment allows students to graduate with little to no debt, even if their entire cost of attendance is not covered.

Many of these policies are targeted at low- and middle-income families, with specific income thresholds determining eligibility. For example, Colgate University has a no-loan initiative for students with family incomes below $175,000, while Haverford College offers no-loan packages to families with incomes below $60,000. Other prominent institutions with strong no-loan policies include Amherst College, Bowdoin College, Grinnell College, Pomona College, Swarthmore College, and Vanderbilt University.

Beyond direct institutional aid, several other strategies and resources can significantly reduce or eliminate the cost of a bachelor's degree.

The Community College Transfer Strategy

Beginning at a two-year community college and then transferring to a four-year institution is one of the most powerful and underutilized strategies for obtaining a high-quality, low-cost degree. This pathway allows students to complete their first two years of coursework at a dramatically lower cost—often for free through state programs like the California College Promise Grant—before moving to a more expensive university to complete their bachelor's degree.

For many students who may not have had the resources to build a competitive application in high school, community college provides a second chance to establish a strong academic record and demonstrate the grit and maturity that elite universities increasingly value in transfer applicants. This path is not a "lesser" option but a distinct and strategic route that can be more effective than applying as a freshman.

Support for Transfer Students

Several organizations provide robust support for this pathway:

Scholarships Beyond Grades

A common misconception is that scholarships are reserved for students with perfect grades. In reality, thousands of scholarships are available that prioritize criteria other than GPA. Many scholarship providers are specifically looking for students who demonstrate financial need, a commitment to community service, leadership potential, or the resilience to have overcome personal adversity.

There are numerous awards for students with GPAs in the 2.0 to 3.0 range, as well as scholarships that have no GPA requirement at all.

Reputable Scholarship Search Platforms

When searching for scholarships, it is vital to use trusted, free resources to avoid scams or paying for information that is publicly available.

Achieving a debt-free college education is not a matter of luck but of strategy and diligence. The path is built upon a clear framework: first, establishing a foundation of federal aid; second, capitalizing on state-level Promise Programs; third, targeting institutions with financial aid policies that eliminate costs for low-income families; and finally, supplementing with strategic pathways like community college transfers and targeted scholarships.

The journey for every student begins with a single, critical action: completing the Free Application for Federal Student Aid (FAFSA). This one application unlocks the potential for federal, state, and institutional aid and is the non-negotiable first step.

While the process of researching programs, completing applications, and meeting deadlines requires effort, a high-quality college degree without the crushing weight of debt is a tangible and attainable goal for every determined student from a low-income family.

There is no single income cutoff. For Federal Pell Grants, eligibility is determined by your Student Aid Index (SAI) from the FAFSA, not just income. Many state Promise programs and no-loan colleges have their own specific income thresholds, often ranging from $65,000 to $150,000 in annual family income.

This varies by program. Most state "Promise" programs are "last-dollar" and cover tuition and fees only. However, a full financial aid package from a no-loan college, combined with a Pell Grant, can often cover room, board, and other essential expenses, leading to a truly debt-free degree.

This is a challenging situation. Generally, you cannot be declared an independent student on the FAFSA simply because your parents refuse to pay. You should contact the financial aid office at each college you're considering to explain your circumstances, as they may offer an institutional dependency override in rare cases.

To receive federal aid like the Pell Grant, you must be a U.S. citizen or an eligible noncitizen (e.g., a permanent resident). State-level programs and institutional aid policies for noncitizens, including DACA recipients or undocumented students, vary significantly by state and school. Always check with the specific institution.

Yes. You must complete the FAFSA every year you are in college to remain eligible for federal and most state and institutional aid. Maintaining eligibility for free college programs also typically requires meeting Satisfactory Academic Progress (SAP) standards, such as maintaining a minimum GPA and completing enough credits.

Absolutely. Many state Promise programs are expanding to include adult learners, not just recent high school graduates. The Federal Pell Grant has no age limit. Additionally, many community colleges offer specific grants and tuition waivers for returning adult students seeking new skills or a degree.

Yes. While some merit-based scholarships require a high GPA, need-based aid like the Pell Grant does not have a GPA requirement for initial eligibility. Many community college Promise programs focus on residency and financial need over high school grades, providing a clear path to higher education.

This is known as "scholarship displacement" or "over-awarding." In most cases, the college will adjust your financial aid package. At "no-loan" colleges, they typically reduce the loan or work-study portion of your aid first, ensuring the scholarship provides a true financial benefit to you.

For some students, yes. Institutions like West Point or the Air Force Academy are extremely competitive, requiring a congressional nomination, top grades, and physical fitness. In exchange for a completely free education and a living stipend, graduates have a multi-year active duty service commitment after graduation.

Yes, work colleges integrate a student work program into the educational experience. All resident students are required to work a set number of hours per week on campus. The earnings from this work, combined with grants and scholarships, are applied directly to cover the full cost of tuition.

Securing a personal loan in California requires navigating a financial landscape shaped by state-specific regulations, a diverse array of lenders, and robust consumer protection laws. Whether for consolidating debt, financing a home improvement project, or covering an emergency, a personal loan can be a powerful tool.

Success, however, depends on a thorough understanding of the options available, the rules that govern them, and the steps needed to qualify. This analysis provides an in-depth examination of personal loan interest rates, the lender ecosystem, and the critical regulations enforced by California's financial authorities. This empowers borrowers to make sound, informed decisions.

A personal loan is a form of installment credit where you borrow a lump sum and repay it in fixed monthly payments over a set period, typically one to seven years. The primary appeal lies in its flexibility; unlike a mortgage or auto loan, the funds can be used for nearly any purpose.

Common uses include consolidating high-interest credit card balances, financing home renovations, covering medical bills, or managing other large, one-time expenses.

Unsecured vs. Secured Loans: The Collateral Question

Personal loans in California are offered in two primary structures: unsecured and secured. The distinction hinges on whether you must pledge collateral to back the loan.

Unsecured Loans

Unsecured loans represent the vast majority of personal loan products. These loans are granted based on your creditworthiness, which includes factors like credit score, income, and existing debt. Because there is no collateral for the lender to seize in case of default, these loans present a higher risk to the financial institution.

Consequently, interest rates and approval criteria are heavily dependent on your financial profile. Lenders such as Discover, PNC Bank, and California Bank & Trust are prominent providers of unsecured personal loans.

