Millions of qualified residents are missing out on up to $48,000 in total assistance. Take 60 seconds to secure your benefits before the current window closes.

Claim Your Benefits Now »Securing a Georgia personal loans can be a pivotal step toward achieving your financial goals. Whether you are consolidating high-interest debt, managing unexpected expenses, or funding a significant life event, understanding your options is key.

For residents of the Peach State, the lending landscape offers a diverse array of choices, from local credit unions to national online lenders. Navigating these options requires a clear understanding of state-specific regulations, typical interest rates, and qualification criteria. This overview provides the essential information needed to make a confident and well-informed decision.

Before exploring specific lenders, it is essential to grasp the fundamental characteristics of the loan products available in Georgia. The market is defined by specific loan types, each with distinct features.

What is a Personal Loan?

A personal loan is a form of installment credit. When approved, you receive a single, lump-sum payment from the lender, which contrasts with revolving credit like a credit card.

Repayment is structured and predictable. You agree to pay back the borrowed amount, plus interest, in a series of fixed monthly payments over a predetermined period, known as the loan term. This simplifies budgeting, as you know exactly how much you owe each month and when the loan will be fully paid off.

Key characteristics of a personal loan include:

Unsecured vs. Secured Loans

Personal loans in Georgia fall into two main categories: unsecured and secured. The primary difference is the requirement of collateral—an asset pledged to guarantee repayment.

Why Installment Loans are the Standard in Georgia

Georgia's financial landscape is shaped by a key piece of consumer protection legislation: the prohibition of payday loans. These high-cost, short-term loans are illegal in the state, which significantly impacts the options available to consumers.

In the absence of payday lending, Georgians must use legally sanctioned alternatives, primarily regulated installment loans. An installment loan is repaid over time with a set number of scheduled payments, offering greater transparency and predictability. The Georgia Installment Loan Act governs these smaller loans, ensuring lenders are licensed and adhere to state regulations.

Georgia has a robust legal framework to protect consumers from predatory lending practices. Understanding these state-specific laws is crucial for any borrower.

Interest Rate Caps (Usury Laws)

To prevent exploitative interest rates, Georgia enforces usury laws that set a ceiling on how much interest a lender can charge. These regulations are detailed in the Official Code of Georgia Annotated (O.C.G.A.).

According to O.C.G.A. § 7-4-2, the legal limits are as follows:

Lenders who violate these laws face significant penalties, including the forfeiture of the entire interest amount charged.

The Georgia Installment Loan Act (GILA)

The Georgia Installment Loan Act (GILA) is the cornerstone of small loan regulation in the state, governing consumer loans of $3,000 or less. Under GILA, any company making these smaller loans must be licensed by the Georgia Department of Banking and Finance (DBF).

The DBF regulates state-chartered banks, credit unions, and installment loan companies to ensure they comply with the law. Before signing an agreement, you can and should verify a lender's license on the Nationwide Multistate Licensing System (NMLS) Consumer Access website.

Your Rights in Debt Collection

Georgia consumers are protected by both federal and state laws governing debt collection. The federal Fair Debt Collection Practices Act (FDCPA) and Georgia's Fair Business Practices Act shield you from abusive, unfair, or deceptive tactics.

Prohibited Collector Actions

A debt collector is prohibited from:

Your Right to Dispute a Debt

Within five days of first contact, a collector must send you a written notice detailing the debt. If you send a written dispute within 30 days of receiving that notice, the collector must stop all collection activities until they provide verification of the debt.

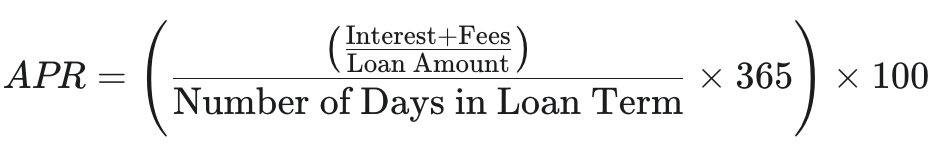

The total cost of a personal loan is determined by its Annual Percentage Rate (APR), which includes the interest rate and certain fees. This rate can vary significantly based on your credit profile and choice of lender.

How Your Credit Score Dictates Your APR

Your credit score is the most influential factor in determining your APR. Lenders see a higher score as an indicator of lower risk, which translates to a better interest rate.

Here is how credit scores correlate with average APRs:

Typical APR Ranges by Lender Type

APRs also vary widely depending on the type of financial institution.

Beyond the APR: Common Loan Fees

Be aware of other potential fees that can add to the total cost of borrowing.

Lenders evaluate several key factors to determine eligibility. Preparing for this evaluation can streamline the application process.

The Four Pillars of Lender Approval

Approval generally rests on four main pillars that show a borrower's financial health.

Preparing Your Application: A Document Checklist

Gathering necessary documents beforehand can speed up the process. You will typically need:

The best lender for you depends on your credit profile, financial needs, and personal preferences.

Top-Tier Options for Excellent Credit (720+)

Borrowers with excellent credit can secure the lowest rates and most favorable terms.

Strong Choices for Good to Fair Credit (630-719)

Borrowers in this range have many options but may face slightly higher APRs.

Navigating Loans with Bad Credit (Below 630)

Securing a loan with bad credit is challenging, and costs will be higher. Focus on finding a manageable loan that can help rebuild credit.

The Local Advantage: Georgia-Based Banks and Credit Unions

Working with a local financial institution can offer more personalized service and flexible underwriting.

The flexibility of a personal loan is one of its greatest assets. The most effective uses are strategic, aimed at improving your financial position.

A personal loan is not always the right solution. For those struggling with debt, alternative resources may be more appropriate.

Other Forms of Credit

Consider other credit products that might be a better fit for your specific need.

Georgia-Specific Assistance and Counseling

Numerous state programs and nonprofit organizations can provide assistance without requiring you to take on additional debt.

Successfully navigating Georgia's personal loan market hinges on being an informed and proactive borrower. The state's regulatory environment provides a solid foundation of consumer protection, but the responsibility lies with you to leverage it.

The key to a positive borrowing experience is a multi-step process. Start with a realistic assessment of your financial standing, particularly your credit score. Next, shop around and compare offers from a diverse set of lenders, always focusing on the total cost of borrowing (APR).

Finally, consider whether a personal loan is truly the best solution or if an alternative might better serve your long-term financial well-being. By arming yourself with this knowledge, you can confidently select a financial product that acts as a stepping stone toward achieving your goals.

Interest rates for Georgia personal loans typically range from 6% to 36% APR. Your specific rate is determined by your credit score, income, loan amount, and the lender. Applicants with excellent credit receive the most competitive rates, while those with fair or poor credit will see higher percentages.

Yes, obtaining a personal loan with bad credit is possible. Many Georgia lenders and online credit providers specialize in loans for individuals with subprime credit scores. Be prepared for higher interest rates and potentially smaller loan amounts, as the lender is taking on more risk.

To apply, you'll generally need a government-issued photo ID (like a driver's license), proof of income (such as recent pay stubs or tax returns), proof of residence (a utility bill), and your Social Security number. Some lenders may also require bank statements to verify your financial standing.

Yes, Georgia's Fair Lending Act provides significant consumer protection. The state enforces interest rate caps to prevent predatory lending. For loans under $3,000, specific regulations limit the fees and interest lenders can charge, offering a safer borrowing environment than in many other states.

Funding speed varies by lender. Online lenders often provide the fastest turnaround, with many capable of depositing funds directly into your bank account within one to two business days after your loan application is approved. Traditional banks and credit unions may take slightly longer, typically three to five business days.

