The annual percentage rate (APR) is the single most important figure for understanding the true cost of borrowing money, yet it remains one of a frequently misunderstood concept in personal finance. While many borrowers focus on the interest rate, the APR provides a more complete and standardized measure that includes not only interest but also most of the mandatory fees associated with a loan.

Grasping the distinction between these two terms is the first step toward making empowered financial decisions. An interest rate represents only the cost of borrowing the principal amount, whereas the APR reflects the total yearly cost of credit, expressed as a percentage.

This comprehensive figure allows for a true "apples-to-apples" comparison between different loan offers, a transparency mandated by federal law to protect consumers. By demystifying the annual percentage rate, borrowers can navigate the complexities of credit cards, mortgages, auto loans, and personal loans with greater confidence, ensuring they select the most affordable option for their financial situation.

The annual percentage rate is not a single charge but a composite figure that bundles together the various costs of obtaining credit. Its primary function is to translate a complex array of interest charges and fees into a single, comparable number.

The gap between a loan's advertised interest rate and its APR widens as the financial product becomes more complex and laden with fees. For a simple credit card, the APR and interest rate might be identical, but for a multifaceted product like a mortgage, the difference can be substantial, making the APR the only reliable guide to the total cost.

The Core Components of APR

Understanding the APR begins with breaking it down into its fundamental parts. These components vary by loan type but generally fall into several key categories that represent the full spectrum of borrowing costs.

APR vs. Interest Rate: A Critical Distinction

The single most common point of confusion for borrowers is the difference between the interest rate and the APR. Failing to understand this distinction can lead to choosing a loan that appears cheaper but costs more over its lifetime.

Consider two hypothetical 30-year fixed-rate mortgage offers for $300,000:

At first glance, Lender A's offer seems better due to the lower interest rate. However, when the fees are factored into the annual percentage rate, a different picture emerges. Lender A's APR would be higher than its interest rate because of the significant fees, while Lender B's APR would be much closer to its interest rate.

A borrower planning to stay in the home for a long time might find that Lender B's offer is actually the more affordable choice, despite the higher interest rate. This is precisely why the APR was created: to provide a single, standardized figure that accounts for these differences, enabling a fair comparison.

APR vs. APY: Borrower Cost vs. Saver Earnings

Another common point of confusion is the difference between APR and Annual Percentage Yield (APY). While they sound similar, they represent opposite sides of the financial coin.

The crucial technical difference between them is the effect of compounding. APY accounts for compound interest, which is the interest earned on both the principal and the previously accumulated interest. APR, in its standard calculation for loans, does not factor in the effect of interest compounding on the debt.

For example, a savings account with a 2% interest rate that compounds monthly will have an APY slightly higher than 2% because the interest earned each month starts earning its own interest. Conversely, a loan's APR is a representation of the annual interest rate plus fees, without illustrating how unpaid interest might compound and increase the total debt over time, as is common with credit cards.

Fixed vs. Variable APR: The Implications for Your Payments

The structure of an APR can be either fixed or variable, a distinction that has significant long-term implications for a borrower's financial planning and stability.

The composition and significance of the annual percentage rate vary considerably across different types of consumer credit. The APR a borrower receives is influenced by a consistent set of factors: the specific loan product, prevailing macroeconomic conditions (like the prime rate), the borrower's individual financial profile (credit score and debt-to-income ratio), and the lender's internal underwriting criteria. Understanding how these levers operate for each product is key to securing the best possible terms.

Credit Card APR Explained

Credit cards are one of the most common forms of revolving credit, and they often feature multiple types of APRs on a single account. Unlike installment loans, the APR on a credit card is often the same as the interest rate because there are typically no separate origination fees included in the calculation.

Types of Credit Card APRs

A single credit card agreement can contain several different APRs, each applying to a different type of transaction:

What Is a Good APR for a Credit Card?

A "good" credit card APR is relative and depends heavily on two factors: the applicant's credit score and the current national average. According to Federal Reserve data, the average APR for credit card accounts assessed interest is over 20%. Therefore, an APR at or below this average can generally be considered good.

However, what is "good" for one person may not be for another. Borrowers with excellent credit scores (e.g., 760 and above) may qualify for rates in the low teens, while those with fair or poor credit will face much higher rates. The following table provides estimated benchmarks for credit card APRs based on creditworthiness.

| Credit Score Tier | Example APR Range for New Offers | Notes |

|---|---|---|

| Excellent (720+) | 12% - 18% | Often qualify for the lowest advertised rates and best rewards cards. |

| Good (690-719) | 18% - 24% | Rates are typically around the national average. |

| Fair (630-689) | 22% - 28% | Rates are generally above the national average; secured cards may be an option. |

| Poor (<630) | 25% - 30%+ | Often limited to secured cards or cards with very high penalty rates. |

How Credit Card Interest Accrues

Credit card interest is typically calculated using the average daily balance method and a daily periodic rate. To avoid interest charges entirely, the cardholder must pay the statement balance in full before the end of the grace period. If a balance is carried, the issuer calculates interest as follows:

Mortgage APR Explained

For mortgages, the APR is an exceptionally powerful tool because these loans involve numerous and substantial fees. The difference between a mortgage's interest rate and its APR is often significant, highlighting the true cost of financing a home.

How Mortgage Fees Inflate the APR

A mortgage APR includes the nominal interest rate plus a host of other required costs rolled into the loan. These fees can include:

Because all lenders are required to calculate the APR using a standardized formula, it provides the only reliable way to compare offers that may have different combinations of interest rates and fees. A loan with a lower interest rate but higher fees could easily have a higher APR—and be more expensive over time—than a loan with a slightly higher rate but minimal fees.

What Is a Good APR for a Mortgage?

A "good" mortgage APR is a moving target, heavily influenced by prevailing market conditions, the borrower's financial health, and the specific loan product. Key factors include:

The best way to determine a good APR is to compare a lender's offer against the current national averages for a similar loan product.

| Loan Product | Example Average Interest Rate | Example Average APR |

|---|---|---|

| 30-Year Fixed-Rate | 6.75% | 6.82% |

| 15-Year Fixed-Rate | 5.94% | 6.04% |

| 5/1 ARM | 6.13% | Varies |

| 30-Year FHA | 6.77% | 6.83% |

| 30-Year VA | 6.84% | 6.89% |

| 30-Year Jumbo | 6.79% | 6.84% |

Auto Loan APR Explained

For auto loans, the APR is also a critical metric, with rates varying significantly based on whether the vehicle is new or used, the length of the loan, and, most importantly, the borrower's credit score.

Comparing APRs for New vs. Used Vehicles

Lenders generally offer lower APRs for new car loans than for used car loans. This is because new vehicles have a higher and more predictable resale value, making them less risky collateral for the lender. A new car is also less likely to experience mechanical failures that could impact its value or the borrower's ability to make payments. In the first quarter of 2025, the average interest rate for a new car loan was 6.73%, while the average for a used car loan was nearly double at 11.87%.

The Impact of Loan Term

The loan term, or repayment period, also affects the APR. Shorter loan terms (e.g., 36 or 48 months) typically come with lower APRs because the lender's risk is spread over a shorter period. However, shorter terms mean higher monthly payments. Conversely, longer terms (e.g., 72 or 84 months) result in lower monthly payments but usually carry higher APRs, leading to more interest paid over the life of the loan.

What Is a Good APR for an Auto Loan?