Secured Loans

Secured loans require you to pledge a financial asset as collateral. This could be funds in a savings account, a share certificate, or sometimes a vehicle. By securing the loan, you significantly reduce the lender's risk.

This often translates into more favorable terms, including a lower annual percentage rate (APR) and a potentially higher loan amount. Secured loans are a valuable option for individuals building or repairing their credit, as they can be easier to qualify for. Many California-based credit unions, such as California Credit Union (CCU) and Credit Union of Southern California (CU SoCal), specialize in these types of loans.

Fixed-Rate Installment Loans vs. Lines of Credit

Beyond collateral, personal loans also differ in how funds are disbursed and repaid.

Fixed-Rate Installment Loans

These are the most common structure. You receive the full loan amount in a single, upfront disbursement. Repayment consists of equal monthly installments over a fixed term at an interest rate that does not change. This predictability is a significant advantage, allowing for straightforward budgeting and providing a clear date for when the debt will be paid off.

Personal Lines of Credit

These function more like a credit card. Instead of a lump sum, you are approved for a maximum credit limit from which you can draw funds as needed. Interest is charged only on the outstanding balance, and as the balance is repaid, the available credit is replenished. This makes a personal line of credit an excellent tool for managing ongoing projects or for establishing a flexible emergency fund. This product is a staple at many California credit unions.

The personal loan market in California is a tightly regulated industry overseen by a state agency to protect consumers. Understanding this regulatory framework is essential for any borrower.

The Role of the Department of Financial Protection and Innovation (DFPI)

The primary regulator for most financial services in the state is the Department of Financial Protection and Innovation (DFPI). The DFPI's mission is to protect California consumers from predatory financial practices and to foster a market where responsible financial products can thrive.

Through the California Consumer Financial Protection Law (CCFPL), the DFPI has expansive authority to supervise financial institutions and enforce laws against unfair, deceptive, or abusive practices. This includes oversight of previously unregulated sectors, ensuring broad protection for Californians.

The California Financing Law (CFL): Rules for Lenders

The specific statute governing most non-bank personal loan providers is the California Financing Law (CFL). This law mandates that any business making or brokering consumer loans in California must obtain a license from the DFPI.

This licensing process is a critical consumer safeguard. Applicants must demonstrate a minimum net worth of $25,000 and secure a $25,000 surety bond, which provides funds to compensate consumers harmed by a licensee's misconduct. It is this license that legally exempts these lenders from California's constitutional usury law, which otherwise caps interest rates.

California's Interest Rate Caps: A Multi-Layered System

California's rules on maximum interest rates are nuanced and represent a crucial aspect of the state's regulatory environment.

This tiered structure has created a "regulatory barbell" effect. The strict caps on loans under $2,500 have made them economically unviable for many lenders. As a result, a large portion of licensed lenders in the state choose to offer loans only above the $2,500 threshold. This has led to instances of lenders encouraging borrowers to take out slightly larger loans than they need—for example, $2,600 instead of $2,400—specifically to move into the higher-rate category.

The process of qualifying for a personal loan is a data-driven assessment of a borrower's ability to repay the debt. Lenders in California evaluate a consistent set of core financial indicators.

The Core Factors: Credit, Income, and Debt

Three pillars form the foundation of any personal loan application:

The Application Process: From Soft Pull to Funding

The modern lending process has been streamlined to be faster and more transparent.

California's lending market is populated by three main types of institutions, each with distinct strengths. The best choice depends on your financial profile, need for service, and desired speed.

Traditional Banks

Major banks like Wells Fargo and U.S. Bank are significant players. For existing customers, the application process can be streamlined. Banks often offer competitive rates and may not charge origination fees, particularly for customers with strong credit. However, they tend to have more stringent credit requirements.

California Credit Unions

Credit unions like CU SoCal and Golden 1 are not-for-profit cooperatives owned by their members. This structure allows them to offer lower interest rates and fewer fees. They are known for personalized service and are often more willing to consider an applicant's entire financial picture, making them a great option for borrowers with fair credit. The main drawback is their membership requirement, which is typically restricted by geography or affiliation.

Online Lenders

Online-only lenders like SoFi and LendingClub have revolutionized the loan process with speed and convenience. Their digital applications can be completed in minutes, with funding often arriving within a day. They cater to a broad spectrum of borrowers and make comparison shopping simple with pre-qualification. The most significant downside is that many charge origination fees, which are deducted from the loan proceeds.

One of the most common reasons to seek a personal loan is to consolidate existing, higher-interest debts, particularly from credit cards. When done correctly, this strategy offers significant benefits.

The Advantages of Consolidation

The Potential Pitfalls and Risks

For Californians with a poor or limited credit history, securing a loan is challenging but not impossible. The market offers several pathways, though they often come with higher costs.

Navigating the Market with a Low Credit Score

While options are more constrained, several lenders are willing to work with borrowers who have less-than-perfect credit.

Credit Builder Loans: A Proactive Strategy

For those whose financial need is not an immediate emergency, a credit builder loan offers a proactive path to improving creditworthiness. These unique products are designed specifically to help individuals establish or repair their credit history.

The mechanics are the reverse of a traditional loan. The borrowed funds are placed into a locked savings account. You then make fixed monthly payments, which the lender reports to the major credit bureaus. This consistent, positive reporting helps build your credit score. Once the loan is paid off, the principal amount is released to you.

California credit unions like Patelco and CU SoCal have well-established credit builder programs. This strategy offers a dual benefit: it directly addresses a poor credit score while acting as a disciplined savings plan.

California has some of the strongest consumer protection laws in the nation. These protections are most effective when you are aware of your rights and know how to use available resources.

How to Verify a Lender's License

Before entering into any agreement, the most crucial step is to verify that the company is properly licensed to do business in California. An unlicensed lender is operating illegally.

Verification is a straightforward process:

Recognizing and Avoiding Predatory Lending

Predatory lending involves deceptive and abusive practices designed to trap borrowers in unaffordable debt. Be vigilant for the following red flags:

What to Do If You Suspect Fraud or Unfair Practices

If you believe you have encountered a predatory lender, you have several avenues for recourse:

While a personal loan can be a useful solution, it is not always the best or only option. For those struggling with debt, several valuable resources are available.