Absolutely. Georgia has very strict laws that make traditional high-interest payday loans illegal. Personal loans are a much safer alternative, offering lower, regulated interest rates, longer repayment periods, and larger loan amounts. They are designed to be a more responsible financial tool for borrowers.

Using a personal loan for debt consolidation involves taking out a single loan to pay off multiple high-interest debts, like credit cards or medical bills. This simplifies your finances into one predictable monthly payment, which often comes with a lower overall interest rate, saving you money over time.

No, the vast majority of Georgia personal loans are unsecured, meaning they do not require you to put up any collateral like a car or house. Approval for these unsecured loans is based primarily on your creditworthiness, income, and ability to repay the debt.

Loan amounts vary significantly among lenders, typically ranging from $1,000 to over $50,000. The maximum you can borrow depends on your credit score, debt-to-income ratio, and the lender’s policies. A stronger financial profile will qualify you for a higher loan amount.

Most reputable lenders offering personal loans in Georgia do not charge prepayment penalties. This feature allows you to pay off your loan ahead of schedule without incurring extra fees, potentially saving you a significant amount in interest. Always confirm this policy with the lender before signing an agreement.

Securing a Florida personal loans can be a pivotal step toward achieving your financial objectives. This could involve consolidating high-interest credit card debt, financing critical home repairs, or covering unforeseen medical expenses. This financial tool provides a lump-sum of cash that is repaid over a fixed period with predictable monthly installments.

Successfully obtaining a loan with favorable terms requires a clear understanding of three core areas. These include the eligibility criteria lenders use, the diverse landscape of financial institutions in the Sunshine State, and the specific consumer protection laws enacted in Florida to safeguard borrowers.

The search for a personal loan is a quest for a solution to a financial challenge. Lenders in Florida, from local credit unions to large national banks and online platforms, offer a wide array of products. Navigating this market effectively means aligning your financial standing with the right lender while being fully aware of your rights and the true cost of borrowing. This involves a careful assessment of interest rates, fees, and repayment terms.

When a borrower in Florida applies for a personal loan, lenders undertake a detailed risk assessment to determine the likelihood of repayment. This evaluation is based on a holistic view of the applicant's financial health. Key metrics, including credit score, debt-to-income ratio, and verified income, form the foundation of the lending decision.

Credit Score's Role in Your Approval

A credit score is a numerical representation of a borrower's creditworthiness. It plays a significant role in both loan approval and the assigned Annual Percentage Rate (APR). While requirements vary, lenders generally categorize scores into distinct tiers:

Lender Preferences and Flexibility

Lenders generally prefer applicants with good to excellent credit, typically a score of 670 or higher, as this indicates a history of responsible debt management. However, the Florida lending market is diverse. Prime lenders like LightStream, an online division of Truist Bank, specifically target applicants with strong credit profiles.

Conversely, many online lenders and credit unions are more flexible. Some lenders will consider applicants with scores as low as 580 or even 550. Certain Florida credit unions may not even have a strict minimum credit score, instead placing greater weight on the applicant's relationship with the institution. This market diversity creates strategic pathways for borrowers with varying credit histories.

The Debt-to-Income (DTI) Ratio Explained

While a credit score reflects past financial behavior, the debt-to-income (DTI) ratio provides a snapshot of a borrower's current capacity to handle new debt. It is calculated by dividing total monthly debt payments by gross monthly income and is expressed as a percentage. Lenders view DTI as a primary indicator of cash flow resilience.

DTI Benchmarks in Florida

Lenders in Florida adhere to general DTI benchmarks:

For personal loans specifically, many lenders prefer a maximum DTI ratio between 36% and 43%. A high income cannot always compensate for a high DTI, as it is the proportion of income committed to debt that signals financial strain.

Income and Employment Verification

To confirm an applicant's ability to make consistent monthly payments, lenders require proof of stable and sufficient income. The documentation needed for this verification is standard across the industry and typically includes:

Self-employed individuals will generally need to provide more extensive documentation, such as two years of tax returns and recent bank statements, to demonstrate consistent earnings.

Florida residents have access to a wide spectrum of lenders, each with distinct business models and product offerings. Choosing the right type of lender is as important as meeting the eligibility criteria and can significantly impact the loan's terms.

The Credit Union Advantage in Florida

Florida's credit unions operate as not-for-profit cooperatives owned by their members. This structure often fosters a "relationship-based" lending model that can be highly beneficial for borrowers. Their focus on serving members can translate into more flexible underwriting and competitive rates.

For example, Florida Credit Union offers personal loans up to $50,000 and features specialized products like "No-Hassle Loans" for members with imperfect credit. Similarly, Orlando Credit Union provides traditional unsecured loans alongside "Share Secured" loans, which allow members to borrow against their savings at very low interest rates.

Banks Operating in Florida: Offerings and Requirements

Major commercial banks in Florida also offer personal loans, though their approach often prioritizes existing customers. This strategy is evident in their application requirements.

Wells Fargo, for instance, offers personal loans from $3,000 to $100,000 but requires applicants to have an account with the bank for at least 12 months. TD Bank offers its "TD Fit Loan" to Florida residents with amounts from $2,000 to $50,000, but it is important to note that a state-specific Documentary Stamp Tax will apply.

Navigating Online Lenders from Florida

Online lenders offer streamlined digital applications and rapid funding times. This market includes prime lenders for borrowers with strong credit and non-prime lenders for those with fair or challenging credit profiles.

Understanding Origination Fees

A key differentiator in the online market is the use of origination fees. Prime lenders often compete by advertising zero fees. In contrast, non-prime lenders frequently charge these fees—a percentage of the loan amount (from 1% to 10%) deducted from the loan proceeds—to offset higher risk. This makes comparing the APR, which includes these fees, essential for understanding the true cost of the loan.

Florida has a robust legal framework designed to protect consumers, governed primarily by the Florida Consumer Finance Act (Chapter 516, Florida Statutes). This framework establishes clear rules for licensed lenders on interest rates, fees, and penalties.

State-Mandated Interest Rate Ceilings

For consumer finance companies licensed to make loans up to $25,000, Florida law sets specific caps on interest rates. According to Florida Statute 516.031, the maximum rates are tiered:

These protections apply specifically to lenders licensed under this act. Traditional banks, savings and loan associations, and credit unions operate under different laws and are not subject to these particular caps.

Freedom from Prepayment Penalties

A powerful consumer right in Florida is the prohibition of prepayment penalties. Under Florida Statute 516.031(6), a licensed lender is legally forbidden from charging a fee for paying off a loan before the scheduled due date. This ensures borrowers can save money on interest by settling their debt early without penalty.

Rules on Late Fees (Delinquency Charges)

Florida law also strictly regulates late fees. A lender can only assess a delinquency charge if a payment is at least 10 days past due, and this charge must have been agreed upon in writing. The maximum allowable late fee for a loan with monthly payments is $15.

The Role of the Florida Office of Financial Regulation (FLOFR)

The Florida Office of Financial Regulation (OFR) is the state agency responsible for licensing and regulating non-depository financial institutions. It serves as the primary watchdog for consumer protection in this sector.

How the OFR Protects You

Florida residents can and should use the OFR's resources to:

This regulatory oversight provides a clear avenue for recourse. Consumers can access these services through the official OFR website. For direct verification of the statutes, consumers can consult the official Florida Senate website.

The modern loan application process is designed for speed and efficiency. Being prepared can prevent delays and improve the chances of a smooth approval.

