Merchant cash advance Blursoft offers quick funding for small businesses by purchasing a portion of their future sales. Unlike traditional loans focused on credit scores, Blursoft considers daily credit card processing volume, making it an option for businesses with less-than-perfect credit. However, it's crucial to understand the repayment structure, including factor rates, to ensure this fast cash solution aligns with your business's financial health.

Qualifying for a Blursoft Merchant Cash Advance

While Blursoft offers a faster and more credit-score-agnostic approach than traditional loans, there are still some requirements you'll need to meet to qualify for a merchant cash advance (MCA). Here's a breakdown of what Blursoft typically looks for:

Business Age and Stability:

- Blursoft may prefer businesses operating for at least 3-6 months. A proven track record demonstrates your business's viability.

Revenue Requirements:

- Blursoft considers your daily credit card processing volume to determine eligibility. They typically have a minimum monthly revenue threshold, potentially in the range of $8,000 to $15,000.

Credit Score:

- Although not the sole focus, a credit score above 550 can improve your approval chances.

Financial Health:

- Blursoft may assess your overall financial health, including any existing debts or outstanding MCAs. Demonstrating responsible financial management is a plus.

Business Bank Account:

- You'll need a dedicated business checking account for receiving the advance and for automatic repayment deductions.

Documents Required:

- Be prepared to submit basic business documents like recent bank statements, business tax returns (if applicable), and processing statements.

Here are some additional factors that can influence your approval:

- Industry: Some industries may be considered higher risk by Blursoft.

- Business Plan: A clear and concise business plan outlining how you'll use the funds can strengthen your application.

- Exit Strategy: Demonstrating a plan for repaying the advance shows responsible financial planning.

Remember: Blursoft's specific requirements can vary. It's always best to contact them directly to get the most up-to-date information on their qualification criteria.

How to Apply for a Blursoft MCA

Needing a quick cash injection for your business? Blursoft offers merchant cash advances (MCAs) as a potential solution. Here's a step-by-step guide to navigate the application process:

Step 1: Gather Your Documents

Before applying, ensure you have the necessary documentation readily available. This typically includes:

- Basic Business Information: Business name, address, phone number, and website (if applicable).

- Financial Documents: Recent bank statements (3-6 months), business tax returns (if applicable), and credit card processing statements.

- Ownership Information: Proof of ownership for your business (e.g., licenses, business registration documents).

Step 2: Visit the Blursoft Website

Head over to the Blursoft website and locate their application section. It's likely labeled something like "Apply Now" or "Get Started."

Step 3: Complete the Online Application

The online application should be relatively straightforward. Be prepared to provide details regarding:

- Your Business: Industry, number of employees, and years in operation.

- Financial Information: Monthly revenue, average daily credit card processing volume, and any existing debts.

- Funding Needs: Desired advance amount and how you plan to utilize the funds.

Step 4: Submit Your Application and Await Response

Once you've reviewed and submitted your application, Blursoft will assess your eligibility. This process is often faster compared to traditional loans, potentially offering a pre-approval decision within 24 hours.

Step 5: Review and Negotiate the Offer (Optional)

If pre-approved, Blursoft will present a formal offer outlining the advance amount, repayment terms, and factor rate (essentially the fees associated with the MCA). Carefully review the terms. While negotiation might be limited, you may be able to clarify specific details or inquire about potential adjustments.

Step 6: Sign the Agreement and Receive Funding

If you agree to the terms, finalize the agreement electronically. Once finalized, Blursoft typically disburses the advance funds within a short timeframe, potentially within 24 hours.

Step 7: Repay the Advance

Repayment is typically automated. Blursoft will deduct a pre-determined percentage of your daily credit card sales until the advance and all associated fees are paid in full.

Additional Tips:

- Be honest and transparent in your application.

- Only apply for the amount you truly need.

- Understand the factor rate and its impact on your overall repayment cost.

- Compare Blursoft's offer with other financing options before committing.

By following these steps and remaining informed, you can navigate the Blursoft MCA application process and make an informed decision for your business.

Factor Rates and Fees Explained

While Blursoft Merchant Cash Advances (MCAs) offer a fast and accessible funding solution, it's crucial to understand the cost implications before diving in. Here's a breakdown of the key factors that impact the overall cost:

Factor Rate:

- This is the heart of the MCA pricing structure. Unlike a traditional loan with an interest rate, Blursoft uses a factor rate.