Non-Profit Credit Counseling

Before taking on new debt, consider contacting a reputable non-profit credit counseling agency. These organizations, often members of the National Foundation for Credit Counseling (NFCC), provide low-cost or free services.

A certified credit counselor can offer a free budget and credit report review, helping you explore all available options. For those with significant credit card debt, they may recommend a Debt Management Plan (DMP), where the agency works with your creditors to potentially lower your interest rates.

How to Compare Personal Loan Offers Effectively

For those who determine a personal loan is the right choice, a disciplined comparison process is key. After gathering multiple pre-qualification offers, evaluate them based on the following criteria:

The market for personal loans in California is dynamic, offering a wide range of products tailored to diverse financial needs. From the flexible lines of credit offered by local credit unions to the speed of online lenders, borrowers have more options than ever. This abundance of choice is governed by a robust regulatory framework managed by the DFPI.

The key to success is proactive and informed decision-making. This begins with leveraging pre-qualification to compare offers and continues with the essential step of verifying a lender's license. By understanding the distinct advantages of different lenders and recognizing the signs of predatory practices, Californians can confidently utilize personal loans as an effective and responsible financial instrument.

Interest rates on California personal loans typically range from 6% to 36% APR. Your exact rate is determined by your credit score, income, debt-to-income ratio, and the lender. Excellent credit secures lower rates, while fair or poor credit will result in higher interest charges on your loan.

Yes, securing a California personal loan with bad credit is possible, though options are more limited. Lenders specializing in subprime credit, and some credit unions, may approve your application. Expect to pay a higher interest rate and potentially face stricter terms or lower loan amounts than a borrower with good credit.

Most lenders offer California personal loans ranging from $1,000 up to $100,000. The maximum amount you can borrow depends on the lender's policies, your creditworthiness, and your ability to repay. High-income earners with excellent credit will qualify for the largest loan amounts available in the state.

California personal loans are primarily regulated by the Department of Financial Protection and Innovation (DFPI) under the California Financing Law (CFL). This includes licensing lenders and enforcing rules on interest rates, fees, and loan terms to protect consumers from predatory practices and ensure fair lending standards.

No, pre-qualifying for California personal loans will not hurt your credit score. Lenders use a soft credit inquiry for pre-qualification, which is not visible to other creditors. A hard credit inquiry, which can temporarily lower your score, is only performed when you formally submit a full loan application.

True "no credit check" personal loans from reputable lenders are extremely rare in California. Be cautious, as offers for no credit check loans often come from predatory lenders with exorbitant fees and interest rates. Most legitimate lenders require at least a soft credit pull to assess your financial history.

Funding speed for a personal loan in California varies by lender. Online lenders are often the fastest, with many capable of depositing funds directly into your bank account within one to two business days after approval. Traditional banks and credit unions might take three to five business days.

Credit unions can be an excellent option for California personal loans, often providing lower interest rates and more flexible terms, especially for their members. While banks may offer larger loan amounts and streamlined digital processes, it is always wise to compare offers from both types of institutions before deciding.

Generally, yes. Most California personal loans are unsecured and can be used for various purposes like debt consolidation, home improvement, or major purchases. However, most loan agreements explicitly prohibit using the funds for business expenses, investing, gambling, or any illegal activities, so always check the lender's terms.

If you default, you have protections under the federal Fair Debt Collection Practices Act (FDCPA) and California's Rosenthal Fair Debt Collection Practices Act. Lenders cannot harass you. It is crucial to contact your lender immediately if you anticipate trouble; they may offer hardship plans or alternative payment arrangements.

Debt settlement offers a potential path to resolving overwhelming unsecured debt by paying a negotiated amount less than what you originally owed. For those struggling with credit card balances, medical bills, or personal loans, this process can seem like a lifeline.

However, it is a financially consequential decision fraught with significant risks, including severe credit damage, potential lawsuits, and unexpected tax liabilities. Making an informed choice requires a clear-eyed understanding of how the process works, its true costs, and the viable alternatives that may better protect your financial future.

At its core, debt settlement is a negotiation. It is an agreement between a consumer and a creditor to consider an unsecured debt paid in full for a reduced amount, often paid as a single lump sum. This is not an act of generosity from the creditor.

It is a calculated business decision made when an account is severely delinquent. The creditor believes that accepting a partial payment is a better financial outcome than risking no payment at all, which becomes more likely as a consumer heads toward potential bankruptcy.

The Process Unveiled: A Step-by-Step Journey

Whether pursued through a for-profit company or undertaken individually, the debt settlement process follows a consistent, and often perilous, path that typically takes between two to four years to complete.

Eligible vs. Ineligible Debts

Debt settlement is not a universal solution and only applies to specific types of debt. It's crucial to understand that even for eligible debts, a creditor's participation is entirely voluntary; they are never legally obligated to accept a settlement offer.

Debts Typically Eligible for Settlement

The process is designed for unsecured debts, which are not tied to any specific collateral. These include:

Debts Typically Ineligible for Settlement

Certain debts cannot be resolved through this process due to their legal status or because they are secured by property. These include:

The appeal of debt settlement is straightforward, but the potential benefits are countered by guaranteed and severe risks. A clear understanding of this trade-off is essential before embarking on this path.

Potential Benefits of Debt Settlement

For consumers in dire financial straits who successfully complete a program, debt settlement can offer several positive outcomes.

Critical Risks of Debt Settlement

The potential benefits of debt settlement are not guaranteed and come at a very high price. The strategy's core tactic—stopping payments to gain leverage—is the very action that triggers its most destructive consequences. This paradox means the consumer must actively and deliberately worsen their financial standing in the hope of an uncertain positive outcome.

Beyond the immediate risks, two long-term consequences of debt settlement are often misunderstood and can lead to significant financial shocks: the tax liability on forgiven debt and the lasting negative mark on a credit report.

The Tax Consequence: Understanding Form 1099-C

A major pitfall of debt settlement is the potential for a surprise tax bill. The Internal Revenue Service (IRS) generally considers any canceled or forgiven debt of $600 or more to be taxable income.

When a creditor settles a debt, they must report the forgiven amount to you and the IRS by issuing a Form 1099-C, "Cancellation of Debt". For example, if you settle a $10,000 credit card balance for $4,000, the forgiven $6,000 is considered income. You must report this amount on your tax return and will owe income tax on it, which can result in a significant tax liability.