Preparing Your Documentation: A Checklist

Having all necessary documents organized before starting an application can significantly accelerate the process. A typical checklist includes:

From Prequalification to Funding: Understanding the Stages

The application journey typically involves several distinct stages.

To make an informed borrowing decision, it is essential to look beyond the monthly payment and understand the total cost of the loan.

Beyond the Interest Rate: Decoding APR

The Annual Percentage Rate (APR) is the most critical figure for comparing loan offers. Unlike the simple interest rate, the APR represents the total annual cost of borrowing because it includes both the interest and any mandatory charges, such as an origination fee.

Common Fees to Watch For

While Florida law prohibits prepayment penalties for many loans, other fees can apply. The most significant is the origination fee, a one-time charge for processing the loan that is deducted from the funds you receive. Lenders like Regions, TD Bank, and LightStream are notable for not charging origination fees. Some Florida credit unions may charge a modest, flat application fee instead.

Choosing Your Repayment Term

The repayment term—the length of time you have to pay back the loan—directly impacts both your monthly payment and the total interest you will pay.

When considering loan offers, it is wise to calculate the total cost for different term lengths to find the right balance between affordability and overall cost.

While a personal loan is a versatile financial tool, it may not always be the optimal solution. Before committing, consider other financing options.

Strategic Use of Credit Cards

For smaller expenses, a credit card offering a 0% introductory APR can be an excellent alternative. These offers typically provide an interest-free period of 12 to 21 months. If the balance is paid in full before this period expires, this method is effectively free of interest charges.

Leveraging Home Equity

For Florida homeowners with significant equity, a Home Equity Loan or a Home Equity Line of Credit (HELOC) can be a powerful option. Because these loans are secured by the home, they typically offer much lower interest rates than unsecured personal loans.

A home equity loan provides a lump sum with a fixed interest rate. A HELOC functions more like a credit card, providing a revolving line of credit with a variable interest rate. The primary risk is that the home is used as collateral.

Other Financing Avenues

Other viable alternatives exist depending on the borrower's circumstances:

Florida law generally caps interest rates at 18% APR for loans up to $500,000. However, this rule has exceptions, and state-licensed lenders can often charge higher rates. It is essential to carefully review the terms and conditions of any Florida personal loans to understand the exact APR you will be paying.

Yes, obtaining Florida personal loans with bad credit is possible. Lenders specializing in subprime credit exist, though they typically charge higher interest rates to offset their risk. Improving your credit score before applying, even slightly, can help you qualify for more favorable terms from Florida-based banks and credit unions.

Online lenders offering Florida personal loans must be licensed with the Florida Office of Financial Regulation and adhere to all state lending laws, including interest rate caps and disclosure requirements. Always verify a lender's license on the OFR website before providing personal information or accepting a loan offer.

In Florida, the statute of limitations for debt based on a written contract, which includes most personal loans, is five years. This means a creditor has five years from your last payment activity to file a lawsuit to collect the debt. After this period, they can no longer sue you for repayment.

While some lenders advertise "no credit check" loans, these are typically high-interest payday or title loans. Most reputable lenders offering installment-based Florida personal loans will perform at least a soft credit inquiry to assess risk. Be cautious, as true no-check loans often carry predatory terms under state law.

Yes, lenders typically require you to be a legal resident of Florida to qualify for a personal loan. You will need to provide proof of residency, such as a valid Florida driver's license, state-issued ID, or a recent utility bill in your name at a Florida address during the application process.

Many reputable lenders offering Florida personal loans do not charge prepayment penalties, allowing you to pay off your loan early without extra fees. However, it is not legally prohibited on all loan types. Always confirm the absence of a prepayment penalty clause in your loan agreement before signing.

Defaulting on a personal loan will not directly result in the suspension of your Florida driver's license. License suspension is typically reserved for driving-related infractions or failure to pay child support. However, a loan default will severely damage your credit score and can lead to wage garnishment after a court judgment.

Since Florida has no state income tax, there is no state-level deduction for personal loan interest. For federal taxes, the IRS generally does not permit you to deduct interest from personal loans unless the funds were used for specific purposes like qualified educational expenses or business investments.

If you believe a lender has violated the Florida Fair Lending Act, you have the right to file a complaint with the Florida Office of Financial Regulation. These protections cover issues like deceptive practices, undisclosed fees, and charging interest rates higher than legally allowed for their license type.

Securing Delaware personal loans can be a pivotal step toward achieving financial stability, whether the goal is to consolidate high-interest credit card debt, manage an unexpected medical expense, or fund a significant home improvement project. For residents of the First State, the lending landscape presents a distinct choice between community-focused local institutions and technologically advanced national online lenders. Understanding this dynamic, along with Delaware’s specific financial regulations and consumer protections, is the key to making a well-informed and confident borrowing decision. This resource provides the clarity needed to navigate your options, from understanding loan mechanics and state laws to identifying the right lender for your unique circumstances.

A personal loan is a versatile financial instrument that provides a lump sum of cash, which is then repaid in fixed monthly installments over a predetermined period. These loans are a common solution for consolidating debt into a single, more manageable payment, often at a lower interest rate than credit cards, or for financing large, one-time expenses like weddings, vacations, or emergency repairs.

In Delaware, personal loans fall into two primary categories: unsecured and secured.

Unsecured Personal Loans

An unsecured personal loan is the most common type and does not require any collateral. Lenders approve these loans based on the borrower's creditworthiness, income, and overall financial history. Because the lender assumes more risk without collateral, interest rates on unsecured loans are typically higher than on secured loans.

Secured Personal Loans

A secured personal loan is backed by a financial asset that the borrower owns, such as a savings account, a certificate of deposit (CD), or a vehicle title. This collateral reduces the lender's risk, which often allows them to offer larger loan amounts or lower interest rates.

For example, some Delaware credit unions allow members to borrow against funds in their savings accounts. While this can be an effective strategy, it's critical to remember that if the borrower defaults, the lender has the right to seize the collateral to recoup their losses.

The state of Delaware has specific laws in place to regulate lending and protect consumers from excessive interest charges. Understanding these regulations provides a baseline for evaluating loan offers and recognizing your rights as a borrower.

State Interest Rate Caps

According to the Delaware Code, the legal interest rate for most loans is capped. A lender may charge an interest rate that is agreed upon in writing, but it cannot exceed 5% over the Federal Reserve discount rate, including any surcharges. If no interest rate is specified in a contract, the same legal limit applies.

The Role of Federal Banking Laws

Many residents will encounter advertised Annual Percentage Rates (APRs) from national online lenders that are significantly higher than this state-level cap, with some reaching up to 35.99%. This is not necessarily a violation of the law. Many national banks and online lenders are chartered in states with more permissive lending laws and are allowed, under federal law, to "export" those interest rates to borrowers in other states, including Delaware.

Delaware's Usury Protections

To further protect borrowers, Delaware law defines and prohibits usury, which is the act of charging an interest rate higher than what is legally permitted. If a borrower enters into a contract with an interest rate that exceeds the lawful limit, they are not required to pay the excess amount.

Furthermore, if a borrower has already paid back a loan with interest that violated the usury law, they have the right to take legal action. They can recover three times the amount of the excess interest paid or $500, whichever is greater, provided the action is initiated within one year of the payment.

The Delaware personal loan market offers a wide array of choices tailored to different financial profiles. The "best" option depends on an individual's credit history, financial needs, and whether they prioritize personalized local service or the speed of an online platform.

Local Expertise: Delaware Banks and Credit Unions

Local banks and credit unions often emphasize their connection to the community, offering benefits like in-person consultations and localized underwriting decisions.