- It's a percentage you'll pay on top of the advance amount to cover Blursoft's fees.

- Factor rates can vary depending on your business profile, creditworthiness, and the advance terms.

Understanding Factor Rates:

- Factor rates are often expressed as a decimal (e.g., 1.25).

- To calculate the total cost, multiply the factor rate by the advance amount.

- For instance, a $10,000 advance with a 1.25 factor rate translates to a total repayment of $12,500 ($10,000 advance + $2,500 in fees).

Additional Fees:

- Be aware of potential additional fees associated with Blursoft MCAs. These might include:

- Application fees: A one-time fee for processing your application.

- Processing fees: Charges associated with setting up and managing your MCA.

- Early termination fees: Penalties if you repay the advance early.

Transparency is Key:

- Ensure you understand all fees involved before signing any agreements with Blursoft.

- Ask for a detailed breakdown of the factor rate and any additional costs.

Comparing Costs:

- Don't solely focus on the advance amount.

- To compare Blursoft MCA with other financing options, calculate the Annual Percentage Rate (APR) equivalent of the factor rate. This provides a more standardized cost comparison.

Remember:

- MCAs can be a more expensive financing option compared to traditional loans.

- Carefully assess the factor rate and fees to determine if a Blursoft MCA aligns with your budget and financial goals.

Blursoft MCA vs. Traditional Loans

Choosing the right financing option for your small business is crucial. Here's a breakdown of the key differences between Blursoft Merchant Cash Advances (MCAs) and traditional loans to help you decide:

Approval Process:

- Blursoft MCA: Generally faster and easier approval. Less emphasis on credit score, focusing more on daily credit card processing volume.

- Traditional Loan: More rigorous approval process with stricter credit score requirements and detailed documentation needed.

Repayment Structure:

- Blursoft MCA: Repayment is tied to your sales. A percentage of your daily credit card sales is automatically deducted until the advance and fees are repaid.

- Traditional Loan: Fixed monthly payments regardless of your sales volume. Offers more predictability in cash flow.

Cost:

- Blursoft MCA: Typically carries a higher overall cost compared to traditional loans. Factor rates can be expensive, leading to significant fees on top of the advance amount.

- Traditional Loan: Interest rates can vary depending on your creditworthiness, but are generally lower than factor rates associated with MCAs.

Focus:

- Blursoft MCA: Ideal for businesses with less-than-perfect credit or those needing quick access to funds.

- Traditional Loan: Suitable for businesses with good credit history and a need for predictable financing for specific projects or equipment purchases.

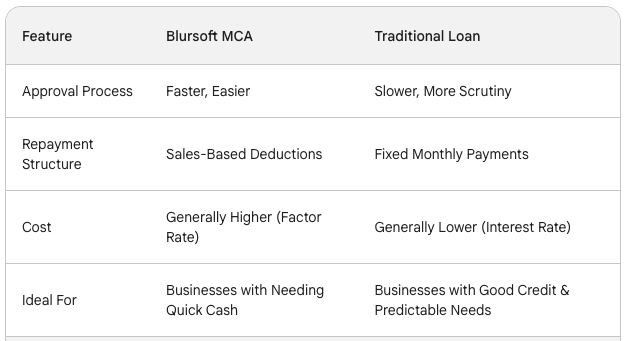

Here's a table summarizing the key differences:

Choosing the Right Option:

- Consider your business's creditworthiness, cash flow needs, and urgency of funding.

- If speed and accessibility are paramount, a Blursoft MCA might be an option. However, be prepared for potentially higher costs.

- For predictable financing with potentially lower interest rates, a traditional loan could be a better fit, assuming you qualify based on credit score and financial history.

Alternatives to Blursoft Merchant Cash Advance

While Blursoft Merchant Cash Advances (MCAs) offer a quick funding solution, their potentially high costs might not be ideal for every business. Here's a breakdown of some alternative financing options to consider:

- Traditional Loans:

- Offered by banks and credit unions, these loans provide a lump sum of cash with fixed repayment terms and interest rates.

- Qualification typically requires good credit history and strong business financials.

- Advantages: Lower interest rates compared to MCAs, predictable repayment structure.

- Disadvantages: Slower approval process, stricter requirements.