This reality exposes a central "savings illusion" in debt settlement. To calculate the actual outcome, one must start with the forgiven amount and then subtract the settlement company's fees, the accrued interest and late fees, and the tax liability. In some cases, this calculation reveals that the consumer has saved very little or has even incurred a net loss.

The Insolvency Exclusion: A Critical Safety Net

Fortunately, the IRS provides a crucial exception that can protect many people from this tax burden: the insolvency exclusion.

The IRS considers you insolvent if, at the moment before your debt was canceled, your total liabilities (everything you owe) were greater than the fair market value of your total assets (everything you own). If you are insolvent, you can exclude the forgiven debt from your taxable income up to the amount by which you are insolvent.

For instance, if your total debts are $50,000 and your assets are worth $30,000, you are insolvent by $20,000. In this scenario, you could exclude up to $20,000 of forgiven debt from your income. To claim this valuable exclusion, you must file IRS Form 982, "Reduction of Tax Attributes Due to Discharge of Indebtedness," with your tax return. Consulting with a qualified tax professional is highly recommended.

The debt relief industry is regulated by federal law, and understanding these rules is the best defense against predatory companies. The Federal Trade Commission (FTC) and the Consumer Financial Protection Bureau (CFPB) provide critical oversight and consumer protections.

Consumer Protections: FTC and CFPB Rules

The FTC's amended Telemarketing Sales Rule established clear guidelines for the debt settlement industry.

Hallmarks of a Reputable Company

While the industry has its risks, legitimate operators do exist. A reputable company can be identified by several key characteristics:

Red Flags and Common Scams

Consumers should be on high alert for tactics that signal a fraudulent or predatory operation.

It is possible to negotiate debt settlements on your own, without paying high fees to a third-party company. This "Do-It-Yourself" (DIY) approach requires organization and persistence but keeps you in control. It is important to recognize that the DIY path carries the exact same fundamental risk to your credit score as using a professional service because both methods rely on strategic delinquency.

Are You a Good Candidate for DIY Settlement?

Before starting, assess if this path is right for you by asking these questions:

A Step-by-Step Negotiation Plan

Debt settlement is a high-risk strategy that should only be considered after exploring safer, more effective alternatives. The correct path depends on whether it is possible for you to repay your debt in full if you receive some help with the terms.

Full Repayment Strategies

If you can afford to repay your principal balance but are struggling with high interest rates, these options are superior to debt settlement because they are far less damaging to your credit.

Reduced Repayment Strategies

If your financial situation is so severe that you cannot repay your debts in full even with lower interest rates, you must choose between strategies that reduce the principal.

Ultimately, the path out of debt requires a careful and honest assessment of your financial reality. While debt settlement presents an alluring promise of paying less, its process is fraught with risks that can leave a consumer in a worse position. By exploring less damaging alternatives first and understanding the true costs, you can make an informed decision that leads to genuine and lasting financial recovery.

For more information from federal regulators, you can visit the Consumer Financial Protection Bureau's page on debt relief programs or the Federal Trade Commission's consumer advice on debt.

Debt settlement is a process where a company negotiates with your creditors on your behalf to accept a lump-sum payment that is less than the total amount you owe. Typically, you stop paying creditors and instead deposit funds into a special savings account to accumulate the settlement amount.

Legitimate debt settlement companies charge a fee based on the amount of debt enrolled or the amount of debt they successfully reduce. As of 2025, these fees often range from 15% to 25% of the total enrolled debt. Reputable companies will not charge you until a settlement is reached.

Debt settlement can cause a significant drop in your credit score, often by 100 points or more. This is because you must stop paying your creditors for negotiations to begin, resulting in delinquencies and charge-offs on your credit report, which can remain for up to seven years.

Yes, you can negotiate directly with creditors to settle your own debt. This approach allows you to avoid the fees charged by debt settlement companies. Be prepared to explain your financial hardship and have a lump-sum payment ready to offer as part of your proposed settlement agreement.

The entire debt settlement process typically takes between two to four years to complete. The timeline depends on how quickly you can save enough money for the lump-sum payments and how willing your creditors are to negotiate. It is not a quick fix for overwhelming financial hardship.

No, debt settlement is designed almost exclusively for unsecured debts like credit cards, medical bills, and personal loans. It is not an option for secured debts like mortgages or auto loans, nor can it be used for federal student loans, which have their own specific relief programs.

The biggest risks of debt settlement include severe damage to your credit score, the possibility of being sued by creditors for non-payment during the negotiation phase, and the potential for the IRS to consider your forgiven debt as taxable income, leading to an unexpected tax bill.

Look for a debt settlement company accredited by organizations like the American Fair Credit Council (AFCC). A reputable firm will provide a clear fee structure, explain the risks involved, and will not charge upfront fees before successfully settling a debt, as mandated by the Federal Trade Commission (FTC).

Yes, creditors are under no legal obligation to accept a debt settlement offer. Success is not guaranteed. They may choose to reject the proposed amount and instead continue collection efforts or pursue legal action, such as a lawsuit, to recover the full amount you owe.

For some individuals, bankruptcy may be a better path. While both options negatively impact your credit, bankruptcy legally stops all collection actions and can resolve debts more quickly and comprehensively. Consulting with a non-profit credit counselor or attorney can help determine which option is right for you.

The annual percentage rate (APR) is the single most important figure for understanding the true cost of borrowing money, yet it remains one of a frequently misunderstood concept in personal finance. While many borrowers focus on the interest rate, the APR provides a more complete and standardized measure that includes not only interest but also most of the mandatory fees associated with a loan.

Grasping the distinction between these two terms is the first step toward making empowered financial decisions. An interest rate represents only the cost of borrowing the principal amount, whereas the APR reflects the total yearly cost of credit, expressed as a percentage.

This comprehensive figure allows for a true "apples-to-apples" comparison between different loan offers, a transparency mandated by federal law to protect consumers. By demystifying the annual percentage rate, borrowers can navigate the complexities of credit cards, mortgages, auto loans, and personal loans with greater confidence, ensuring they select the most affordable option for their financial situation.

The annual percentage rate is not a single charge but a composite figure that bundles together the various costs of obtaining credit. Its primary function is to translate a complex array of interest charges and fees into a single, comparable number.