The primary determinant of an auto loan APR is the borrower's credit score. Lenders use credit score tiers (e.g., super prime, prime, subprime) to set interest rates. A borrower with a super prime score can expect an APR that is dramatically lower than what a subprime borrower would be offered.

| Credit Score Range (VantageScore 4.0) | Average New Car APR | Average Used Car APR |

|---|---|---|

| Super Prime (781+) | 5.18% | 6.82% |

| Prime (661 - 780) | 6.70% | 9.06% |

| Near Prime (601 - 660) | 9.83% | 13.74% |

| Subprime (501 - 600) | 13.22% | 18.99% |

| Deep Subprime (300 - 500) | 15.81% | 21.58% |

Personal Loan APR Explained

Personal loans, which are often used for debt consolidation, home improvements, or major expenses, have one of the widest APR ranges of any consumer credit product.

Why Personal Loan APRs Have a Wide Range

The vast majority of personal loans are unsecured, meaning they are not backed by any collateral like a house or a car. If the borrower defaults, the lender has no asset to seize. To compensate for this higher risk, lenders charge a wider range of interest rates, typically from around 6% for the most creditworthy applicants to 36% or more for those with poor credit. The APR on a personal loan includes the interest rate plus any origination fees the lender may charge.

What Is a Good APR for a Personal Loan?

Similar to other credit products, a "good" personal loan APR is the lowest rate a borrower can qualify for based on their financial profile. The borrower's credit score is the most significant factor.

| Borrower Credit Rating | Estimated Average APR |

|---|---|

| Excellent (720-850) | 13.31% |

| Good (690-719) | 16.48% |

| Fair (630-689) | 20.23% |

| Bad (300-629) | 20.62% |

These averages show that while those with excellent credit receive the best rates, even borrowers with fair or bad credit can often find loans with APRs below those of high-interest credit cards, making personal loans a viable option for debt consolidation.

The annual percentage rate is more than just a financial metric; it is a legally mandated disclosure designed to empower and protect consumers. A robust framework of federal laws ensures that lenders provide clear, timely, and standardized information about the cost of credit, with the APR at its center. Understanding these rights transforms a borrower from a passive recipient of information into an active, informed participant in the lending process.

The Truth in Lending Act (TILA): Your Right to Know

The cornerstone of consumer credit protection in the United States is the Truth in Lending Act (TILA), enacted in 1968. The primary purpose of TILA is not to regulate the rates lenders can charge, but to ensure that they disclose the terms and costs of credit in a clear and uniform manner. This standardization allows consumers to shop for credit more intelligently by comparing the total cost of different loan offers.

Under TILA, lenders must provide borrowers with a disclosure statement before they become legally obligated on a loan. This statement must prominently feature the Annual Percentage Rate (APR) and the Finance Charge (the total dollar amount the credit will cost). By mandating the disclosure of the APR, TILA ensures that all mandatory fees are included, preventing lenders from advertising a deceptively low interest rate while hiding costs in the fine print. TILA applies to most forms of consumer credit, including mortgages, auto loans, credit cards, and personal loans.

CFPB's Regulation Z: The Rules of the Road

The specific rules that implement the Truth in Lending Act are contained in a regulation known as Regulation Z, which is now administered by the Consumer Financial Protection Bureau (CFPB). Regulation Z provides detailed instructions on how and when lenders must disclose the APR and other credit terms.

Key provisions of Regulation Z include:

For more information on consumer rights under TILA and Regulation Z, the Consumer Financial Protection Bureau (CFPB) provides extensive resources for the public, including its "Ask CFPB" tool.

Securing a low annual percentage rate is not a passive process; it requires a two-pronged approach. First, proactively prepare your finances. Second, use your strong financial profile to assertively shop and negotiate. This approach can significantly reduce your cost of borrowing over the life of a loan.

Proactive Measures to Improve Your Borrower Profile

Lenders offer the best rates to the least risky borrowers. The months before applying for a major loan, such as a mortgage or auto loan, should be spent strengthening one's financial standing.

The Art of Negotiation: How to Ask for a Better Rate

Once a strong financial profile is established, the next phase is active negotiation. Many borrowers hesitate to negotiate, but data shows it is often successful. A 2023 LendingTree survey found that 76% of credit cardholders who asked for a lower APR received one, with the average reduction being 6.3 percentage points. This highlights the power of simply asking.

While consumers are not expected to calculate the annual percentage rate themselves—lenders are legally required to do it for them—understanding the basic mechanics can solidify one's grasp of the concept. The calculation process serves as the ultimate proof that APR is a more comprehensive measure of cost than the interest rate alone, as it mathematically incorporates fees into the final figure.

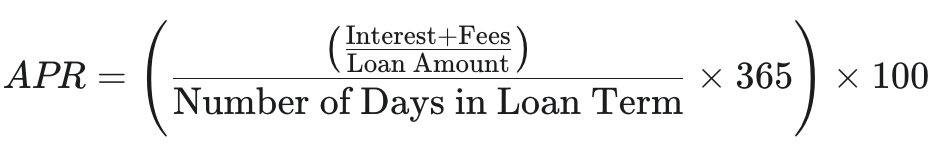

The General APR Formula for Loans

For closed-end loans like mortgages, auto loans, and personal loans, the APR is calculated to reflect the total cost of credit over the loan's term. A simplified version of the formula that captures the core concept is as follows:

To illustrate, consider a personal loan with the following terms:

Step-by-Step Calculation:

The final APR for this loan is 17.24%. This example clearly shows how the $50 fee is incorporated, resulting in an APR that is higher than what the interest charge alone would suggest.

How Credit Card Interest Is Calculated

The APR on a credit card is not used in a single annual calculation. Instead, because balances can change daily, interest is typically calculated on a daily basis and compounded monthly. The key terms are:

The interest charge for a billing cycle is then calculated by multiplying the Average Daily Balance by the Daily Periodic Rate, and then multiplying that result by the number of days in the billing cycle. This method underscores why even small daily balances can lead to significant interest charges over time if the full balance is not paid off each month.

The annual percentage rate is far more than a number in the fine print of a loan agreement. It is the most powerful tool a consumer has for navigating the landscape of credit. By encapsulating the interest rate and the majority of associated fees into a single, standardized figure, the APR cuts through marketing claims and confusing fee structures to reveal the true, comparable cost of a loan.

This transparency, mandated by laws like the Truth in Lending Act, empowers borrowers to make decisions based on clarity and fact rather than on potentially misleading advertised rates. From the revolving debt of a credit card to the long-term commitment of a mortgage, the principles remain the same: a lower APR translates to a lower total cost of borrowing.

By understanding the components of APR, recognizing how it varies across different financial products, and actively employing strategies to secure a more favorable rate, individuals can save thousands of dollars over time. Mastering the concept of the annual percentage rate is a fundamental step toward achieving greater financial control, making smarter borrowing choices, and building a more secure economic future.

Yes, your annual percentage rate can change if you have a variable-rate loan, where the rate is tied to a financial index. For fixed-rate loans, the APR is set for the loan's duration. However, on credit cards, a promotional annual percentage rate may expire, or a penalty APR could be triggered.

Checking your potential annual percentage rate through pre-qualification typically results in a soft inquiry, which does not affect your credit score. A hard inquiry, which can temporarily lower your score, usually only occurs once you formally submit a full loan application to a lender for final approval.

A 0% annual percentage rate offer means you won't pay interest for a specific period. It's not entirely free, as it may come with fees (like balance transfer fees). If you don't pay the balance in full by the time the promotional period ends, you'll start accruing interest on the remaining amount.

A cash advance annual percentage rate is typically higher than your standard purchase APR because lenders view cash advances as riskier transactions. These loans often lack a grace period, meaning interest starts accumulating immediately, making the cost of borrowing significantly higher from day one.

A high annual percentage rate on a credit card is often linked to your credit risk profile. Factors like a lower credit score, limited credit history, or high existing debt can lead lenders to assign a higher rate. The type of card and prevailing market interest rates also play a crucial role.