National and Online Lenders Serving Delaware

For borrowers who prioritize speed and convenience, national online lenders offer a compelling alternative with fully digital application processes and rapid funding times.

Solutions for Challenging Credit

Several specialized lenders serving Delaware focus on individuals with poor or no credit history, providing opportunities to secure needed funds.

Navigating the personal loan application process is more manageable when broken down into a series of clear steps. A methodical approach ensures you are fully prepared and can secure the most favorable terms.

Step 1: Check Your Financial Health

Before applying, it is crucial to understand your current credit score. Lenders use this score as a primary indicator of creditworthiness, and it heavily influences the interest rates you will be offered.

Scores in the good (670-739) to exceptional (800+) ranges typically qualify for the lowest interest rates. You can check your credit score for free through various online services. Reviewing your credit report for errors can also strengthen your application.

Step 2: Determine Your Needs

Carefully calculate the exact amount of money you need to borrow to avoid taking on unnecessary debt. Create a detailed monthly budget to determine how much you can comfortably afford to pay each month. Factoring a new loan payment into your budget ensures you can meet your repayment obligations without financial strain.

Step 3: Get Prequalified (The Soft Inquiry)

Prequalification is a valuable tool for loan shopping. Many lenders, including local banks like WSFS and national online platforms, allow you to check potential rates with only a "soft" credit inquiry, which does not impact your credit score. It is advisable to get prequalified with at least three to five different lenders to get a comprehensive view of the market.

Step 4: Gather Your Documents

To streamline the formal application, gather all necessary documentation in advance. You will typically need to provide the following:

Step 5: Submit the Formal Application (The Hard Inquiry)

After comparing prequalification offers, submit the formal application with your chosen lender. This step will trigger a "hard" credit inquiry, which can cause a small, temporary dip in your credit score. The lender will use this to provide a final, firm loan offer. Upon approval and acceptance, funds are disbursed, often as quickly as the next business day.

Borrowing safely, understanding your rights, and knowing where to turn for help are critical. Delaware provides a strong network of state agencies and non-profit organizations dedicated to consumer protection and financial education.

Recognizing and Avoiding Predatory Lending & Scams

Being able to identify the warning signs of predatory lending is the first line of defense in protecting your finances. Be cautious if you encounter any of the following red flags:

Your Rights and Resources in Delaware

If you believe you have encountered a predatory lender or a loan scam, Delaware has two primary state agencies that can provide assistance.

Alternatives and Support Systems

A personal loan is not always the right solution. Delaware is home to several reputable non-profit organizations that offer alternatives and support.

Choosing the right personal loan in Delaware requires careful consideration of your financial situation, credit profile, and personal priorities. By using this information, you are equipped to move forward with clarity.

The final decision rests on a balanced comparison of key factors. Evaluate the Annual Percentage Rate (APR), which represents the total cost of borrowing. Scrutinize the loan agreement for any additional charges, such as origination fees or prepayment penalties.

Consider the loan term and ensure the monthly payment fits comfortably within your budget. Finally, weigh the distinct advantages of different lender types—the personalized service of a local Delaware credit union versus the speed and convenience of a national online lender.

By approaching this process methodically, you can secure a financial tool that helps you achieve your goals and strengthens your overall financial well-being.

Lenders in Delaware typically require a valid government ID, proof of steady income (like pay stubs), a verifiable address, and a Social Security number. Most lenders also check your credit score and debt-to-income ratio to assess your ability to repay the loan, with minimum credit scores often starting around 600.

Yes, securing a personal loan in Delaware with bad credit is possible. While traditional banks may have stricter requirements, many online lenders and local credit unions specialize in loans for borrowers with fair or poor credit. Be prepared for higher Annual Percentage Rates (APRs) to offset the lender's increased risk.

As of late 2025, interest rates for Delaware personal loans can range from approximately 8% for borrowers with excellent credit to over 36% for those with poor credit. Your final APR depends on your creditworthiness, loan amount, and repayment term. It is crucial to compare offers from multiple lenders.

When applying for a personal loan in DE, you should have your driver's license or other photo ID, recent pay stubs or tax returns to verify income, and a recent utility bill or bank statement to prove residency. Many online lenders now offer digital verification, which can streamline this process significantly.

The funding speed for Delaware personal loans varies by lender. Online lenders are often the fastest, with many providing loan decisions in minutes and disbursing funds within one to two business days. Traditional banks and credit unions might take longer, typically three to five business days from approval.

Unsecured personal loans, which are more common, do not require any collateral and are approved based on your credit history and income. In contrast, secured personal loans are backed by an asset, such as a car or savings account, which generally results in lower interest rates due to reduced lender risk.

No, checking your rate through a pre-qualification process will not hurt your credit score. Most lenders use a "soft" credit inquiry for pre-approval, which is not visible to other creditors. A "hard" inquiry, which can slightly lower your score, only occurs after you formally apply for the loan.

The vast majority of reputable lenders offering Delaware personal loans do not charge prepayment penalties. This allows you to pay off your loan ahead of schedule to save on interest without incurring an extra fee. Always review your loan agreement to confirm the lender's policy before you sign.

Absolutely. Using a personal loan for debt consolidation is one of the most common reasons people borrow. By combining multiple high-interest debts, such as credit cards, into a single loan with a lower fixed interest rate, you can simplify payments and potentially save a significant amount on interest.

To find the best lender, compare the full APR, which includes both interest and fees. Read recent customer reviews and check for any origination or late fees. Ensure the lender is licensed to operate in Delaware and compare offers from online lenders, local banks, and credit unions to secure the most favorable terms.

For residents seeking financial flexibility, Connecticut personal loans offer a versatile solution to manage a wide range of expenses. A personal loan provides a lump sum of capital that can be used for nearly any purpose, from funding significant home improvements and consolidating high-interest debt to covering unexpected medical bills or financing major life events.

The majority of these are unsecured loans, meaning they do not require collateral like a home or vehicle, presenting a viable alternative to credit cards or other forms of secured financing. Borrowers repay the loan through predictable, fixed monthly installments over a predetermined period, which simplifies budgeting and financial planning.

Flexibility in the Connecticut Market

The competitive financial market in Connecticut has led local banks and credit unions to emphasize the adaptability of their loan products. Marketing language from institutions across the state frequently highlights that funds can be used to "cover any expense" or for "almost any purpose". This reflects a deep understanding of the diverse financial needs of Connecticut residents.

This competitive environment empowers borrowers, allowing them to seek out lenders who not only offer favorable terms but also accommodate their specific financial goals. Whether that involves launching a small business, managing college tuition, or taking a long-awaited vacation, the flexibility is a key feature.

Connecticut's financial institutions offer a variety of personal loan products, each designed to meet different consumer needs and credit profiles. Understanding these options is the first step toward selecting the right financial tool.

Unsecured Personal Loans: The Standard Option

The most common type of personal loan in Connecticut is the unsecured loan. Lenders determine eligibility and interest rates based on an applicant's credit history, income, and overall financial standing, without requiring any collateral. These loans offer significant flexibility with amounts and terms.

Key features often include:

Secured Personal Loans: Leveraging Your Assets

For residents who may not qualify for the most competitive unsecured rates, secured personal loans are a powerful alternative. Offered prominently by Connecticut credit unions, these loans allow members to use funds in their savings accounts or certificates of deposit (CDs) as collateral.

Institutions like Nutmeg State Financial Credit Union and Sikorsky Credit Union feature these products. The primary advantages are a significantly lower interest rate and a more accessible path to approval. An added benefit is that the collateralized savings or CD continues to earn dividends for the borrower throughout the life of the loan.