The gap between a loan's advertised interest rate and its APR widens as the financial product becomes more complex and laden with fees. For a simple credit card, the APR and interest rate might be identical, but for a multifaceted product like a mortgage, the difference can be substantial, making the APR the only reliable guide to the total cost.

The Core Components of APR

Understanding the APR begins with breaking it down into its fundamental parts. These components vary by loan type but generally fall into several key categories that represent the full spectrum of borrowing costs.

APR vs. Interest Rate: A Critical Distinction

The single most common point of confusion for borrowers is the difference between the interest rate and the APR. Failing to understand this distinction can lead to choosing a loan that appears cheaper but costs more over its lifetime.

Consider two hypothetical 30-year fixed-rate mortgage offers for $300,000:

At first glance, Lender A's offer seems better due to the lower interest rate. However, when the fees are factored into the annual percentage rate, a different picture emerges. Lender A's APR would be higher than its interest rate because of the significant fees, while Lender B's APR would be much closer to its interest rate.

A borrower planning to stay in the home for a long time might find that Lender B's offer is actually the more affordable choice, despite the higher interest rate. This is precisely why the APR was created: to provide a single, standardized figure that accounts for these differences, enabling a fair comparison.

APR vs. APY: Borrower Cost vs. Saver Earnings

Another common point of confusion is the difference between APR and Annual Percentage Yield (APY). While they sound similar, they represent opposite sides of the financial coin.

The crucial technical difference between them is the effect of compounding. APY accounts for compound interest, which is the interest earned on both the principal and the previously accumulated interest. APR, in its standard calculation for loans, does not factor in the effect of interest compounding on the debt.

For example, a savings account with a 2% interest rate that compounds monthly will have an APY slightly higher than 2% because the interest earned each month starts earning its own interest. Conversely, a loan's APR is a representation of the annual interest rate plus fees, without illustrating how unpaid interest might compound and increase the total debt over time, as is common with credit cards.

Fixed vs. Variable APR: The Implications for Your Payments

The structure of an APR can be either fixed or variable, a distinction that has significant long-term implications for a borrower's financial planning and stability.

The composition and significance of the annual percentage rate vary considerably across different types of consumer credit. The APR a borrower receives is influenced by a consistent set of factors: the specific loan product, prevailing macroeconomic conditions (like the prime rate), the borrower's individual financial profile (credit score and debt-to-income ratio), and the lender's internal underwriting criteria. Understanding how these levers operate for each product is key to securing the best possible terms.

Credit Card APR Explained

Credit cards are one of the most common forms of revolving credit, and they often feature multiple types of APRs on a single account. Unlike installment loans, the APR on a credit card is often the same as the interest rate because there are typically no separate origination fees included in the calculation.

Types of Credit Card APRs

A single credit card agreement can contain several different APRs, each applying to a different type of transaction:

What Is a Good APR for a Credit Card?

A "good" credit card APR is relative and depends heavily on two factors: the applicant's credit score and the current national average. According to Federal Reserve data, the average APR for credit card accounts assessed interest is over 20%. Therefore, an APR at or below this average can generally be considered good.

However, what is "good" for one person may not be for another. Borrowers with excellent credit scores (e.g., 760 and above) may qualify for rates in the low teens, while those with fair or poor credit will face much higher rates. The following table provides estimated benchmarks for credit card APRs based on creditworthiness.

| Credit Score Tier | Example APR Range for New Offers | Notes |

|---|---|---|

| Excellent (720+) | 12% - 18% | Often qualify for the lowest advertised rates and best rewards cards. |

| Good (690-719) | 18% - 24% | Rates are typically around the national average. |

| Fair (630-689) | 22% - 28% | Rates are generally above the national average; secured cards may be an option. |

| Poor (<630) | 25% - 30%+ | Often limited to secured cards or cards with very high penalty rates. |

How Credit Card Interest Accrues

Credit card interest is typically calculated using the average daily balance method and a daily periodic rate. To avoid interest charges entirely, the cardholder must pay the statement balance in full before the end of the grace period. If a balance is carried, the issuer calculates interest as follows:

Mortgage APR Explained

For mortgages, the APR is an exceptionally powerful tool because these loans involve numerous and substantial fees. The difference between a mortgage's interest rate and its APR is often significant, highlighting the true cost of financing a home.

How Mortgage Fees Inflate the APR

A mortgage APR includes the nominal interest rate plus a host of other required costs rolled into the loan. These fees can include:

Because all lenders are required to calculate the APR using a standardized formula, it provides the only reliable way to compare offers that may have different combinations of interest rates and fees. A loan with a lower interest rate but higher fees could easily have a higher APR—and be more expensive over time—than a loan with a slightly higher rate but minimal fees.

What Is a Good APR for a Mortgage?

A "good" mortgage APR is a moving target, heavily influenced by prevailing market conditions, the borrower's financial health, and the specific loan product. Key factors include:

The best way to determine a good APR is to compare a lender's offer against the current national averages for a similar loan product.

| Loan Product | Example Average Interest Rate | Example Average APR |

|---|---|---|

| 30-Year Fixed-Rate | 6.75% | 6.82% |

| 15-Year Fixed-Rate | 5.94% | 6.04% |

| 5/1 ARM | 6.13% | Varies |

| 30-Year FHA | 6.77% | 6.83% |

| 30-Year VA | 6.84% | 6.89% |

| 30-Year Jumbo | 6.79% | 6.84% |

Auto Loan APR Explained

For auto loans, the APR is also a critical metric, with rates varying significantly based on whether the vehicle is new or used, the length of the loan, and, most importantly, the borrower's credit score.

Comparing APRs for New vs. Used Vehicles

Lenders generally offer lower APRs for new car loans than for used car loans. This is because new vehicles have a higher and more predictable resale value, making them less risky collateral for the lender. A new car is also less likely to experience mechanical failures that could impact its value or the borrower's ability to make payments. In the first quarter of 2025, the average interest rate for a new car loan was 6.73%, while the average for a used car loan was nearly double at 11.87%.

The Impact of Loan Term

The loan term, or repayment period, also affects the APR. Shorter loan terms (e.g., 36 or 48 months) typically come with lower APRs because the lender's risk is spread over a shorter period. However, shorter terms mean higher monthly payments. Conversely, longer terms (e.g., 72 or 84 months) result in lower monthly payments but usually carry higher APRs, leading to more interest paid over the life of the loan.