Yes, many lenders offer a pre-qualification process that allows you to see your estimated annual percentage rate without a formal application. This involves a soft credit check and provides a good idea of the loan cost, helping you compare offers from different financial institutions before you commit.

Not necessarily. The advertised annual percentage rate is often the lowest possible rate reserved for applicants with excellent credit. Your actual offered APR will depend on your specific credit score, income, debt-to-income ratio, and the loan term you select, as determined by the lender's underwriting process.

Generally, shorter-term loans may have a lower annual percentage rate but higher monthly payments. Conversely, longer-term loans might feature a slightly higher APR but more manageable monthly payments. Lenders associate longer terms with greater risk, which can be reflected in the interest cost.

Missing a payment can trigger a penalty annual percentage rate on your account, which is substantially higher than your standard APR. This rate can apply to your existing balance and future purchases, significantly increasing your borrowing costs. The terms for this are outlined in your credit agreement.

Inflation often leads central banks to raise benchmark interest rates to control the economy. Lenders pass these increases on to consumers, resulting in a higher average annual percentage rate for new loans and credit cards. Your personal financial health still remains the most critical factor in the rate you receive.

When you need help with transportation, finding churches that help with gas vouchers near me can feel like a critical lifeline. The cost of fuel can be a significant barrier to getting to a job interview, a doctor’s appointment, or even the grocery store. While it can feel overwhelming, there are established networks of faith-based organizations and community services dedicated to providing support.

The real challenge is often knowing where to start and how to connect with the right local provider. Help is available, and it comes in many forms, from emergency gas money and fuel vouchers to free bus passes and direct ride services. This resource provides a clear, step-by-step path to finding the transportation assistance you need through major national organizations and proven local strategies.

Before making individual calls to churches, the single most effective first step for anyone seeking assistance in the United States is to contact 2-1-1. This free and confidential service, operated in partnership with United Way, acts as a central clearinghouse for all local health and human services.

Many churches and charities have limited, volunteer-run staff and fluctuating benevolence funds, so they are not always equipped to be the primary public entry point for community needs. For this reason, many faith-based organizations rely on 2-1-1 to help screen and direct requests.

Calling 2-1-1 first demonstrates that you have already engaged with the primary social service system, which can make your subsequent request to a church more effective. A trained 2-1-1 specialist can assess your situation and connect you to the most appropriate resource. This saves you the time and frustration of making dozens of calls to organizations that may not have funding or may not serve your area.

What is 2-1-1?

Think of 2-1-1 as the master key to unlocking local resources. When you call, a specialist accesses the most comprehensive and up-to-date database of community service providers in your specific area.

They can tell you which local churches, synagogues, and faith-based organizations are currently offering financial or transportation assistance. They can also provide their specific eligibility rules, hours, and current funding status.

This service is available 24/7 and can be reached by:

Ride United: A Direct Transportation Solution

In many communities, 2-1-1 offers a direct solution to transportation needs through the Ride United program. This initiative, launched in 2018 in partnership with Lyft and United Way, provides free or discounted rides to essential services. This is a tangible, modern alternative to a physical gas voucher that can solve an immediate transportation problem.

Since its inception, Ride United has provided over 500,000 rides to more than 125,000 people. The process is straightforward:

Several large, faith-based organizations operate nationwide networks dedicated to providing emergency assistance. It is crucial to understand that while these organizations have a national presence, all aid is distributed at the local level. Funding, program rules, and the types of assistance available can vary significantly from one city or county to the next.

The Salvation Army: Gas Vouchers and Emergency Support

The Salvation Army is an evangelical part of the universal Christian Church and one of the largest social service providers in the United States, operating in nearly every ZIP code. They offer a vast range of programs to help families and individuals facing financial hardship.

How to Find Local Help

Assistance is provided by your local Salvation Army corps community center, not a national office. There are three primary ways to connect:

Types of Assistance and Eligibility

The Salvation Army provides a wide array of emergency financial services, which can include transportation assistance.

Catholic Charities: Local Transportation and Financial Aid

Catholic Charities USA is a national network of 168 independent, local member agencies that provide services to people of all faiths and backgrounds. It is important to note that the national office in Alexandria, VA, does not provide direct aid; all services are handled by the local diocesan agency.

How to Find Local Help

The best way to find your local agency is to use the "Find a Local Agency" locator tool on the Catholic Charities USA national website. This allows you to search by city, state, or ZIP code to find the contact information for the agency serving your area.

Types of Assistance and Eligibility

The services offered by Catholic Charities vary significantly from one diocese to another. Some agencies provide general financial assistance for rent or utilities, which can free up personal funds for transportation. However, many local agencies operate robust and direct transportation programs.

Society of St. Vincent de Paul: Person-to-Person Help Through Local Conferences

The Society of St. Vincent de Paul operates through a unique and personal model. Assistance is provided by local volunteer groups, known as "Conferences," which are based at Catholic parishes.

The hallmark of their service is the "home visit," where two Vincentian volunteers meet with an individual or family in their home. This allows them to offer friendship, listen to their struggles, and determine the best way to provide support in a dignified and respectful manner.

How to Find Your Local Conference

Connecting with the correct conference is a critical step, as each one serves a specific geographic territory.

Types of Assistance and Eligibility

Vincentians provide help with a wide range of basic needs, including rent, utilities, food, clothing, and transportation.

Lutheran Social Services: Diverse Transportation Programs

Lutheran Social Services is a nationwide network of regional social service organizations. There is no single national structure, so the programs offered are incredibly diverse and tailored to the needs of the local community they serve.

How to Find Local Help

Because there is not a centralized national locator, the most effective way to find help is to perform an internet search for "Lutheran Social Services" followed by your state or city (e.g., "Lutheran Social Services of Minnesota").

Types of Assistance and Eligibility

Transportation programs operated by Lutheran Social Services are often innovative and varied.

United Methodist Churches: Benevolence Funds at the Local Level

It is important to understand that The United Methodist Church does not have a national, denominational program for transportation assistance. Any assistance provided comes directly from individual, local churches through their own outreach ministries or benevolence funds.

How to Find Local Help

Types of Assistance and Eligibility

Assistance is entirely at the discretion of the local church and its available funds. Help may come in the form of local bus passes or transit cards.

A crucial piece of advice is to contact other community agencies via 2-1-1 before calling a church. Many churches will want to know what other resources you have already pursued before providing financial assistance.

The process of asking for help is often as important as knowing where to go. The social service ecosystem is a patchwork of independent organizations, each with its own process. Being prepared, persistent, and polite can significantly increase your chances of success. Do not be discouraged if the first organization you contact cannot help; the right assistance may be available from the next one you call.

How to Approach a Church for Financial Help

When you are ready to reach out, a personal connection is almost always preferred over an anonymous digital message.

Essential Documents for Your Application

Being prepared with the correct paperwork demonstrates that you are organized and helps the organization process your request efficiently. While requirements vary, most agencies will ask for a similar set of documents to verify your identity, residence, and need.

| Document Category | Specific Examples | Why It's Needed |

|---|---|---|

| Proof of Identity | State-issued Driver's License or ID card, Passport. | To verify who you are and confirm you are an adult. |

| Proof of Residence | Utility bill, lease agreement, or mortgage statement with your name and current address. | To confirm you live within the organization's designated service area. |

| Proof of Income | Recent pay stubs, Social Security/SSI award letter, unemployment benefits statement, or a zero-income form if applicable. | To verify your household income and confirm you meet the program's eligibility guidelines. |

| Household Information | Social Security cards or birth certificates for all members of your household. | To verify the number of people in your household, which can affect the type and amount of aid you receive. |

| Proof of Need | The bill you need help with (e.g., utility disconnect notice), or documentation of the essential travel (e.g., a doctor's note with an appointment date and time). | To document the specific crisis and the exact amount of assistance required. |

In addition to faith-based organizations, other community groups are part of the same support network and often work in partnership with churches.