Debt Consolidation Loans: Streamlining Your Finances

A personal loan can be a strategic tool for debt consolidation, combining multiple high-interest debts into a single new loan with one fixed monthly payment. The goal is to secure a lower overall interest rate to reduce borrowing costs and accelerate debt repayment.

Connecticut lenders, such as Thomaston Savings Bank with its "Debtonator" loan, market specialized products for this purpose. Some lenders will even send the loan proceeds directly to the original creditors on the borrower's behalf. For more significant debt challenges, nonprofit consumer credit counseling agencies licensed by the state offer Debt Management Plans (DMPs).

Credit-Builder Loans: A Path to Better Credit

Designed for individuals with limited or poor credit history, credit-builder loans are a unique and constructive financial product. With this type of loan, the borrowed funds are held in a secured savings account by the lender instead of being given to the borrower upfront.

The borrower makes regular, fixed monthly payments, which the lender reports to the national credit bureaus to help establish a positive payment history. Upon successful completion of the loan term, the borrower gains access to the principal amount, often plus any interest earned. Liberty Bank's "Credit Builder Loan & Saver Program" is a leading example in Connecticut.

Connecticut residents have access to a diverse range of lenders, each with distinct advantages. The optimal choice depends on the borrower's financial profile, priorities, and relationship with financial institutions.

Local Connecticut Banks and Credit Unions

Local institutions are often the bedrock of community finance, providing personalized service. Banks like Liberty Bank and Thomaston Savings Bank have a strong presence in the state. Credit unions, such as Sikorsky Credit Union and American Eagle Financial Credit Union, serve members within specific communities, with broad eligibility requirements. These local lenders are particularly notable for offering specialized secured and credit-builder loans.

National Banks with a Connecticut Presence

Large national banks operating in Connecticut often feature higher loan limits and extended repayment terms.

These institutions can be an excellent choice for well-qualified borrowers, especially those who can leverage an existing banking relationship for potential discounts.

Online-Only Lenders

The digital lending marketplace offers convenience and speed, often promising funding in as little as one business day. However, their availability and terms can vary for Connecticut residents. Some may place restrictions on how loans can be used, such as for educational expenses , while others may not be licensed to operate in the state.

It is imperative for borrowers to verify an online lender's license. Under state law, any company making a loan of $50,000 or less with an APR greater than 12% to a Connecticut resident must be licensed and regulated by the Connecticut Department of Banking.

The Annual Percentage Rate (APR) is the most critical number to understand when comparing personal loan offers, as it represents the total annual cost of borrowing.

What Determines Your Annual Percentage Rate (APR)?

Lenders assess a borrower's risk profile to set the interest rate. The primary factors include:

Typical APR Ranges in Connecticut

Market data provides a general guide to the rates Connecticut borrowers can expect based on their creditworthiness:

Connecticut's Usury Law: A Critical Distinction

Connecticut's general usury statute, C.G.S. 37-4, sets a maximum legal interest rate of 12% per year. However, this law contains a critical list of exemptions. C.G.S. 37-9 exempts any loan made by state or national banks, as well as state or federal credit unions.

This means the 12% cap effectively governs private or unlicensed lending but does not apply to the licensed financial institutions where most consumers obtain personal loans. For consumers borrowing from these established institutions, protection comes from robust federal and state consumer protection laws that mandate transparent disclosures and prohibit unfair practices.

Securing a personal loan in Connecticut follows a clear and increasingly digital process. Understanding the stages can help borrowers navigate their options efficiently.

1. Pre-Qualification and Rate Shopping

The modern loan process begins with pre-qualification. Many lenders offer online tools to "Check My Rate," which requires basic financial information and results in a soft credit inquiry that does not affect your credit score. This allows you to see potential offers and shop for the most favorable terms, a practice strongly encouraged by the Consumer Financial Protection Bureau (CFPB).

2. Gathering Your Documentation

Once you identify a promising offer, you will need to prepare documentation for the formal application. A typical checklist includes:

3. The Formal Application and Hard Credit Inquiry

After selecting a lender and submitting your documentation, you complete the formal application. This authorizes the lender to perform a hard credit inquiry, which can cause a temporary, minor dip in your credit score. To minimize this impact, it is advisable to conduct all of your loan shopping within a concentrated timeframe (typically 14 to 45 days), as credit scoring models often treat multiple inquiries as a single event.

4. Approval and Funding

The final stages are often remarkably fast. Many lenders provide a credit decision on the same day the application is submitted. If approved, you will receive loan documents for review and electronic signature. It is common for borrowers to receive the funds in their bank account as quickly as the next business day.

Connecticut has a strong regulatory framework designed to ensure a fair and transparent lending market. Residents are protected by a combination of robust state laws and comprehensive federal regulations.

Key State and Federal Protections

Several key statutes form the foundation of borrower rights in Connecticut:

Identifying and Avoiding Predatory Lending

Predatory lending involves practices that impose unfair or abusive loan terms on a borrower. While Connecticut's specific abusive lending laws focus on home loans, their principles serve as a valuable guide. Warning signs include:

These practices often target vulnerable consumers, such as the elderly, low-income individuals, or those with past credit problems.

Who Regulates Lenders in Connecticut?

Several state and federal agencies oversee lenders and protect consumers.

Your Right to Accurate Credit Reporting and Improvement

Your credit history is fundamental to the loan process. The federal Fair Credit Reporting Act (FCRA) grants you the right to access your credit reports for free once a year and to dispute any information you believe is inaccurate. The Federal Trade Commission (FTC) outlines a clear process for filing disputes.

To improve a credit score, federal consumer protection agencies consistently advise focusing on three core habits:

Lenders typically require a steady income source, a valid government-issued ID, proof of Connecticut residency, and a Social Security number. While a good credit score (often 670+) is preferred for the best rates, some lenders have options for various credit profiles, making these loans accessible to many residents.

As of late 2025, personal loan rates in CT vary based on your credit score, income, and the lender. Expect Annual Percentage Rates (APRs) to range from approximately 8% for borrowers with excellent credit to over 30% for those with poor credit. Comparing offers is essential to secure a competitive rate.

Yes, obtaining a personal loan with bad credit in Connecticut is possible, though you will likely face higher interest rates. Lenders specializing in subprime loans or local credit unions may offer more flexible terms. Applying with a co-signer or for a secured loan can also improve your approval chances.

Connecticut law protects consumers by capping interest rates on most loans under $15,000 from non-bank lenders at 12% APR. However, state-chartered banks and certain other licensed institutions have different rules. Always confirm your lender is licensed by the Connecticut Department of Banking to ensure compliance and protection.

Funding speed for Connecticut personal loans varies by lender. Online lenders are often the quickest, with some providing funds via direct deposit in as little as one business day after approval. Traditional banks and credit unions may take several business days to process and disburse the loan.

Most unsecured personal loans in CT are flexible, allowing you to cover expenses like home improvements, medical bills, or major purchases. Lenders generally prohibit using funds for illegal activities, gambling, or for post-secondary education costs. Always check your specific loan agreement for any stated use restrictions.

Both are great options for Connecticut personal loans. Credit unions, being member-owned, often provide lower interest rates and more personalized service. Banks may offer a streamlined digital application process and may not require membership. It is wise to get quotes from both to determine the best financial fit.

Using a personal loan for debt consolidation in Connecticut involves securing a new loan to pay off multiple high-interest debts, such as credit cards. This consolidates your payments into one fixed monthly bill, often at a lower overall interest rate, which can save money and simplify your finances.