What Is a Good APR for an Auto Loan?

The primary determinant of an auto loan APR is the borrower's credit score. Lenders use credit score tiers (e.g., super prime, prime, subprime) to set interest rates. A borrower with a super prime score can expect an APR that is dramatically lower than what a subprime borrower would be offered.

| Credit Score Range (VantageScore 4.0) | Average New Car APR | Average Used Car APR |

|---|---|---|

| Super Prime (781+) | 5.18% | 6.82% |

| Prime (661 - 780) | 6.70% | 9.06% |

| Near Prime (601 - 660) | 9.83% | 13.74% |

| Subprime (501 - 600) | 13.22% | 18.99% |

| Deep Subprime (300 - 500) | 15.81% | 21.58% |

Personal Loan APR Explained

Personal loans, which are often used for debt consolidation, home improvements, or major expenses, have one of the widest APR ranges of any consumer credit product.

Why Personal Loan APRs Have a Wide Range

The vast majority of personal loans are unsecured, meaning they are not backed by any collateral like a house or a car. If the borrower defaults, the lender has no asset to seize. To compensate for this higher risk, lenders charge a wider range of interest rates, typically from around 6% for the most creditworthy applicants to 36% or more for those with poor credit. The APR on a personal loan includes the interest rate plus any origination fees the lender may charge.

What Is a Good APR for a Personal Loan?

Similar to other credit products, a "good" personal loan APR is the lowest rate a borrower can qualify for based on their financial profile. The borrower's credit score is the most significant factor.

| Borrower Credit Rating | Estimated Average APR |

|---|---|

| Excellent (720-850) | 13.31% |

| Good (690-719) | 16.48% |

| Fair (630-689) | 20.23% |

| Bad (300-629) | 20.62% |

These averages show that while those with excellent credit receive the best rates, even borrowers with fair or bad credit can often find loans with APRs below those of high-interest credit cards, making personal loans a viable option for debt consolidation.

The annual percentage rate is more than just a financial metric; it is a legally mandated disclosure designed to empower and protect consumers. A robust framework of federal laws ensures that lenders provide clear, timely, and standardized information about the cost of credit, with the APR at its center. Understanding these rights transforms a borrower from a passive recipient of information into an active, informed participant in the lending process.

The Truth in Lending Act (TILA): Your Right to Know

The cornerstone of consumer credit protection in the United States is the Truth in Lending Act (TILA), enacted in 1968. The primary purpose of TILA is not to regulate the rates lenders can charge, but to ensure that they disclose the terms and costs of credit in a clear and uniform manner. This standardization allows consumers to shop for credit more intelligently by comparing the total cost of different loan offers.

Under TILA, lenders must provide borrowers with a disclosure statement before they become legally obligated on a loan. This statement must prominently feature the Annual Percentage Rate (APR) and the Finance Charge (the total dollar amount the credit will cost). By mandating the disclosure of the APR, TILA ensures that all mandatory fees are included, preventing lenders from advertising a deceptively low interest rate while hiding costs in the fine print. TILA applies to most forms of consumer credit, including mortgages, auto loans, credit cards, and personal loans.

CFPB's Regulation Z: The Rules of the Road

The specific rules that implement the Truth in Lending Act are contained in a regulation known as Regulation Z, which is now administered by the Consumer Financial Protection Bureau (CFPB). Regulation Z provides detailed instructions on how and when lenders must disclose the APR and other credit terms.

Key provisions of Regulation Z include:

For more information on consumer rights under TILA and Regulation Z, the Consumer Financial Protection Bureau (CFPB) provides extensive resources for the public, including its "Ask CFPB" tool.

Securing a low annual percentage rate is not a passive process; it requires a two-pronged approach. First, proactively prepare your finances. Second, use your strong financial profile to assertively shop and negotiate. This approach can significantly reduce your cost of borrowing over the life of a loan.

Proactive Measures to Improve Your Borrower Profile

Lenders offer the best rates to the least risky borrowers. The months before applying for a major loan, such as a mortgage or auto loan, should be spent strengthening one's financial standing.

The Art of Negotiation: How to Ask for a Better Rate

Once a strong financial profile is established, the next phase is active negotiation. Many borrowers hesitate to negotiate, but data shows it is often successful. A 2023 LendingTree survey found that 76% of credit cardholders who asked for a lower APR received one, with the average reduction being 6.3 percentage points. This highlights the power of simply asking.

While consumers are not expected to calculate the annual percentage rate themselves—lenders are legally required to do it for them—understanding the basic mechanics can solidify one's grasp of the concept. The calculation process serves as the ultimate proof that APR is a more comprehensive measure of cost than the interest rate alone, as it mathematically incorporates fees into the final figure.

The General APR Formula for Loans

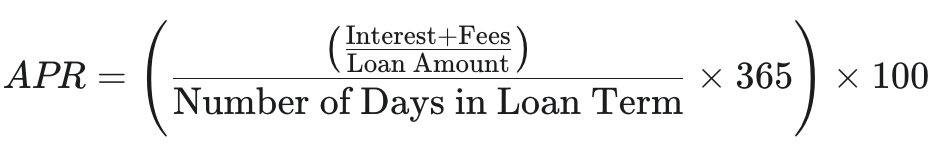

For closed-end loans like mortgages, auto loans, and personal loans, the APR is calculated to reflect the total cost of credit over the loan's term. A simplified version of the formula that captures the core concept is as follows:

To illustrate, consider a personal loan with the following terms:

Step-by-Step Calculation:

The final APR for this loan is 17.24%. This example clearly shows how the $50 fee is incorporated, resulting in an APR that is higher than what the interest charge alone would suggest.

How Credit Card Interest Is Calculated

The APR on a credit card is not used in a single annual calculation. Instead, because balances can change daily, interest is typically calculated on a daily basis and compounded monthly. The key terms are:

The interest charge for a billing cycle is then calculated by multiplying the Average Daily Balance by the Daily Periodic Rate, and then multiplying that result by the number of days in the billing cycle. This method underscores why even small daily balances can lead to significant interest charges over time if the full balance is not paid off each month.

The annual percentage rate is far more than a number in the fine print of a loan agreement. It is the most powerful tool a consumer has for navigating the landscape of credit. By encapsulating the interest rate and the majority of associated fees into a single, standardized figure, the APR cuts through marketing claims and confusing fee structures to reveal the true, comparable cost of a loan.