Seeking help is a courageous and necessary step when facing a difficult time. The organizations and programs detailed here exist because communities believe in supporting their neighbors.

The path to finding assistance may require patience and persistence, but it is a path worth taking. By starting with 2-1-1, being prepared with your documents, and approaching each conversation with honesty, you can navigate this system and find the support you need to keep moving forward.

To receive a gas voucher for a job interview, you will likely need to provide a valid driver's license and current vehicle registration. You should also be prepared to show proof of the interview, such as an email or letter from the employer, to verify the need for transportation assistance.

While most churches that help with gas vouchers near me offer aid to the general public, some programs have specific funds for veterans. Organizations like The Salvation Army and national services like 2-1-1 can also connect veterans to specialized transportation resources and other benefits they are entitled to.

Yes, individuals experiencing homelessness can often receive transportation assistance. This support is typically part of a broader range of services, which may include emergency shelter, case management, and help with obtaining IDs. The goal is to provide immediate relief while working toward stable housing.

Yes, some churches and affiliated organizations extend their gas voucher programs to cover family emergencies. A common example is providing fuel assistance to help someone travel to an out-of-town funeral for an immediate family member, provided funds are available and the need can be verified.

Most organizations limit how frequently you can receive aid to ensure resources are available for many people. Policies vary, but it is common to see limits such as once every 6 or 12 months. This type of assistance is intended for short-term emergencies, not ongoing support.

Direct assistance for car repairs from churches is uncommon. However, some larger organizations like The Salvation Army may offer emergency financial services that can occasionally be used for essential car repairs, depending on the local branch's funding and policies.

If direct gas vouchers aren't available, ask local churches or community agencies about assistance with other essential bills like rent or utilities. Receiving help in one area can free up your own money for fuel. Also, always check with United Way's 2-1-1 for the most comprehensive list of local resources.

No, you typically do not need to be a church member. Major faith-based organizations like Catholic Charities, The Salvation Army, and the Society of St. Vincent de Paul provide services to all people in need, regardless of their religious affiliation or background.

Yes, there are specific programs available. Some resource networks partner with organizations like the Cancer Services Network, which directly assists cancer patients with gasoline expenses to ensure they can get to and from active treatment appointments. These services often include emotional support for patients and their families.

Some national organizations, like The Salvation Army, have an online portal where you can begin a confidential application for financial assistance by entering your zip code. However, most local churches require you to call or visit in person to discuss your needs with a pastor or benevolence coordinator.

When facing a financial hardship, the cost of fuel for essential travel can become an overwhelming barrier. If you are struggling to afford gas for a critical medical appointment, a job interview, or to get to work, a nationwide service is available to connect you with local support.

By contacting 211, you can learn about 211 gas vouchers and other transportation assistance programs designed to help you through a crisis. This service is a free, confidential, 24/7 resource that links individuals and families to a vast network of community services, including financial aid for transportation. The system is designed to be a single, simple starting point for finding help right in your community.

The first step in finding assistance is understanding what 211 is and how it functions. It is not a government agency that directly provides funds, but rather a powerful navigation tool that connects you to the organizations that do.

What is 211? Your Connection to Local Help

211 is a three-digit phone number designated by the Federal Communications Commission (FCC) for free information and referrals to health and human services. Think of it as a shortcut through what can be a confusing maze of different agencies and programs.

When you contact 211, you don't reach a massive, impersonal national call center. Instead, you are connected with a highly trained, compassionate specialist from a local organization in your area. This local focus is the key to 211’s effectiveness.

The service is operated by a network of over 200 independent organizations across the United States, including well-known non-profits like United Way, Goodwill, and Community Action Partnerships. Because these specialists are part of your community, they have expert knowledge of the specific resources available where you live, from a church-run gas voucher program to a county-specific transportation service for seniors.

It is important to understand that 211 is primarily a referral system. The 211 specialists themselves do not typically have a pool of funds to distribute. Their job is to assess your unique situation and use their comprehensive database to give you a direct referral to the local agencies that offer the specific help you need, such as a gas card or a bus pass.

These specialists are expert guides who can point you in the right direction, tell you who to call, and explain how to apply. This saves you the time and frustration of searching on your own.

How to Contact 211

Accessing this service is simple and designed to be available to everyone. You can reach out in several ways:

All communications with 211 are confidential, and you can remain anonymous if you choose.

While "gas voucher" is a common term, assistance for transportation can come in several different forms. The goal of these programs is to solve an immediate transportation crisis, so the type of aid offered is tailored to the specific need and local resources.

It's More Than Just a Voucher

When you request help with transportation, the solution might be one of the following:

Why is Transportation Assistance Offered? The "Critical Need" Requirement

These programs are not designed for general travel or daily errands. Funding is almost always reserved for specific, critical needs that support health, safety, and financial stability.

The system is fundamentally designed to provide a temporary bridge during an acute crisis to prevent a person's situation from worsening. For example, a $20 gas card can be the deciding factor that allows someone to attend a job interview and break a cycle of unemployment.

You will have the greatest chance of success if your request is for one of these approved purposes:

Important Distinction: Transportation Fuel vs. Home Heating Gas

It is crucial to be clear about the type of "gas" you need help with. Many callers contact 211 for help with their utility bills, including their natural gas bill for heating their home. The primary federal program for this is the Low Income Home Energy Assistance Program (LIHEAP).

While some LIHEAP funds can occasionally be used for broader energy-related needs, its main purpose is to help with home heating and cooling costs, not gasoline for a vehicle. When you speak with a 211 specialist, specify that you need assistance with transportation fuel or gasoline for your car to ensure they connect you to the correct programs.

Navigating the process can feel daunting, especially during a stressful time. Following these steps can make it more manageable.

Step 1: Make the Initial Contact with 211

Begin by calling 2-1-1, texting your ZIP code to 898211, or visiting your local 211 website. You will be connected with a live specialist who is trained to help you. Remember, the call is free and confidential.

Step 2: The Needs Assessment - What to Tell the Specialist

The specialist's job is to understand your situation so they can find the best resource for you. Be ready to calmly and clearly explain:

Step 3: Receiving the Referral - Connecting to a Local Agency

Using the information you provide, the 211 specialist will search a comprehensive, up-to-date database of local service providers. If they find a program that matches your need and may have available funding, they will give you a referral.

This referral typically includes:

In some instances, the specialist might be able to perform a "warm transfer," connecting you directly to the agency over the phone.

Step 4: Applying with the Referred Agency

Receiving a referral is the key that unlocks the door, but you still have to go through it. You must follow up with the specific agency you were referred to. This is the organization that manages the funds and makes the final decision. Follow their application process precisely. This is the stage where you will need to provide documentation to verify your eligibility.

While the final decision rests with the local agency 211 refers you to, most programs across the country share a similar set of eligibility criteria. Qualifying is rarely based on a single factor. Instead, it's typically about meeting several requirements at once, such as having a low income, facing a verifiable crisis, and living within the agency's service area.

1. Income Level

Nearly all programs are intended for low-income individuals and families. Eligibility is typically calculated based on your household's gross income (before taxes) in relation to official poverty metrics. Common thresholds include:

The 211 specialist or the referred agency can tell you the specific income limits for programs in your area.