While many modern lenders have eliminated this fee, some personal loans in Connecticut may still include a prepayment penalty for paying off your balance early. It is crucial to ask the lender directly about their policy and carefully review the terms of your loan agreement before signing.

To apply for personal loans in CT, you will generally need to provide a government-issued photo ID, your Social Security number, recent pay stubs or tax returns as proof of income, and a utility bill or lease agreement to verify your address. Having these documents ready can speed up the application process.

Obtaining Colorado personal loans offers a flexible financial tool for residents. These unsecured funds can help manage significant life events, consolidate high-interest debt, or cover unexpected expenses. Navigating the lending landscape requires a clear understanding of the available options and prevailing interest rates.

From local credit unions in Denver and Colorado Springs to statewide online lenders, borrowers have many choices. It's also essential to be aware of the robust consumer protection laws that govern the state. A well-informed approach empowers borrowers to select the right product, secure favorable terms, and achieve their financial objectives with confidence.

Personal loans in Colorado serve a wide array of purposes, often reflecting the unique lifestyle and economic landscape of the state. Lenders frequently tailor their marketing to appeal to specific local aspirations, such as financing a "special vacation" or a "sandy beach" getaway. This acknowledges that financial tools are a means to enhance quality of life.

Debt Consolidation

Combining multiple high-interest debts, like credit card balances, into a single loan is a primary use. This strategy often results in a single fixed monthly payment and a potentially lower overall interest rate.

Home Improvements

Many Coloradans use personal loans to fund renovations, upgrades, or essential repairs. This is common in growing communities from Fort Collins to Aurora.

Major Purchases and Life Events

These loans can cover the cost of large appliances, furniture, or technology without depleting savings. They are also used to finance significant occasions such as weddings, honeymoons, or relocation for a new job.

Medical and Vehicle Expenses

Personal loans can help pay for medical bills, elective procedures, or orthodontics not fully covered by insurance. They are also used for unexpected vehicle repairs or financing outdoor equipment central to the Colorado lifestyle, such as skis or mountain bikes.

Lenders in Colorado offer several types of personal loans. Each is designed to meet different financial needs and borrower profiles. The most common distinction is whether the loan is secured by collateral.

Unsecured Personal Loans (Signature Loans)

Unsecured loans, often called signature loans, are the most prevalent form of personal financing. Approval is based on the borrower's creditworthiness, including their credit score, income, and existing debt. Because there is no collateral, these loans represent a higher risk to the lender, which is typically reflected in the interest rate.

Loan amounts for unsecured personal loans vary significantly. Local institutions like Canvas Credit Union may offer amounts from $500 to $15,000. In contrast, a regional bank like Vectra Bank provides a wider range of $2,500 to $100,000, while online lenders like LendingPoint offer loans from $1,000 to $36,500.

Secured Personal Loans

A secured personal loan requires the borrower to pledge an asset as collateral. This reduces the lender's risk, often resulting in a lower interest rate and more favorable terms. This option can increase accessibility for borrowers with fair or developing credit histories.

In Colorado, common forms of collateral are financial assets held at the lending institution:

Personal Lines of Credit

Unlike a traditional loan that provides a lump sum, a personal line of credit is a revolving account. A lender approves a specific credit limit, and the borrower can draw funds as needed. Interest is charged only on the outstanding balance. This structure offers flexibility for ongoing or unpredictable expenses, such as overdraft protection.

Specialized Loans for Building and Rebuilding Credit

Many Colorado credit unions offer products specifically designed to help individuals establish or repair their credit. With these "Credit Builder" loans, the borrowed funds are placed into a locked savings account. The borrower makes regular monthly payments, which are reported to the major credit bureaus.

Once the loan is fully paid off, the funds are released to the borrower. The primary purpose is to build a positive payment history, a key component of a strong credit score. Institutions like Fitzsimons Credit Union and Partner Colorado Credit Union actively promote these loans as a pathway to financial inclusion.

The Annual Percentage Rate (APR) is the most important figure for comparing loan offers. It represents the total annual cost of borrowing, including the interest rate and most mandatory fees.

What Determines Your Annual Percentage Rate (APR)

Lenders in Colorado assess several key factors to determine a borrower's risk profile and APR:

Typical APR Ranges in Colorado

APRs for personal loans in Colorado vary widely. Local credit unions and banks tend to advertise a single, competitive "as low as" rate to attract prime borrowers. National online lenders market a broad APR range to capture applicants from the entire credit spectrum.

Beyond the Rate: Common Fees to Watch For

While the APR includes many costs, borrowers should be aware of specific fees that can impact their loan.

A credit score is a numerical representation of a person's credit history. Lenders use it to quickly assess the risk of lending money. Both FICO and VantageScore models are commonly used and carry significant weight in a lending decision.

Credit Score Tiers and Loan Eligibility

Loan options and terms in Colorado generally align with the following credit score tiers:

Colorado has some of the strongest consumer lending protections in the nation, codified in the Colorado Uniform Consumer Credit Code (UCCC). This set of laws ensures transparency and fairness in lending.

State-Mandated Interest Rate Caps

Colorado law establishes legal limits on interest rates. A general consumer loan interest rate limit of 12% per year applies to unsupervised lenders. However, a "supervised loan" is legally defined as a consumer loan where the finance charge exceeds 12% per year.

To legally charge more than 12%, a lender must obtain a license and become a "supervised lender." This requirement brings nearly all legitimate banks, credit unions, and finance companies under state oversight, enforcing the full suite of UCCC protections. For other loan types, Colorado has established firm ceilings:

Required Disclosures and Prohibited Practices

The UCCC provides Colorado borrowers with several fundamental rights and protections:

The modern loan application process is largely streamlined, especially with online lenders and digital banking platforms.

Colorado borrowers have access to a diverse market of lenders, each with distinct advantages.

Colorado Credit Unions

Local and National Banks

Online Lenders

A personal loan is a powerful tool, but it is not always the optimal solution. Responsible borrowing involves considering all available options.

Exploring Other Financing Options

Non-Profit Credit Counseling and Debt Management

For individuals struggling with overwhelming debt, a new loan may not be the best solution. Non-profit credit counseling agencies offer a valuable alternative. These organizations provide free budget counseling and can help enroll individuals in a Debt Management Plan (DMP).

A DMP is not a loan, but a structured repayment program. The agency works with creditors to negotiate lower interest rates and consolidate debts into a single monthly payment. Reputable organizations approved to serve Colorado residents can be found through the National Foundation for Credit Counseling.

State and Local Assistance Programs

For residents facing severe financial hardship, state and local programs can offer a crucial safety net. The Colorado Housing and Finance Authority (CHFA) offers programs to support affordable homeownership, including down payment assistance. For those at risk of eviction, the Colorado Emergency Rental Assistance (CERA) program may provide aid to help stabilize their housing situation.

Colorado law, under the Uniform Consumer Credit Code (UCCC), sets specific interest rate caps. For supervised loans, lenders can charge up to 36% on unpaid balances up to $1,000, 21% on amounts up to $3,000, and 15% on balances exceeding that, preventing excessively high rates on Colorado personal loans.

You should always verify a lender’s legitimacy. The Colorado Attorney General's Office maintains a searchable database of all licensed lenders and supervised loan providers. Checking this list ensures the lender is authorized to operate in the state and complies with its consumer protection laws before you apply.