This transparency, mandated by laws like the Truth in Lending Act, empowers borrowers to make decisions based on clarity and fact rather than on potentially misleading advertised rates. From the revolving debt of a credit card to the long-term commitment of a mortgage, the principles remain the same: a lower APR translates to a lower total cost of borrowing.

By understanding the components of APR, recognizing how it varies across different financial products, and actively employing strategies to secure a more favorable rate, individuals can save thousands of dollars over time. Mastering the concept of the annual percentage rate is a fundamental step toward achieving greater financial control, making smarter borrowing choices, and building a more secure economic future.

Yes, your annual percentage rate can change if you have a variable-rate loan, where the rate is tied to a financial index. For fixed-rate loans, the APR is set for the loan's duration. However, on credit cards, a promotional annual percentage rate may expire, or a penalty APR could be triggered.

Checking your potential annual percentage rate through pre-qualification typically results in a soft inquiry, which does not affect your credit score. A hard inquiry, which can temporarily lower your score, usually only occurs once you formally submit a full loan application to a lender for final approval.

A 0% annual percentage rate offer means you won't pay interest for a specific period. It's not entirely free, as it may come with fees (like balance transfer fees). If you don't pay the balance in full by the time the promotional period ends, you'll start accruing interest on the remaining amount.

A cash advance annual percentage rate is typically higher than your standard purchase APR because lenders view cash advances as riskier transactions. These loans often lack a grace period, meaning interest starts accumulating immediately, making the cost of borrowing significantly higher from day one.

A high annual percentage rate on a credit card is often linked to your credit risk profile. Factors like a lower credit score, limited credit history, or high existing debt can lead lenders to assign a higher rate. The type of card and prevailing market interest rates also play a crucial role.

Yes, many lenders offer a pre-qualification process that allows you to see your estimated annual percentage rate without a formal application. This involves a soft credit check and provides a good idea of the loan cost, helping you compare offers from different financial institutions before you commit.

Not necessarily. The advertised annual percentage rate is often the lowest possible rate reserved for applicants with excellent credit. Your actual offered APR will depend on your specific credit score, income, debt-to-income ratio, and the loan term you select, as determined by the lender's underwriting process.

Generally, shorter-term loans may have a lower annual percentage rate but higher monthly payments. Conversely, longer-term loans might feature a slightly higher APR but more manageable monthly payments. Lenders associate longer terms with greater risk, which can be reflected in the interest cost.

Missing a payment can trigger a penalty annual percentage rate on your account, which is substantially higher than your standard APR. This rate can apply to your existing balance and future purchases, significantly increasing your borrowing costs. The terms for this are outlined in your credit agreement.

Inflation often leads central banks to raise benchmark interest rates to control the economy. Lenders pass these increases on to consumers, resulting in a higher average annual percentage rate for new loans and credit cards. Your personal financial health still remains the most critical factor in the rate you receive.

For many families, the cost of braces can seem like an insurmountable barrier, placing a healthy, confident smile out of financial reach. However, orthodontic treatment is not a luxury; it is a critical component of a child's overall health and well-being. It can profoundly impact their ability to eat and speak properly, maintain oral hygiene, and develop self-esteem.

The belief that high-quality orthodontic care is unaffordable for those with limited means is a common misconception. In reality, a variety of robust programs and financial strategies exist specifically to provide free braces for low-income families or to make them significantly more affordable.

The path to securing this care can appear complex, involving applications, eligibility rules, and different organizational structures. The purpose of this resource is to demystify that process. It is not a single, narrow path but a series of distinct, accessible routes.

By understanding these options, families can navigate the system with confidence and identify the best approach for their specific circumstances. The following sections provide a clear, step-by-step roadmap to the most effective avenues for obtaining affordable orthodontic treatment, including national non-profit organizations, government health benefits, university dental clinics, and other financial assistance programs.

Several national non-profit organizations are dedicated to connecting children from low-income families with orthodontists who donate their time and services. These programs are a cornerstone of affordable care, bridging the gap for families who do not qualify for other assistance or cannot cover the full cost of treatment.

Understanding the Scholarship Model

It is important to approach these programs as competitive scholarships. While they are designed to help those in need, they often have specific academic and character requirements alongside financial ones. The organizations are investing in children and families who demonstrate a commitment to completing the treatment plan, which can last for two to three years.

Applications are often detailed and require precise documentation. A successful outcome depends on carefully following all instructions.

Program Costs

While treatment is donated by the orthodontist, most programs require a small administrative or application fee. This contribution is a fraction of the typical cost of braces, which can range from $3,000 to $8,000, and often helps sustain the program for future families.

Smiles Change Lives (SCL)

Smiles Change Lives (SCL) is a leading national non-profit that provides access to orthodontic treatment for children from families who cannot afford the full cost of braces. The organization operates on a unique "pay it forward" model, where each participating family's financial contribution helps SCL recruit more orthodontists and serve more children in the future. This creates a powerful sense of community, as each family helps make it possible for the next child to be treated.

Eligibility Requirements

To qualify for the SCL program, a child must meet several criteria. These are designed to ensure that the donated services are provided to children who have a clear need and are prepared for the commitment of orthodontic treatment.

Eligibility Requirements

The SCL application process is thorough and requires careful attention to detail.

Smile for a Lifetime Foundation (S4L)

The Smile for a Lifetime Foundation (S4L) provides orthodontic scholarships to children through a network of local chapters, each led by a volunteer orthodontist. The mission extends beyond straightening teeth; it aims to build self-confidence, inspire hope, and change lives in a meaningful way. S4L chapters are run by local boards of directors who select the scholarship recipients from their community.

Eligibility Requirements

The S4L program has a distinct set of qualifications that include academic and character-based criteria, reflecting its nature as a competitive scholarship.

Application Process and Costs

The S4L application process is highly structured and requires specific documentation. Incomplete or incorrect submissions can delay the process or lead to denial.

The AAO's Gifted Smiles Program

Gifted Smiles is the charitable program of the American Association of Orthodontists Foundation (AAOF). It leverages the AAO's extensive national network of member orthodontists who volunteer to provide necessary treatment to children whose families lack access to care. The program has been in operation for over a decade and has helped thousands of children nationwide.

Eligibility Requirements

The eligibility criteria for Gifted Smiles are straightforward and primarily based on age and financial need.