2. Proof of a Verifiable Crisis or Hardship

These programs are for emergencies. You must be able to demonstrate that you are facing an urgent situation that you cannot resolve on your own. This could be documented with an eviction notice, a utility shut-off warning, a letter confirming a job loss, or significant medical bills.

3. Residency

You must be a resident of the specific city, county, or geographic area that the funding agency serves. You will need to provide proof of your address.

4. Specific Populations

Some funds are earmarked for particular groups, and these individuals are often given priority. These populations include:

Walking into an appointment prepared can make the application process much smoother and faster. Agencies require documentation to ensure that limited funds are distributed fairly and according to the guidelines set by their funders (such as government grants or private donors). Having your paperwork in order shows that you are serious and helps the caseworker help you more efficiently.

While requirements vary, here is a checklist of documents that are commonly requested.

| Document Category | Specific Document Examples | Why It's Usually Needed |

|---|---|---|

| Proof of Identity | Government-issued photo ID (Driver's License, State ID); Social Security cards for all household members. | To verify who you are and confirm everyone living in your household. |

| Proof of Income | Recent pay stubs (last 30-90 days); award letters for Social Security, Disability, or VA benefits; unemployment statements; child support printouts. | To confirm your household's gross income meets the program's low-income guidelines. |

| Proof of Zero Income | Recent termination letter from an employer; denial letters for unemployment or disability benefits; IRS verification of non-filing. | To officially document a lack of financial resources if you have no current income. |

| Proof of Address | Current, signed lease agreement; mortgage statement; a recent utility bill; or other official mail with your name and current address. | To prove you are a resident of the agency's designated service area. |

| Proof of Need/Crisis | An appointment card from a doctor's office; a letter from a potential employer confirming an interview; a new hire letter; a valid driver's license and proof of car insurance (for gas vouchers). | To document the specific, urgent, and approved reason for your transportation request. |

211 works with a wide array of partners. The organizations you are most likely to be referred to for gas vouchers or transportation help include:

It can be disheartening if you are denied assistance, but don't give up. Funding is often limited, and a denial may simply mean that the program ran out of money for the month. Here are some alternative steps you can take:

Finding help can be a difficult process, but you have already taken the most important step by seeking information. Remember that 211 is always available as a starting point. If your situation changes or if you need help with a different issue, you can always call them back.

Yes, obtaining transportation for employment-related reasons, such as a job interview or getting to work before your first paycheck, is a common reason people seek help. The availability of a specific "211 gas voucher" depends on the rules of the local agency that 211 connects you with.

Yes, they are entirely different. The Low Income Home Energy Assistance Program (LIHEAP) specifically helps with home heating and cooling costs. In contrast, 211 gas vouchers or transportation assistance programs are designed to help you with fuel for your vehicle or other transit costs.

No, you do not need to own a car. 211 can connect you to a wide range of transportation resources based on your needs. This often includes bus passes, tokens for public transit, or access to volunteer-driven transportation services for essential appointments if you don't have a vehicle.

The timeframe varies significantly by location and the specific partner agency. In an emergency, some organizations may provide same-day assistance. However, the standard process, which may require an application and document verification, can take several business days depending on demand and available funding.

Yes. Your call with 211 is confidential. While the partner agency providing the gas voucher will require personal information to verify your eligibility, all data is handled securely. These organizations are committed to protecting your privacy in accordance with federal and state laws.

This depends on the policies of the local service provider and their funding. Many programs are designed for one-time, emergency assistance to prevent a crisis. However, some agencies may allow you to apply for help periodically, such as once every 12 months, if you continue to meet eligibility criteria.

If direct gas vouchers are unavailable, ask the 211 specialist about other transportation resources. They are experts on local aid and can refer you to alternatives, such as charities that offer bus tokens or pre-paid transit cards, or non-profit ride services like United Way's Ride United program.

While there are not typically programs exclusively for students, they can still receive help. If a student meets the standard eligibility requirements of a local agency—such as being low-income and needing transportation for essential reasons like a medical appointment—they may qualify for a gas voucher or other transit aid.

Usually, no. If you receive a physical voucher or a pre-paid gas card, it is often redeemable only at specific, participating gas station chains. The providing agency will give you clear instructions on where and how you can use the assistance.

While direct financial aid for car repairs is less common than fuel assistance, it is possible. Some community action agencies or charities that 211 partners with have limited funds for minor repairs that are essential for maintaining employment or getting to medical appointments. Always ask the 211 specialist about this option.

Understanding Alabama payday loan laws is essential for residents seeking short-term financial solutions. These regulations, primarily encapsulated in the Alabama Deferred Presentment Services Act, govern how cash advances operate. They outline crucial consumer protections and lender responsibilities.

Navigating the terms, fees, and potential pitfalls of payday loans requires a clear grasp of this legal framework. This knowledge ensures informed decision-making and safeguards against predatory practices.

Payday loans, formally known as deferred presentment services in Alabama, are short-term, high-cost credit products. They are typically used to cover unexpected expenses until a borrower's next paycheck. These financial instruments are distinct from other types of small loans, which are governed by the Alabama Small Loan Act.

This distinction is significant because the regulations, including allowable fees and borrower protections, differ markedly. The Alabama State Banking Department (ASBD) serves as the primary regulatory authority overseeing payday lenders within the state, tasked with enforcing these specific laws. The existence of a separate Act for payday loans suggests a recognition of their unique characteristics and potential risks, prompting a tailored regulatory approach.

The ASBD also issues warnings about unlicensed online lenders, indicating this is a persistent concern for Alabama consumers. The prevalence of payday lending establishments in Alabama, reportedly outnumbering essential services like hospitals or high schools, points to a substantial demand for such credit. This demand often stems from economic vulnerabilities among certain population segments. This high density does not necessarily translate to lower costs for borrowers, as the regulatory framework sets fee ceilings.

The cornerstone of Alabama payday loan laws is the Alabama Deferred Presentment Services Act, codified at Ala. Code § 5-18A-1 et seq.. The stated purpose of this Act is to shield consumers from potential abuses within the payday lending market.

Maximum Loan Amounts and Terms

A key provision limits the total amount a borrower can have in outstanding deferred presentment transactions. Across all lenders, this sum cannot exceed $500. To enforce this, lenders are mandated to utilize a third-party private sector database. This database verifies a customer's existing payday loan obligations before entering into a new agreement.

This aggregate limit, coupled with database verification, represents a significant regulatory effort. It aims to prevent individuals from accumulating excessive debt by taking out multiple payday loans simultaneously. The effectiveness of this measure depends on the accuracy, real-time updates, and comprehensive usage of the database by all licensed lenders.

The duration of these loans is also strictly defined. Loan terms must fall between a minimum of 10 days and a maximum of 31 calendar days.

Permissible Fees and Finance Charges

Lenders are permitted to charge a fee that does not exceed 17.5% of the amount advanced. For instance, on a $100 loan, the maximum fee would be $17.50.

It is mandated that all fees associated with deferred presentment transactions be disclosed as finance charges. This must comply with the federal Truth-in-Lending Act (TILA), 15 U.S.C. §1605, and its accompanying regulations.

Rollovers and Loan Renewals

Alabama law restricts the practice of extending payday loans. Only one rollover is permitted per loan. A "rollover" is defined as a transaction where the loan is not paid in full. The licensee allows the customer to pay only the fee to initiate a new deferred presentment transaction for the same principal amount.

Furthermore, a licensee is prohibited from redeeming, extending, or otherwise consolidating a deferred presentment agreement with the proceeds of another deferred presentment transaction made by the same or an affiliated provider. This is except as expressly provided under Section 5-18A-12, which pertains to the Extended Repayment Plan.