Yes, they are very different. Colorado has strict regulations that limit high-cost payday lending. Traditional Colorado personal loans are structured as installment loans with longer repayment terms and interest rate caps set by the UCCC, making them a more transparent and generally safer borrowing option for consumers.

The Colorado Attorney General, through the Administrator of the Uniform Consumer Credit Code (UCCC), is the primary regulator for consumer credit in the state. This office enforces lending laws, licenses lenders, investigates complaints, and works to protect borrowers from predatory lending practices.

While no official minimum exists, most lenders in the competitive Colorado market prefer credit scores of 640 or higher for the best terms. Options for borrowers with bad credit exist, but these Colorado personal loans will feature higher interest rates that are still capped by state law.

Yes, Colorado-based credit unions like Ent Credit Union, Canvas Credit Union, and Bellco Credit Union are often excellent sources. They frequently offer lower interest rates and more flexible terms on personal loans than national banks, especially for individuals who are already members of the credit union.

If you default and a lender obtains a court judgment, they can garnish your wages in Colorado. However, state law protects a portion of your income. A creditor can only garnish the lesser of 20% of your disposable earnings or the amount by which your earnings exceed the federal minimum wage.

No, generally they do not. Unlike some specific financial products like mortgages, standard Colorado personal loans do not include a legally mandated "right of rescission" or a cooling-off period. Once you sign the loan agreement, the contract is considered legally binding and you are obligated to its terms.

No, the legal requirements are consistent statewide. Lenders must follow the same Colorado Uniform Consumer Credit Code (UCCC) regulations whether you are in Denver, Colorado Springs, or Durango. While local market competition might vary slightly, the core lending laws and consumer protections do not change by city.

Yes, you must provide proof of Colorado residency, such as a state-issued ID, utility bill, or lease agreement. Lenders must ensure you are a resident to apply the correct state-specific interest rate caps and consumer protections as mandated by Colorado law for all personal loans originated within the state.

An unsecured loan provides a powerful way to access funds without pledging personal assets like a house or car as collateral. Unlike secured financing, which relies on property to guarantee repayment, lenders approve these loans based on your creditworthiness, including your credit score and income.

This structure offers significant flexibility for needs like debt consolidation or major purchases. However, it also means that interest rates and qualification standards are critically important. Exploring how these loans work, who qualifies, and how they compare to other options is the first step toward making a sound financial decision.

The world of lending is fundamentally built on managing risk. Lenders provide capital with the expectation of being repaid with interest. The mechanisms they use to ensure repayment define the type of loan offered.

Unsecured loans represent one of the purest forms of lending. They are based not on physical assets but on the lender's confidence in the borrower's financial character and capacity to repay.

Defining the Unsecured Loan: Beyond Collateral

At its core, an unsecured loan is a form of debt that is not protected by a guarantor or collateralized by a lien on specific assets. The lender advances funds based solely on the borrower's contractual promise to repay the debt. This is why these are often called "signature loans"; the borrower's signature on the loan agreement is the primary assurance the lender receives.

This structure places the bulk of the immediate financial risk squarely on the lender. If a borrower defaults on the loan—meaning they fail to make the agreed-upon payments—the lender cannot automatically seize a pre-determined asset like a car or a house to recoup its losses. This is the defining characteristic that separates it from secured lending.

How Lenders Mitigate Risk Without Collateral

Given the absence of collateral, lenders must use other methods to assess and mitigate their risk. They do this by conducting a thorough evaluation of a borrower's creditworthiness, which is a comprehensive analysis of their financial history, stability, and ability to manage debt.

The primary factors in this assessment are:

To compensate for the elevated risk, lenders' primary defense mechanism is the interest rate. Unsecured loans almost always carry higher interest rates, or Annual Percentage Rates (APRs), than secured loans. This higher rate builds a larger profit margin for the lender, which helps offset potential losses from borrowers who may eventually default.

The Core Difference: Unsecured vs. Secured Lending Explained

Understanding the distinction between unsecured and secured loans is crucial for any borrower. The choice between them has significant implications for cost, accessibility, and risk.

Choosing an unsecured loan involves a trade-off between convenience and cost. The benefits are significant for the right borrower in the right situation, but the drawbacks must be carefully considered to avoid potential financial strain.

Key Benefits of Unsecured Loans

Potential Drawbacks and Risks

When an Unsecured Loan Is the Right Financial Tool

Despite the drawbacks, an unsecured loan is an excellent financial tool in several specific scenarios:

Securing an unsecured loan hinges on a lender's confidence in your ability to repay. This confidence is built by evaluating a few key financial metrics that paint a picture of your overall financial health.

The Central Role of Your Credit Score

Your credit score is a three-digit number that summarizes your credit history. To a lender, it is the most direct indicator of your reliability as a borrower. Lenders use risk-based pricing, which directly ties the interest rate they offer to your credit score. A higher score signifies lower risk, earning you a lower APR.

This creates a feedback loop. A borrower with a high score gets a low-interest loan, making payments manageable and further strengthening their credit. In contrast, a borrower with a low score receives a high-interest loan, increasing financial strain and the risk of a missed payment, which would further damage their credit.

Credit Score Ranges and Their Implications

While specific requirements vary by lender, qualifications generally fall into these tiers based on the FICO scoring model (300 to 850):

Understanding Your Debt-to-Income (DTI) Ratio

While your credit score reflects your past willingness to pay, your debt-to-income (DTI) ratio measures your current ability to take on new debt. It is a critical metric for lenders because it shows whether your income can realistically support another monthly payment.

The calculation is straightforward: DTI=Gross Monthly IncomeTotal Monthly Debt Payments

Lenders have general guidelines for DTI ratios:

Verifying Income and Employment Stability

Finally, lenders need to confirm that your income is both stable and sufficient to make your loan payments consistently. A strong credit score and low DTI are meaningless without an active source of income.

To verify this, you will be required to provide documentation, such as:

A consistent employment history further strengthens your application by demonstrating financial stability.

Applying for an unsecured loan has become increasingly streamlined, especially with online lenders. Following a structured process can help you secure the best possible terms.

Step 1: Prequalification - Test the Waters

Before you formally apply, it is essential to shop around. The prequalification process allows you to see potential loan terms without any negative impact on your credit score. During prequalification, the lender performs a "soft" credit inquiry, which is not visible to other lenders. By getting prequalified with several lenders, you can compare offers and identify the best deal.

Step 2: Gather Your Financial Documents

Once you have chosen a lender, gathering your documentation in advance will speed up the formal application process. Be prepared to provide copies of the following:

Step 3: Submit the Formal Application

After choosing the best prequalified offer, you will proceed to the lender's formal application. This step triggers a "hard" credit inquiry, which is visible on your credit report and can cause a small, temporary dip in your credit score. This is why it is important to limit formal applications to only the lender you have chosen.

Step 4: From Approval to Funding

The final stage is the lender's underwriting and approval process. Underwriting is where your application is reviewed to finalize the loan terms.

The term "unsecured loan" encompasses a variety of financial products. While they all share the core characteristic of not requiring collateral, their mechanics can vary significantly.

Personal Installment Loans

This is the most common type of unsecured loan. A borrower receives a single, lump-sum payment and repays it in equal, fixed monthly payments over a set term.

Unsecured Lines of Credit

An unsecured line of credit operates as revolving credit, much like a credit card. A borrower is approved for a maximum credit limit and can draw funds as needed.

Student Loans

Both federal and private student loans are a specialized form of unsecured debt designed to cover costs associated with post-secondary education. The funds are intended for qualified educational expenses like tuition, books, and housing.