Application Process and Costs

The application process for Gifted Smiles is streamlined and digitally focused.

| Program Name | Age Eligibility | Key Financial Rule | Total Family Cost | Application Starting Point |

|---|---|---|---|---|

| Smiles Change Lives | 7–18 years | Varies by geographic location | $680 ($30 fee + $650 investment) | smileschangelives.org/apply |

| Smile for a Lifetime | 8–18 years | At or below 200% of Federal Poverty Level | $500 ($20 fee + $480 fee) | smileforalifetime.org/how-to-apply |

| Gifted Smiles (AAOF) | 18 years or younger | At or below 200% of Federal Poverty Level | $200 (administrative fees) | aaofoundation.net/charitable-giving/gifted-smiles |

For many of the lowest-income families in the United States, government-sponsored health programs are the most direct and comprehensive pathway to obtaining orthodontic care for their children. The two primary programs are Medicaid and the Children's Health Insurance Program (CHIP).

While they are federally funded, they are administered at the state level. This means that specific rules, eligibility, and coverage details can vary significantly from one state to another. However, both programs operate under federal guidelines that mandate certain levels of dental care for children.

How Medicaid Covers Braces for Children (EPSDT)

Medicaid provides health coverage to millions of Americans, including eligible low-income adults, children, pregnant women, elderly adults, and people with disabilities. Federal law requires that all states provide dental benefits to children covered by Medicaid as part of a comprehensive set of services known as the Early and Periodic Screening, Diagnostic, and Treatment (EPSDT) benefit.

The EPSDT benefit is the cornerstone of children's health coverage under Medicaid. It is designed to ensure that children receive early, preventative care as well as any treatment needed to correct or ameliorate health conditions.

The "Medically Necessary" Standard

A critical component of the EPSDT mandate is that if a problem is discovered during a screening, the state must provide the necessary services to treat it, whether or not that service is normally included in the state's Medicaid plan.

For orthodontics, this means that if braces are determined to be "medically necessary," Medicaid must cover the cost. The term "medically necessary" is key. It means the treatment is not for purely cosmetic reasons. Instead, it is intended to address conditions that cause pain, infection, interfere with function (like chewing or speaking), or are associated with a congenital disease or anomaly.

Each state has its own specific definition and criteria for what qualifies as medically necessary orthodontic care. It is essential to check the rules for a specific state's Medicaid program.

The Children's Health Insurance Program (CHIP)

The Children's Health Insurance Program (CHIP) was created to provide low-cost health coverage for children in families who earn too much money to qualify for Medicaid but cannot afford to buy private insurance. Like Medicaid, CHIP is administered by states, but it is jointly funded by federal and state governments.

Federal law also requires that CHIP programs provide dental coverage. This coverage must be robust enough to be considered "benchmark" coverage, meaning it is at least equal to the dental benefits found in top federal employee or commercial health plans. The services must be sufficient to prevent disease, promote oral health, restore oral structures to health and function, and treat emergency conditions.

Coverage for braces under CHIP, similar to Medicaid, typically hinges on the principle of medical necessity. The specific criteria and approval processes vary by state. Some states may incorporate their CHIP population into their existing Medicaid program, while others run a separate CHIP program with its own rules and provider networks.

The best resource for any family to learn about their state's specific Medicaid and CHIP programs, check eligibility, and find participating dental providers is the national website InsureKidsNow.gov.

To understand how a state-level government program works in practice, California's Medicaid program, known as Medi-Cal, serves as an excellent and detailed example. The policies and procedures used by Medi-Cal offer a concrete model that can help families in any state understand what to look for in their own local programs. Medi-Cal Dental provides a comprehensive range of dental services, including orthodontics for children who qualify.

Who is Eligible for Medi-Cal Orthodontics?

Eligibility for orthodontic services under Medi-Cal is clearly defined and has strict limitations.

The Key to Approval: The Handicapping Labio-Lingual Deviation (HLD) Index

The central requirement for getting braces covered by Medi-Cal is that the treatment must be deemed "medically necessary." In California, this determination is made using a standardized assessment tool called the Handicapping Labio-Lingual Deviation (HLD) Index.

The process works as follows:

Understanding Potential Costs

A critical and often overlooked aspect of this process is the potential for out-of-pocket costs. While the initial consultation may be covered, the orthodontist may charge a fee for the diagnostic records required to submit the case for approval. One provider, for example, charges a $200 fee for these records.

This fee is an upfront cost to the family. If Medi-Cal approves the case, this fee may be covered. However, if Medi-Cal denies the case and the family chooses not to proceed with private payment, they will not be reimbursed for this $200 fee. For a low-income family, this represents a significant financial risk. It is essential for families to ask the orthodontic office about their specific policies regarding fees for records before beginning the evaluation process.

Automatic Qualifying Conditions

In addition to the HLD point system, California regulations specify several severe conditions that automatically qualify a child for medically necessary orthodontic treatment, regardless of their HLD score. These conditions represent clear, functionally impairing issues that require intervention.

| Automatic Qualifying Condition | Description |

|---|---|

| Cleft Palate Deformities | Congenital conditions where the roof of the mouth has not closed completely, often requiring extensive orthodontic and surgical coordination. |

| Deep Impinging Overbite | A severe overbite where the lower front teeth bite into the soft tissue of the palate (roof of the mouth), causing pain and damage. |

| Anterior Crossbite | A crossbite of the front teeth that is causing damage to the soft tissue of the gums. |

| Severe Overjet | An overjet (protrusion of the upper front teeth) greater than 9 millimeters, particularly when accompanied by incompetent lips (lips that cannot close naturally over the teeth). |

| Severe Reverse Overjet | A reverse overjet (underbite) greater than 3.5 millimeters where the patient reports difficulties with chewing or speech. |

| Severe Traumatic Deviations | Significant facial or jaw deformities resulting from physical trauma, burns, or other diseases that impact growth. |

University dental schools are an excellent and often underutilized resource for receiving high-quality, low-cost orthodontic care. These institutions operate clinics where treatment is provided by dental students or, for specialty care like orthodontics, by residents—dentists who have already graduated and are pursuing several years of advanced, full-time training in a specialty field.

All work is performed under the constant and direct supervision of experienced, board-certified faculty members who are experts in their fields.

The Dental School Advantage: Cost and Quality