While limiting to a single rollover appears protective, its financial implications are important. For a $500 loan, the initial fee can be $87.50. A rollover means an additional $87.50 fee, totaling $175 in fees without reducing the principal. This can pressure borrowers towards the Extended Repayment Plan if they cannot clear the debt.

The Alabama Deferred Presentment Services Act affords specific rights to individuals who take out payday loans. These are aimed at ensuring transparency and fair treatment.

Right to Clear Information and Loan Agreements

Lenders have a legal obligation to provide comprehensive disclosures. Before an agreement is finalized, the lender must give the customer a written explanation in clear language. This explanation details the fees and the date the check or debit authorization may be deposited.

All fees must be disclosed as finance charges under TILA. Crucially, the customer must receive and acknowledge notification of all itemized and total fees and costs before the transaction. Lenders must also provide a copy of the loan agreement before signing, and consumers should read it thoroughly.

Every licensee must conspicuously display a schedule of all fees, charges, and penalties. This schedule must include the statement: "NOTICE: FEES FOR DEFERRED PRESENTMENT TRANSACTIONS MAY BE SIGNIFICANTLY HIGHER THAN FOR OTHER TYPES OF LOANS," in all capital letters and at least 12-point type, above the borrower's signature line.

The Extended Repayment Plan (ERP)

A critical protection for borrowers facing repayment difficulties is the Extended Repayment Plan (ERP). Alabama law mandates that payday lenders must offer a free ERP. This plan consists of four equal monthly payments and must be offered before a lawsuit can be initiated to collect on a defaulted loan. The ERP should not include any additional charges.

The mandatory ERP implies legislative acknowledgment that standard loan terms might lead to default for many. The "no additional charges" provision is vital, preventing further cost escalation and aiming for a genuine repayment pathway.

Protection Against Unlawful Collection Practices

The Act provides safeguards against certain aggressive collection tactics. Payday lenders cannot prosecute or threaten to incarcerate a borrower for a check returned due to insufficient funds (NSF). An individual issuing a check or authorizing a debit for a deferred presentment transaction cannot be convicted under Alabama's bad check law (Section 13A-9-13.1) if it's returned for NSF.

However, a critical distinction exists. If a check or debit authorization is returned because the account was closed, collection efforts under Section 13A-9-13.1 may be permissible. This means while the state protects from criminal charges for simple inability to pay (NSF), it doesn't shield actions perceived as deliberate fraud, like using a known closed account.

If a check is returned for NSF or a closed account, the licensee can pursue civil remedies. This can include court costs and a reasonable attorney's fee, not exceeding 15% of the check's face amount. Lenders are also prohibited from engaging in unfair or deceptive acts, practices, or advertising.

Other Rights

Borrowers have several other important rights:

All entities offering deferred presentment services to Alabama residents must be licensed by the Alabama State Banking Department (ASBD). Operating without a license carries penalties, and unlicensed lenders cannot keep any fees collected.

The Role of the Alabama State Banking Department (ASBD)

The ASBD is the primary state agency for regulating and licensing payday lenders. It provides consumer resources, handles complaints against licensed entities, and enforces the Deferred Presentment Services Act. The Supervisor of the Bureau of Loans, within the ASBD, specifically administers and enforces the Act.

Licensing Requirements for Lenders

To become a licensed payday lender in Alabama, applicants must meet several criteria:

These detailed licensing prerequisites aim to ensure that only entities meeting minimum standards of operational integrity and stability can offer payday loans.

How to Verify a Lender's License

Consumers are strongly cautioned against using unlicensed lenders. To verify a payday lender's license in Alabama:

The ASBD's warnings about unlicensed online lenders, especially those claiming tribal immunity, highlight a consumer protection challenge. Alabama's authority over unlicensed entities operating online from outside its jurisdiction is limited, making license verification crucial.

Prohibited Lender Conduct

Lenders are subject to specific prohibitions:

While the 17.5% fee per $100 advanced might seem manageable, it translates to an exceptionally high Annual Percentage Rate (APR) due to the short loan terms. A $17.50 fee on a $100 loan for 14 days equals an APR of 456.25%.

This APR starkly contrasts with other credit forms. Alabama's Small Loan Act caps interest on other small, short-term loans at 3% a month (36% APR). This disparity indicates a legislative exception for payday lenders, permitting what would otherwise be usurious rates. The consequence is an inherently expensive product risking debt cycles for vulnerable consumers.

The single permitted rollover can still contribute to debt cycles due to high costs. Repeatedly paying a substantial fee to extend the term drains resources without reducing principal. Data from The Pew Charitable Trusts has shown Alabama with high average payday loan APRs over longer hypothetical periods.

Emphasizing the "fee" rather than the APR in marketing can be less alarming for consumers focused on immediate cash needs. While TILA mandates APR disclosure , the initial focus on a fixed dollar amount might obscure the true annualized cost, especially with rollovers or frequent loans.

The following table summarizes key financial parameters under Alabama's payday loan laws:

Table 1: Alabama Payday Loan Key Figures

| Feature | Details under Alabama Law |

|---|---|

| Maximum Loan Amount | $500 (aggregate from all lenders) |

| Minimum Loan Term | 10 days |

| Maximum Loan Term | 31 days |

| Maximum Finance Charge | 17.5% of the amount advanced (e.g., $17.50 per $100) |

| Example APR (14-day $100 loan) | 456.25% |

| Rollovers Permitted | One |

| Extended Repayment Plan (ERP) | Yes, mandatory offer before lawsuit, 4 equal monthly payments, no extra fees |

| NSF Fee (charged by lender for returned check) | Up to $30 (plus potential bank fees from the borrower's bank) |

Defaulting on a payday loan in Alabama can trigger a cascade of negative consequences. It is crucial for borrowers to understand these risks.

Consequences of Defaulting on a Payday Loan

If a borrower defaults, several things can happen:

Understanding Debt Collection Practices

Borrowers are protected by the federal Fair Debt Collection Practices Act (FDCPA) when dealing with third-party debt collectors. This act prohibits abusive, deceptive, and unfair practices. Collectors cannot harass, use obscene language, make false statements, or threaten arrest for non-payment of a payday loan (prohibited in Alabama for NSF checks).

Special Considerations for Online and Tribal Lenders

Risks can be amplified with online lenders not licensed by the ASBD, or with lenders affiliated with Native American tribes.

Jurisdictional complexities with unlicensed online and tribal lenders create a regulatory gray area. Alabama consumers may find fewer protections, underscoring the importance of dealing only with ASBD-licensed lenders.

Given the high costs and risks of payday loans, exploring alternative financial solutions is prudent for Alabama residents.

Credit Union Payday Alternative Loans (PALs)

Many credit unions offer Payday Alternative Loans (PALs), designed by federal regulation to be more affordable. These typically feature lower APRs and longer repayment terms.

PALs from credit unions, with APRs around 25-28%, offer viable, less predatory lending models. While membership requirements can be a barrier, these loans encourage stable banking relationships and help build credit.

Other Personal Loan Options

Banks and other credit unions may offer traditional small personal loans or lines of credit. Five Star Credit Union, for example, mentions an Express Loan as a payday loan alternative and offers personal lines of credit. These generally have more favorable terms than payday loans.

Non-Profit and Community Financial Assistance

Non-profit organizations and community programs can offer assistance without incurring debt.

These programs can address immediate crises without high-interest debt, highlighting the importance of financial literacy and awareness of community support. Negotiating directly with creditors for existing debts can also free up funds.