Federal vs. Private Student Loans

Credit Cards

Credit cards are the most common form of revolving unsecured debt. They provide a pre-set credit limit for purchases and cash advances. While they offer great flexibility, credit cards typically have much higher interest rates than personal loans, making them an expensive way to finance large purchases over time. However, some cards feature valuable 0% introductory APR periods, making them a powerful tool for short-term, interest-free financing.

Unsecured personal loans can be deployed as strategic financial tools to solve specific problems, such as simplifying debt or funding major projects without risking assets.

Debt Consolidation: Simplifying and Saving

One of the most powerful uses for a personal loan is debt consolidation. This strategy involves taking out a single, new loan to pay off multiple existing debts, most commonly high-interest credit card balances.

The primary benefits are:

Personal Loans vs. 0% APR Balance Transfer Cards

When consolidating credit card debt, borrowers often choose between a personal loan and a 0% APR balance transfer card.

Financing Home Improvements

Unsecured personal loans are a practical way to fund home renovation projects, particularly for moderate-sized updates. Their main advantages are speed and safety. The funding process is much faster than home equity-based financing, and they do not require using your home as collateral.

Comparing Unsecured Loans with HELOCs

For home improvements, the primary alternative is a Home Equity Line of Credit (HELOC), which is a secured loan.

The decision depends on the project's scale and the homeowner's risk tolerance. An unsecured loan is better for urgent repairs or for homeowners unwilling to place their home on the line.

Covering Medical Expenses

Unexpected medical bills can create significant financial strain. Medical loans, which are typically unsecured personal loans, can provide a structured way to manage these costs. The fast funding time and fixed monthly payments make it easier to budget for medical debt compared to high-interest credit cards.

Before taking out a loan, it is wise to explore other alternatives:

The landscape of unsecured lending is undergoing a profound transformation, driven by advancements in artificial intelligence (AI) and financial technology (FinTech). These innovations are reshaping how lenders assess risk and how borrowers experience the lending process.

AI-Powered Credit Assessment

Traditionally, lending decisions have relied heavily on the FICO credit score. However, modern lenders are increasingly deploying sophisticated AI algorithms to conduct more nuanced credit assessments.

These systems can analyze a much broader array of data points to create a more holistic financial profile, including:

By looking beyond a simple credit score, lenders can potentially identify creditworthy individuals who might be overlooked by traditional models. This could expand access to credit for people with limited credit histories.

Streamlining the Borrower Experience

AI is also revolutionizing the operational side of lending. Automation can accelerate the entire loan lifecycle, reducing approval and processing times from days to minutes.

Furthermore, technologies like conversational AI can guide applicants through the process in real-time. These tools can answer questions and clarify requirements, making the process more intuitive and supportive. The result is a lending experience that is faster, more transparent, and more personalized.

Challenges and Considerations

This technological shift is not without its challenges. While AI can reduce human biases, it can also amplify existing societal biases if the algorithms are trained on flawed data.

There is also the challenge of transparency. The "black box" nature of some machine learning models can make it difficult for lenders to provide clear reasons for a loan denial, raising concerns for regulators. Finally, ensuring robust data privacy and security is paramount to maintain consumer trust.

An unsecured loan can be a gateway to achieving financial goals, but it is also a significant responsibility. Understanding the potential consequences of mismanagement is essential for ensuring the loan serves as a helpful tool.

The Consequences of Default

Failing to repay an unsecured loan can trigger a cascade of negative financial events.

Best Practices for Managing Your Loan

Responsible loan management begins before you apply and continues until the final payment.

Regulatory Protections for Borrowers

Borrowers in the United States are protected by several laws and agencies designed to ensure fair practices.

Unsecured loans are a flexible financial instrument when approached with diligence. By understanding the relationship between your credit profile and the loan terms, weighing the costs against the benefits, and committing to a disciplined repayment strategy, you can effectively leverage this form of credit to achieve your financial objectives.

Your overall creditworthiness is the single most critical factor. Lenders evaluate this through your credit score, payment history, and especially your debt-to-income (DTI) ratio. Since there is no collateral, your demonstrated ability to manage and repay debt responsibly is the lender's primary assurance against risk.

Defaulting on unsecured loans severely damages your credit score for up to seven years. The lender will likely send the account to a collection agency, leading to persistent contact. Furthermore, the creditor can file a lawsuit, which may result in a court judgment to garnish your wages or bank account.

Interest rates on unsecured loans are based purely on the lender's assessment of borrower risk. A person with an excellent credit history and low debt poses less risk and receives a lower rate. Lenders have different risk models, leading to a wide variation in the rates offered for the same loan amount.

Your DTI ratio compares your total monthly debt payments to your gross monthly income. Lenders use this key metric to determine if you can afford to take on new debt. A DTI below 43% is often required for approval on most unsecured loans.

Many common financial products are actually unsecured loans. These include student loans, credit cards, and personal lines of credit. In each case, the money is lent based on your credit history and promise to repay, not on a physical asset like a car or house.

Generally, unsecured personal loans offer great flexibility. You can use the funds for almost any legitimate purpose, including debt consolidation, home repairs, medical bills, or travel. Lenders typically only prohibit using the funds for illegal activities, gambling, or certain investments like purchasing securities.

Each formal application for an unsecured loan usually results in a hard credit inquiry, which can temporarily lower your credit score by a few points. Applying with many lenders in a short time frame can signal financial distress, potentially making it harder to get approved on favorable terms.

Online lenders often feature a faster application and funding process for unsecured loans, sometimes with more competitive rates due to lower operational costs. Banks may be preferable for existing customers or those who value face-to-face service. It's best to compare offers from both before making a decision.

Pre-qualification is an initial step where a lender estimates the loan amount and interest rate you might receive. This process uses a soft credit check, which does not affect your credit score. It's a risk-free way to shop around and compare potential offers from various lenders.

Most reputable lenders today do not charge prepayment penalties on unsecured loans, meaning you can pay off your balance early to save on interest without extra fees. However, this is not a universal rule, so you must always confirm by reading the terms and conditions in your loan agreement.

A secured loan is a form of credit where a borrower pledges a valuable asset as collateral to obtain financing from a lender. This collateral, which can range from real estate and vehicles to financial accounts, serves as a guarantee for the loan. This arrangement fundamentally reduces the financial risk for the lending institution.

Should the borrower fail to meet their repayment obligations, the lender has a legal right to take possession of the pledged asset to recover its losses. This mechanism distinguishes secured loans from unsecured loans, which are granted based on creditworthiness alone. The presence of collateral reshapes the entire lending equation, influencing interest rates, loan amounts, and approval criteria.

Understanding secured lending begins with grasping the concepts of collateral and the legal framework that empowers lenders. This structure is a powerful tool for borrowers, but it also carries significant risks.

What Makes a Loan "Secured"?

A loan becomes "secured" when a borrower offers an asset as a form of security to the lender. This act of pledging collateral transforms a simple promise to repay into a debt backed by tangible value. The primary purpose of this arrangement is to mitigate the lender's risk of financial loss.

With a secured loan, the lender has a direct claim to a specific asset, providing a clear path to recouping the outstanding balance if the borrower defaults. Because the lender's risk is lower, they are often willing to offer more advantageous terms. This is the central trade-off: in exchange for the risk of losing an asset, the borrower can gain access to better credit options.

The Mechanics of Collateral and Liens

The legal instrument that formalizes a lender's claim on collateral is known as a lien. When a borrower accepts a secured loan, they grant the lender a lien on the specified asset for the loan's duration. This is a legally enforceable claim, often recorded in public records to establish the lender's priority over other creditors.