- Small Business Line of Credit:

- Similar to a credit card, a line of credit offers access to revolving funds up to a certain limit.

- You only pay interest on the amount you use.

- Provides flexibility for ongoing operational expenses.

- Advantages: More manageable repayments, good for ongoing needs.

- Disadvantages: Maintaining a good credit score is crucial for continued access.

- Invoice Factoring:

- Sell your outstanding invoices to a factoring company for immediate cash, typically at a discount.

- Ideal for businesses with slow-paying customers.

- Advantages: Faster access to cash than waiting for customer payments.

- Disadvantages: Discount fees can eat into profits, potential recourse if customers default.

- Equipment Financing:

- Loan specifically designated for purchasing equipment.

- The equipment itself serves as collateral for the loan.

- Advantages: Spreads the cost of equipment purchases over time, helps conserve working capital.

- Disadvantages: Requires a down payment, may have limitations on equipment types.

- Angel Investors or Venture Capital:

- If your business has high-growth potential, consider seeking investment from angel investors or venture capitalists.

- They provide funding in exchange for equity in your company.

- Advantages: Potentially large sums of funding available, mentorship from experienced investors.

- Disadvantages: Loss of ownership stake, pressure to meet investor expectations.

- Government Grants or Loans:

- Government agencies offer grants or loans for specific purposes, often tied to job creation or economic development.

- Qualification criteria and application processes can vary.

- Advantages: Potentially low-interest rates or even free money (grants).

- Disadvantages: Highly competitive application process, specific use restrictions may apply.

Choosing the Right Alternative:

- Consider your business's financial health, creditworthiness, and funding needs.

- Traditional loans or lines of credit might be suitable for businesses with good credit seeking predictable repayment structures.

- Invoice factoring can be helpful for businesses with slow-paying clients.

- Equipment financing eases the burden of equipment purchases.

- Angel investors or venture capital are options for high-growth businesses comfortable with equity investment.

- Government grants or loans can provide low-cost funding but often have specific requirements.

Remember:

- Research and compare different financing options before committing.

- Consult a financial advisor if needed to navigate your funding choices.

By exploring these alternatives, you can identify a financing solution that aligns with your business's specific needs and financial goals, potentially at a lower cost compared to Blursoft MCAs.

Frequently Asked Questions

What is a Blursoft Merchant Cash Advance?A Blursoft MCA is a financing option that provides a quick cash injection for your business in exchange for a percentage of your future sales. Unlike traditional loans focused on credit scores, Blursoft considers your daily credit card processing volume to determine eligibility.

How quickly can I get funded with a Blursoft MCA?Blursoft boasts a faster approval process compared to traditional loans. Approval can potentially happen within 24 hours, with funding disbursed within another business day.

What are the qualifications for a Blursoft MCA?While Blursoft focuses less on credit scores, they typically look for businesses operating for at least 3-6 months with a minimum monthly revenue threshold (potentially $8,000 to $15,000). Having a healthy business bank account and a solid plan for utilizing the funds can also strengthen your application.

How does repayment work for a Blursoft MCA?Repayment is typically automated. Blursoft deducts a pre-determined percentage of your daily credit card sales until the advance and all associated fees are paid in full.

What are the costs involved with a Blursoft MCA?The main cost factor is the factor rate, a percentage you'll pay on top of the advance amount to cover Blursoft's fees. Factor rates can vary, but can be significant, making the total cost potentially higher than traditional loans. Be sure to inquire about any additional fees like application or processing charges.

Is a Blursoft MCA right for my business?Blursoft MCAs can be a solution for immediate funding needs, especially for businesses with less-than-perfect credit. However, carefully consider the potentially high costs associated with factor rates. Explore alternative financing options like traditional loans or lines of credit that might offer lower interest rates and predictable repayment structures.

Can I negotiate the terms of a Blursoft MCA?While negotiation might be limited, you can clarify details or inquire about potential adjustments in the factor rate or fees.

What are the potential downsides of a Blursoft MCA?High factor rates can lead to a significant overall repayment cost compared to traditional loans. The automated daily deductions from your sales can strain cash flow if not managed carefully.

Where can I find more information about Blursoft MCAs?Start by visiting the Blursoft website. You can also find reviews and comparisons of Blursoft MCAs with other financing options on reputable financial websites. Remember, it's crucial to do your research and compare options before committing to any financing agreement.