The following table summarizes some key alternatives:

Table 2: Payday Loan Alternatives in Alabama

| Alternative Type | Provider Examples (Alabama specific where possible) | Key Features/Benefits | Typical Cost Range/APR (if applicable) |

|---|---|---|---|

| Credit Union PALs | Redstone FCU, Navigator CU, Century Federal CU | Lower APRs, longer repayment terms, potential for credit building | ~25-28% APR + small application fee |

| Other Credit Union/Bank Loans | Five Star CU (Express Loan, Personal Line of Credit) | Potentially lower rates than payday loans, established banking relationship benefits | Varies, generally significantly lower than payday loans |

| Non-Profit Emergency Assistance | AL Power Foundation (ABC Trust), American Red Cross, Catholic Center of Concern, Salvation Army | Grants or direct aid for utilities, rent, food; no repayment typically needed | Free (if eligible) |

| Negotiating with Creditors | N/A (Direct negotiation with existing creditors) | Payment plans, potential for reduced amounts owed or waived fees on existing debts | Potential for waived fees or reduced interest |

Consumers in Alabama who believe a payday lender has violated the law have avenues for filing complaints. Attempting to resolve the issue directly with the lender first is advisable.

Complaints Against State-Licensed Lenders

For issues with ASBD-licensed payday lenders:

This formal complaint process provides accountability for licensed lenders.

Complaints Against Tribal-Run or Unlicensed Online Lenders

The ASBD may have limited jurisdiction over online lenders not licensed in Alabama or those affiliated with Native American tribes. For these entities, contact federal agencies:

This bifurcated system can be confusing. It's important to first try to determine the lender's licensing status. When filing any complaint, include comprehensive information and supporting documentation.

Alabama's payday loan laws present a complex environment. While regulations offer some protections, the high cost and short terms of these loans necessitate extreme caution.

Borrowers should critically assess their ability to repay the full loan amount, including fees, by the due date. The potential for rollovers to increase costs and severe default consequences underscore this.

Exploring all alternatives is crucial. Credit union PALs, other small personal loans, and non-profit assistance can offer more sustainable solutions. Keeping meticulous records of all loan documents and correspondence is vital.

While informed individual decision-making is paramount, it operates within a legal framework that some advocacy groups argue still permits challenging terms. These groups often advocate for reforms like lower APR caps. Proactive financial planning, enhanced financial literacy, and awareness of all resources are key to avoiding over-reliance on high-cost credit and fostering financial stability.

No. Under Alabama payday loan laws, you cannot have more than $500 in payday loans from all lenders combined at any one time. The state maintains a central database to track all transactions, preventing lenders from issuing a new loan to a borrower who has reached this legal limit.

If you are unable to repay, the lender must first offer you an Extended Repayment Plan (ERP) consisting of four equal monthly installments. They cannot pursue civil action or charge additional fees until this offer is made and you decline or default on the ERP, as stipulated by Alabama's payday loan regulations.

Yes, but only after they have taken you to court and won a judgment against you. A payday lender cannot unilaterally garnish your wages. The court must first issue a judgment, and even then, Alabama law limits the amount that can be garnished from your paycheck to protect a portion of your income.

A single renewal or "rollover" is permitted. If you cannot pay at the end of the initial term, the lender can extend the loan once at the same fee. After that one renewal, you must either pay the debt or accept the Extended Repayment Plan (ERP) before any new loans are allowed.

Lenders can charge a fee of up to 17.5% of the amount borrowed. For example, on a $100 loan, the maximum fee is $17.50. This fee structure is a key component of the Alabama payday loan laws designed to regulate the cost of borrowing and prevent excessively high charges.

No, you cannot be arrested or threatened with criminal charges for failing to pay back a payday loan. The Alabama Deferred Presentment Services Act specifically prohibits lenders from using the threat of criminal prosecution to collect a debt, unless the check was returned because the account was closed.

You should always verify a lender's status through the Alabama State Banking Department's official website. They provide a free online search tool that allows you to check if a lender holds a valid license to operate in the state, ensuring they are compliant with all Alabama payday loan laws.

After repaying a payday loan (and its one allowable rollover), you must wait until the next business day before you can take out another payday loan. This mandatory cooling-off period is designed to prevent borrowers from becoming trapped in a continuous cycle of debt by taking out new loans immediately after paying off old ones.

If you suspect a lender is not following Alabama payday loan laws, you have the right to file a formal complaint with the Alabama State Banking Department. They are responsible for investigating claims of predatory lending, illegal fees, or unlicensed operations and can take action against the lender.

State licensing requirements and laws apply to any lender doing business with Alabama residents. However, some online lenders may operate from outside the state or from tribal land, claiming they are not subject to Alabama's jurisdiction. Consumers should be extremely cautious, as the Alabama State Banking Department may have limited ability to assist with complaints against these entities.

Many individuals and families relying on the Supplemental Nutrition Assistance Program (SNAP) wonder if popular fast-food chains like Little Caesars accept Electronic Benefit Transfer (EBT) cards. Understanding this requires looking into SNAP regulations, the Restaurant Meals Program (RMP), and specific state and local policies.

The answer isn't a simple yes or no. Generally, hot, prepared foods from restaurants are not EBT eligible under standard SNAP rules. However, important exceptions exist, which will be explored here.

What is SNAP?

The Supplemental Nutrition Assistance Program (SNAP) is a federal initiative aimed at helping low-income individuals and families purchase nutritious food. The U.S. Department of Agriculture's (USDA) Food and Nutrition Service (FNS) administers SNAP at the federal level. State agencies then manage the program locally, handling eligibility and benefit distribution.

How are SNAP Benefits Distributed?

SNAP benefits are provided through an Electronic Benefits Transfer (EBT) card, which operates similarly to a debit card. Participants can use their EBT cards at authorized retail stores to buy eligible food items. The EBT system deducts the purchase amount from the participant's SNAP account to reimburse the store.

Eligible Food Items

Standard SNAP benefits are intended for purchasing foods that will be prepared and eaten at home. Typically, these include:

Ineligible Items

Items generally not eligible for purchase with SNAP EBT include:

Cold Prepared Foods vs. Hot Foods

Cold prepared foods, such as sandwiches or salads from a grocery store deli meant for off-premises consumption, are generally SNAP-eligible. However, if a food item is heated or cooked by the retailer before or after purchase, it is typically not considered a staple food for retailer eligibility and is generally not SNAP-eligible outside of specific programs.

What is the RMP?

The primary exception allowing SNAP EBT use for hot, prepared meals at restaurants is the Restaurant Meals Program (RMP). The RMP is a state-administered option. It permits certain SNAP recipients—specifically those who are elderly (age 60 or older), disabled, or homeless, and their spouses—to use EBT cards for meals at authorized restaurants. This program acknowledges that these individuals might face difficulties preparing their own meals or may lack stable housing for food storage and preparation.

Conditions for Restaurant Participation in RMP

For a restaurant to participate in the RMP, several conditions must be met:

State Discretion and Client Eligibility

States have the discretion to set their own RMP participation requirements, including which and how many restaurants are approved. Eligible SNAP clients in RMP states will have their EBT cards specially coded for acceptance at participating restaurants. An EBT card from an ineligible client or a client in a non-RMP state will be declined.

States with an RMP

As of mid-2024, states known to operate an RMP include Arizona, California, Illinois (limited counties), Maryland, Massachusetts, Michigan, New York, Rhode Island, and Virginia. Nevada is not currently listed by the USDA as an RMP state.

Hot, Prepared Foods Ineligibility

Generally, Little Caesars primarily sells hot, prepared pizzas and other items like Crazy Bread® and Caesar Wings®. Under standard SNAP regulations, these hot, ready-to-eat foods are not eligible for EBT card purchase because they are intended for immediate consumption and are hot at the point of sale.

Uncooked or "Take-and-Bake" Pizzas

Some have wondered if Little Caesars might offer uncooked or "take-and-bake" style pizzas, similar to chains like Papa Murphy's, which could potentially make them eligible for standard SNAP EBT. Papa Murphy's products are generally SNAP-eligible because they are sold cold and intended for home baking.

However, there is no widespread evidence that Little Caesars offers uncooked pizzas as a standard menu item for EBT purchase. Their business model centers on HOT-N-READY® items and freshly baked pizzas. While a customer might theoretically request an uncooked pizza, this is not a standard offering. Its EBT eligibility would still be questionable under SNAP's retailer definitions, as Little Caesars is primarily classified as a restaurant.

Restaurant Classification

The USDA FNS clarifies that if over 50% of a firm's total gross sales come from hot or cold prepared foods not intended for home preparation and consumption (including carryout), it's considered a restaurant. Generally, restaurants cannot be SNAP-authorized as retail food stores unless they participate in an RMP. Little Caesars, with its menu of predominantly hot, prepared foods, clearly fits the restaurant category.

Therefore, for standard SNAP EBT purchases (outside of RMP), Little Caesars is not an option.

Conditions for EBT Acceptance at Little Caesars

The only way Little Caesars could accept EBT for their hot, prepared food is if specific locations participate in a state's Restaurant Meals Program. This participation is highly dependent on:

Little Caesars RMP Participation by State

Information on Little Caesars' participation in RMP is limited and varies by location:

Factors Affecting Participation

It's important to note that even in states with an RMP, not all eligible restaurants or fast-food chains choose to participate. Participation involves administrative steps, potential equipment costs, and sometimes requirements for offering concessional pricing. Some states, like Massachusetts, have historically limited which types of restaurants can join their RMP, potentially affecting large chains. However, policies can change.

Little Caesars' official website does not provide information about EBT acceptance or RMP participation.

Key Takeaway: Little Caesars' EBT acceptance is rare. It is confined to specific, approved locations within states operating an RMP, and only for RMP-eligible individuals. It is not a nationwide company policy.

Given the variability, SNAP recipients eligible for RMP who wish to use their EBT card at Little Caesars should verify acceptance at their local store.

Methods for Verification:

Quick Guide: Checking Little Caesars EBT Acceptance

| Method | Description | Key Considerations |

|---|---|---|

| Official State RMP Lists | Check your state's SNAP agency website (e.g., Dept. of Social Services, Dept. of Economic Security). | Lists may not always be instantly updated. Good starting point. |

| Call Specific Little Caesars Store | Directly phone the restaurant. | Most accurate way to confirm current participation for that specific location. |

| Look for In-Store Signage | Check the restaurant's door/window for official RMP signs. | Signs should be present if they participate, but absence isn't definitive (always call). |

| Contact Local SNAP/Social Services | Reach out to your county office. | Can provide localized guidance. |

| Third-Party Apps/Websites (Use Caution) | Some apps or websites (e.g., Propel , food assistance blogs ) list RMP locations. | Information may not be official or current. Always cross-verify with official sources or by calling the store. |

Important Note on Verification

Information from non-official sources should always be verified. State RMP lists and individual restaurant participation can change. A direct call to the specific Little Caesars location is highly recommended before visiting, especially if relying on EBT.

Clarification on Nevada

The Nevada Division of Welfare and Supportive Services (DWSS) website states that SNAP benefits can be used by eligible groups "to purchase meals at approved restaurants, congregate eating sites, and from meals on wheels." This language resembles RMP provisions.

However, Nevada is not officially listed by the USDA as a state operating an RMP that includes commercial fast-food restaurants. The USDA's FNS page for Nevada SNAP also doesn't mention RMP participation. This suggests "approved restaurants" in Nevada likely refer to specific non-profit meal providers, communal dining facilities, or home-delivered meal services with separate USDA authorization, not for-profit fast-food chains in a formal RMP. For a chain like Little Caesars to accept EBT for hot meals, the state typically needs a formal, USDA-recognized RMP, and the restaurant must be an authorized vendor. Given the lack of evidence for such an RMP in Nevada including fast-food chains, and no specific Little Caesars locations cited as EBT-accepting there, it's unlikely Little Caesars accepts EBT in Nevada. Nevada residents should contact DWSS directly for clarification.

To summarize, using SNAP EBT for hot, prepared food at Little Caesars is generally not possible under standard SNAP rules. The main way this can happen is through a state-operated Restaurant Meals Program. This program is available only in select states and for specific eligible individuals (elderly, disabled, or homeless).

Even in RMP states, Little Caesars' participation is not guaranteed and is limited to specific, approved franchise locations. Standard SNAP benefits cannot be used for Little Caesars' typical hot food offerings due to federal rules against purchasing hot, ready-to-eat meals. Using standard EBT for any cold, unprepared items at Little Caesars is highly improbable due to their standard menu and restaurant classification.

The Importance of Verification

The most critical action for any SNAP recipient is to personally verify EBT acceptance. This involves checking the latest official state RMP participant lists and, most importantly, calling the specific Little Caesars store before assuming EBT is accepted. Policies and participation can change, making direct verification essential.

SNAP recipients should familiarize themselves with their state's SNAP rules and whether an RMP is active in their area. For general SNAP information, the USDA SNAP program website is a valuable resource. Understanding SNAP and RMP basics, along with diligent local verification, helps individuals use their EBT benefits correctly where allowed.

Standard SNAP benefits are restricted by federal law to unprepared food items intended for home consumption. Since Little Caesars primarily sells hot, ready-to-eat pizza, it falls under the "hot food" exclusion. This policy applies to most fast-food restaurants, not just Little Caesars.

No. Even in states with an RMP, each individual restaurant franchise must apply for and receive state and federal approval to participate. Little Caesars' participation is extremely rare, so you should never assume a location accepts EBT, even if your state has the program.

You can typically purchase cold, packaged beverages like soda or water with your SNAP EBT card. However, items like Crazy Bread®, which are sold hot and ready-to-eat, fall under the same "hot food" restriction as pizza and are generally not eligible for purchase with SNAP benefits.

Take-and-bake pizzerias, like Papa Murphy's, sell uncooked pizzas that are intended to be baked at home. Because the food is not sold hot, it qualifies as a standard grocery item under SNAP rules. Little Caesars sells cooked, hot food, which makes it ineligible under the same regulations.

No, you cannot use an EBT card for payment on the Little Caesars app or website. EBT processing, especially for the very few locations that might accept it through the Restaurant Meals Program, requires a physical card transaction in-store on a specific EBT-enabled terminal.

Yes, if you receive cash benefits (like TANF) on your EBT card, you can use them just like a debit card. You can withdraw this cash at an ATM or use it to purchase any item, including hot prepared food at Little Caesars, as it is not subject to SNAP restrictions.

The most reliable method is to call the specific Little Caesars store directly. Since participation in the Restaurant Meals Program is so rare and location-dependent, asking an employee at that franchise is the only way to get a guaranteed, up-to-date answer before you visit.

There have been no widespread announcements from Little Caesars corporate about plans to expand EBT acceptance. Participation remains a franchise-level decision in states with a Restaurant Meals Program and is subject to significant operational and administrative requirements, making broad adoption unlikely in the near future.

While "Restaurant Meals Program" or RMP is the official federal term, states may brand it differently. For example, in California, it's often referred to as the CalFresh Restaurant Meals Program. Regardless of the name, the core function and eligibility requirements (elderly, disabled, or homeless) remain consistent.

If you are eligible for the Restaurant Meals Program in a participating state (like Arizona, California, or Michigan), your state's SNAP agency website is the best source. They often provide official, searchable lists or maps of all currently authorized restaurants where you can use your benefits.